First Solar Inc (FSLR) Surpasses Analyst Earnings and Revenue Estimates in Q1 2024

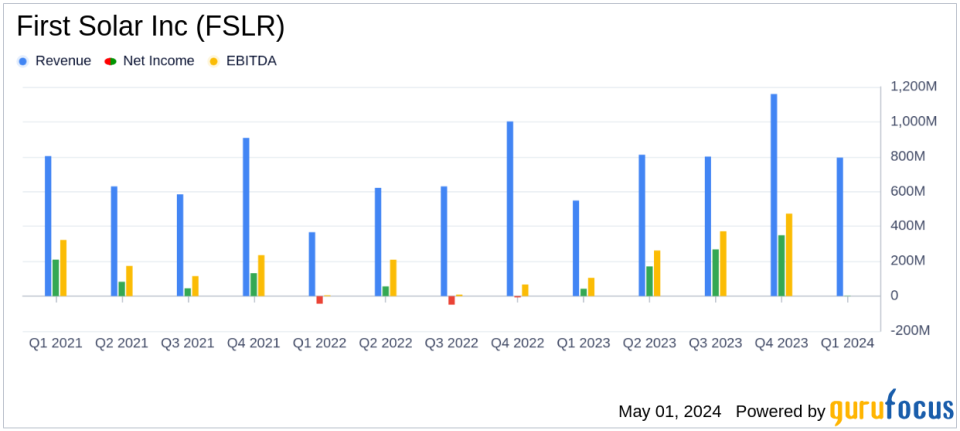

Revenue: Reported at $794 million, surpassing the estimated $702.18 million.

Earnings Per Share (EPS): Achieved $2.20 per diluted share, exceeding analyst expectations of $1.99.

Net Income: Realized net income significantly exceeded expectations with $236.6 million compared to the estimated $212.90 million.

Net Cash Balance: Ended the quarter with $1.4 billion, reflecting a decrease from the previous quarter's $1.6 billion due to capital expenditures.

Year-to-Date (YTD) Net Bookings: Reached 2.7 GW, with an average selling price of 31.3 cents per watt, excluding adjusters.

Guidance: Full-year 2024 earnings guidance remains unchanged, with expected net sales between $4.4 billion and $4.6 billion and EPS ranging from $13.00 to $14.00.

Capital Expenditures: Updated to range from $1.8 billion to $2.0 billion, reflecting ongoing investments in manufacturing capacity expansions.

First Solar Inc (NASDAQ:FSLR) released its 8-K filing on May 1, 2024, disclosing a strong financial performance for the first quarter of the year. The company reported net sales of $794 million and a net income per diluted share of $2.20, both exceeding analyst expectations which had projected earnings of $1.99 per share on revenues of $702.18 million. This performance highlights First Solar's robust operational execution and strategic positioning in the solar technology sector.

First Solar, a leading American solar technology company, is renowned for its advanced thin-film photovoltaic modules and its commitment to eco-efficient solar solutions. With manufacturing facilities across Vietnam, Malaysia, the United States, and India, First Solar stands as the world's largest thin-film solar module manufacturer, leveraging cadmium telluride technology to convert sunlight into electricity.

Financial and Operational Highlights

The company's financial strength is evident from its net cash balance of $1.4 billion, despite a decrease from the previous quarter's $1.6 billion, primarily due to capital expenditures for expanding manufacturing capacity in Alabama, Louisiana, and Ohio. This strategic expansion underscores First Solar's commitment to enhancing its production capabilities and maintaining its industry leadership.

First Solar's CEO, Mark Widmar, expressed satisfaction with the company's performance, citing "good operating performance, selective bookings with a year-to-date average selling price over 31 cents per watt excluding adjusters, and solid financial results." This statement reflects the company's strategic focus on profitable growth and market adaptability amid industry fluctuations.

The company has maintained its full-year 2024 guidance, expecting net sales between $4.4 billion and $4.6 billion and earnings per diluted share ranging from $13.00 to $14.00. These projections are supported by a strong sales backlog of 78.3 GW and year-to-date net bookings of 2.7 GW, demonstrating robust market demand for First Solar's products.

Analysis of Financial Statements

Reviewing the condensed consolidated statements of operations, First Solar's cost of sales stood at $448 million for the quarter, resulting in a gross profit of $346 million. The operational expenses, including selling, general and administrative costs, and research and development, totaled approximately $104 million. This efficient cost management facilitated an operating income of $243 million.

The balance sheet further reveals a solid financial position with total assets amounting to $10.76 billion as of March 31, 2024, compared to $10.36 billion at the end of 2023. The increase in assets is a positive indicator of the company's ongoing investments in its operational capabilities and technological advancements.

Market Outlook and Strategic Movements

First Solar's performance in the first quarter of 2024 positions it well within the competitive landscape of the solar industry. The company's focus on technological innovation, cost-effective production processes, and strategic market positioning are pivotal in driving its financial success and operational resilience. As the industry continues to evolve with increasing emphasis on renewable energy solutions, First Solar's proactive strategies and robust financial health suggest a promising outlook for its stakeholders.

Investors and market watchers will likely keep a close eye on First Solar's progress through 2024, as it continues to navigate the complexities of the global solar market while striving to deliver sustainable shareholder value.

Explore the complete 8-K earnings release (here) from First Solar Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance