Franco-Nevada Corp's Dividend Analysis

An In-depth Look at Upcoming Dividends and Historical Performance

Franco-Nevada Corp (NYSE:FNV) recently announced a dividend of $0.36 per share, set to be paid on June 27, 2024, with an ex-dividend date of June 13, 2024. As investors anticipate this forthcoming dividend, it's crucial to delve into the company's dividend track record, yield, and growth rates. This analysis will draw on data from GuruFocus to evaluate the sustainability and attractiveness of Franco-Nevada Corp's dividends.

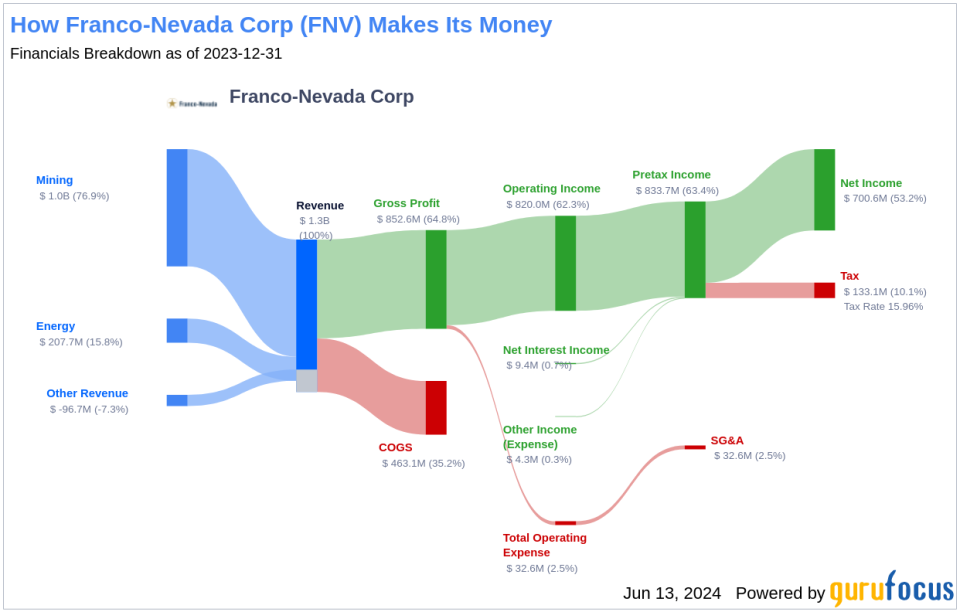

Understanding Franco-Nevada Corp's Business Model

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

Franco-Nevada Corp is a key player in the precious metals sector, focusing primarily on royalty and investment. Unlike traditional mining companies, Franco-Nevada Corp does not engage in mining, project development, or exploration activities. Instead, it manages a diversified portfolio of precious metals and royalty streams, deriving the majority of its revenue from gold, silver, and platinum. The company's financial outcomes are closely tied to commodity prices and production levels from its assets, which are strategically located across the US, Canada, and Australia.

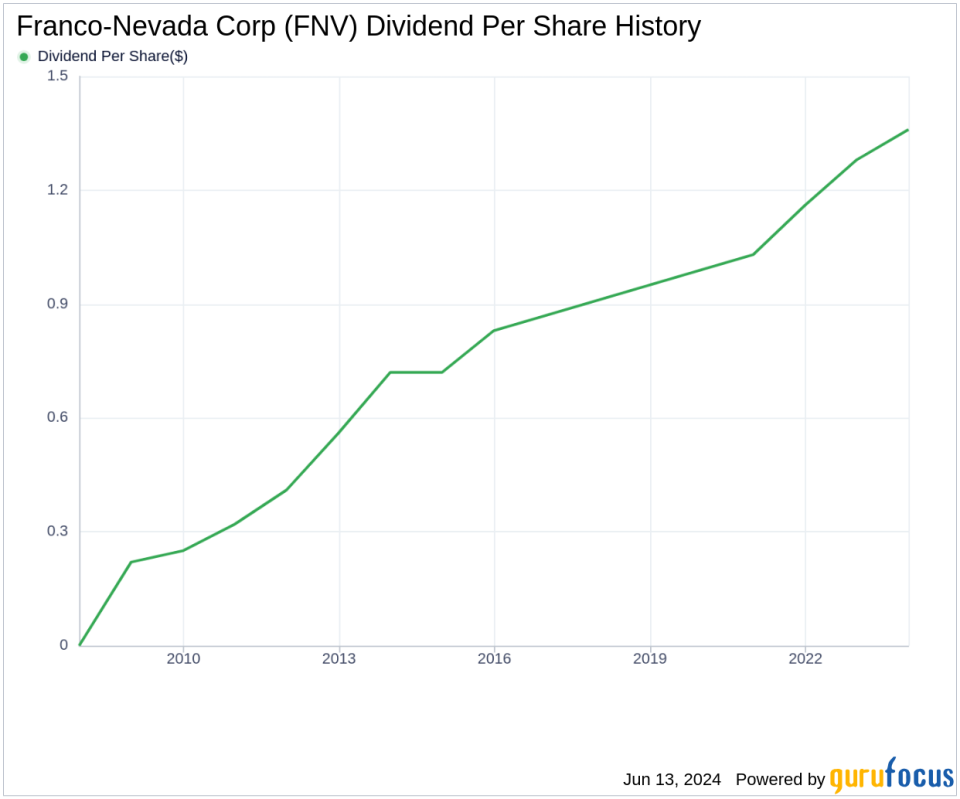

Review of Franco-Nevada Corp's Dividend History

Since 2008, Franco-Nevada Corp has consistently paid dividends, transitioning to a quarterly distribution schedule. The company has not only maintained but also increased its dividend annually, earning it the status of a dividend achievera recognition awarded to companies with at least a 16-year history of consecutive dividend increases.

Below is a graphical representation of Franco-Nevada Corp's annual Dividends Per Share to illustrate historical trends.

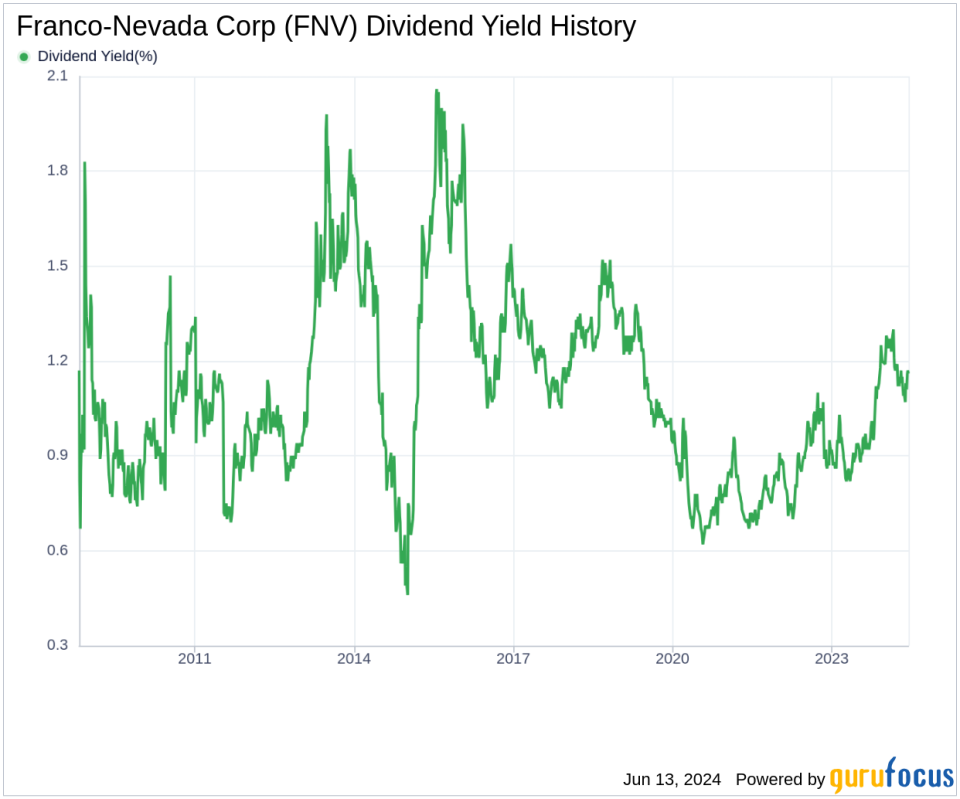

Analysis of Franco-Nevada Corp's Dividend Yield and Growth

Currently, Franco-Nevada Corp boasts a trailing dividend yield of 1.16% and a forward dividend yield of 1.20%, indicating expectations of a slight increase in dividend payments over the next year. Over the past three years, the annual dividend growth rate stood at 22.80%, though it moderated to 9.10% over a five-year period and further to 7.40% over the last decade. The 5-year yield on cost is approximately 1.79% as of today.

Evaluating Dividend Sustainability

The sustainability of dividends is crucial for long-term investment considerations. Franco-Nevada Corp's dividend payout ratio currently stands at 1.24, which may raise concerns about the sustainability of its dividend payments. However, the company's profitability rank of 8 out of 10, combined with consistent net profits over the past decade, suggests robust profitability.

Future Growth Prospects

Looking ahead, Franco-Nevada Corp's growth metrics are promising, with a growth rank of 8 out of 10. However, its average annual revenue growth rate of 7.30% slightly lags behind 58.15% of global competitors. Additionally, the company's 3-year EPS growth rate declined by an average of 25.90% annually, underperforming 77.27% of global competitors. The 5-year EBITDA growth rate of 8.50% also trails 57.22% of global peers.

Concluding Thoughts on Franco-Nevada Corp's Dividend Outlook

While Franco-Nevada Corp has demonstrated a commendable dividend history and maintains a solid profitability rank, potential investors should carefully consider the company's payout ratio and mixed growth metrics. The ability to sustain dividends in the long term may hinge on improvements in these areas. For those looking to explore further, the High Dividend Yield Screener available to GuruFocus Premium users is an excellent resource for identifying high-yield investment opportunities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance