FormFactor Inc (FORM) Q1 2024 Earnings: Aligns with EPS Projections Amidst Robust DRAM Demand

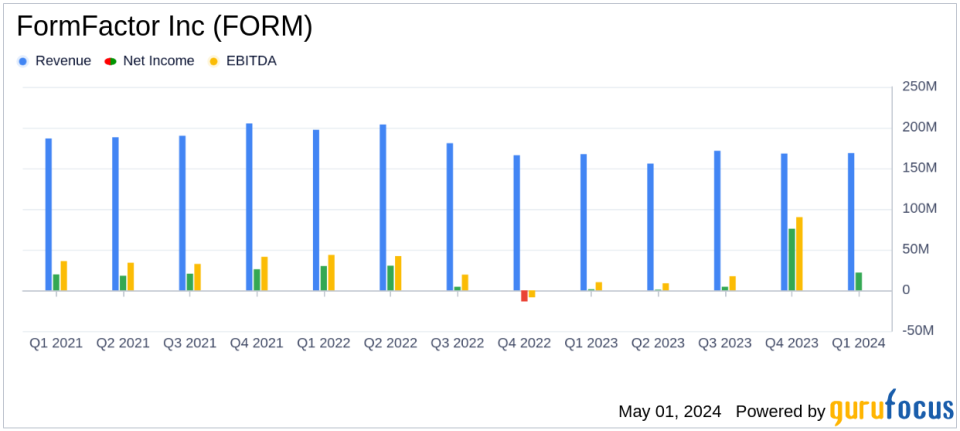

Revenue: Reported at $168.7 million, a slight increase of 0.8% from $167.4 million in the same quarter last year, exceeding estimates of $165.35 million.

Net Income: GAAP net income stood at $21.8 million, significantly higher than the $1.3 million in the previous year's first quarter, surpassing the estimated $14.99 million.

Earnings Per Share (EPS): Non-GAAP EPS was $0.18, slightly below the estimated $0.19.

Gross Margin: Non-GAAP gross margin was 38.7%, showing a slight improvement from 38.4% in the first quarter of the previous year.

Free Cash Flow: Achieved $19.7 million, a substantial improvement from the negative $7.3 million in the first quarter of the previous year.

Operational Efficiency: GAAP net cash provided by operating activities increased to $33.0 million from $12.3 million in the same period last year.

Future Outlook: Expects a significant increase in demand and improvements in gross margin and non-GAAP EPS for Q2, driven by strength in DRAM and Foundry & Logic probe cards.

On May 1, 2024, FormFactor Inc (NASDAQ:FORM) released its 8-K filing, detailing the financial outcomes for the first quarter ended March 30, 2024. The company reported quarterly revenues of $168.7 million, slightly surpassing the estimated $165.35 million, indicating a resilient performance in a challenging market. However, the non-GAAP earnings per share (EPS) of $0.18 slightly missed the analyst estimate of $0.19.

FormFactor Inc, a pivotal player in the semiconductor industry, specializes in the design, development, and support of semiconductor probe card products. Operating primarily through its Probe Cards and Systems Segments, the company has recently undergone significant organizational changes to bolster its market position and address the escalating demand in DRAM and advanced packaging technologies.

Financial Highlights and Strategic Initiatives

The first quarter saw a modest year-over-year revenue growth of 0.8%, with the gross margin on a GAAP basis reported at 37.2%, reflecting a slight improvement from 36.5% in the same quarter the previous year. The non-GAAP gross margin also showed a marginal increase to 38.7%. These figures underscore FormFactor's ongoing efforts to optimize its product mix and manage operational costs effectively.

CEO Mike Slessor highlighted the robust demand for DRAM probe cards, with revenue levels matching the peak figures of 2021. The company's strategic realignment, including the consolidation of global operations and key executive appointments, is aimed at harnessing growth opportunities presented by the industry's shift towards advanced semiconductor packaging solutions.

Operational and Financial Challenges

Despite the positive revenue outcomes, FormFactor faced challenges reflected in its non-GAAP EPS, which did not meet the midpoint of the company's outlook range. This was primarily due to lower-than-expected gross margins stemming from a weaker product mix and elevated warranty costs across both business segments. Additionally, the company's operational income saw a significant reduction from the previous quarter, indicating the impact of these challenges on profitability.

Looking Forward

Looking ahead to Q2 2024, FormFactor expects a substantial increase in demand, projecting revenues around $195 million and aiming for a non-GAAP gross margin of approximately 45%. This optimistic outlook is supported by continued strength in both DRAM and Foundry & Logic probe cards, driven by the broader industry adoption of sophisticated packaging technologies.

The company's financial stability is further evidenced by its strong cash flow performance. GAAP net cash provided by operating activities was $33.0 million, a significant improvement over the previous quarters. The free cash flow stood at $19.7 million, recovering from negative figures in the past, highlighting FormFactor's effective capital management and operational efficiency.

Conclusion

FormFactor's first quarter of 2024 encapsulates a period of strategic repositioning and adaptation to the dynamic demands of the semiconductor industry. With its focused approach on DRAM and advanced packaging, coupled with organizational enhancements, FormFactor is well-positioned to capitalize on the emerging market trends. However, the company must continue to navigate the challenges of product mix optimization and cost management to enhance its profitability and shareholder value in forthcoming quarters.

For detailed financial tables and further information, please refer to the official 8-K filing by FormFactor Inc.

Explore the complete 8-K earnings release (here) from FormFactor Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance