Eye These 5 Retail Building Products Stocks From a Prospering Industry

The Zacks Building Products – Retail industry participants are likely to benefit from technology initiatives to bolster the e-commerce experience. Companies have been strengthening digital ecosystems, providing the best online assortments and bolstering omni-channel capabilities. Industry participants are also benefiting from accretive acquisitions, the focus on expanding supply-chain facilities and digital initiatives. Continued innovation, e-commerce expansion and strong demand are likely to benefit players like The Home Depot Inc. HD, Lowe's Companies LOW, Fastenal Company FAST, Beacon Roofing Supply BECN and GMS, Inc. GMS.

However, the industry players have been witnessing broad-based pressure across the business, driven by softened consumer demand versus expectations, which is likely to affect their performances. Severe constraints related to inflation, a deflation in lumber prices, and product and transportation cost inflation are worrisome.

About the Industry

The Zacks Building Products – Retail industry mainly comprises U.S. home improvement retailers, manufacturers of industrial and construction materials, and distributors of wallboard and ceiling systems. Some industry participants offer products and services for home decoration, repair and remodeling, and in-home delivery and installation services. A few industry players provide construction products, ranging from cement or concrete foundation materials to roofing boards and shingles. The companies also sell lumber, insulation materials, drywall, plumbing fixtures, hard-surface flooring, and lawn and garden decor products. Some players deal in threaded fastener products, and manufactured and natural stone tiles. In addition to general consumers, the industry players cater to professional builders, sub-contractors, remodelers and retailers.

3 Trends Shaping the Future of Building Products - Retail Industry

Digitization & Acquisitions in Focus: Retail Building Products industry participants have been witnessing a surge in online business transactions, owing to consumers’ growing digital dependency. The focus on virtual platforms to boost customer engagement has been rewarding for top-line growth of many industry players. Companies have, therefore, been strengthening their digital presence by expanding the availability of online assortments and bolstering omni-channel capabilities. Such prudent measures have been aiding industry participants to meet accelerated demand. Companies are also ramping up their delivery operations to provide safe and swift services. The digital transaction boom should continue to drive the top lines of the key industry players. Acquisitions have been crucial parts of growth strategies of companies in the Retail Building Products industry. Some Players have been focusing on exploring acquisition options to expand extensively across vast geographic boundaries and improve organic revenues.

Do-it-Yourself (DIY) & Pro Projects: Despite a slowdown in the spending trends, the demand for revamping interiors and repair-remodel creates opportunities for the industry players. DIY projects for decorating and maintaining furniture and fixtures are being widely undertaken. Additionally, consumers are open to hiring professionals (“Pros”) to complete their home renovations, resulting in rising demand for Pro projects. Companies noted that Pro backlogs continue to be healthy and elevated. This is likely to aid participants in the home improvement space, with a focus on building Pro offerings.

Rising Costs: Inflationary pressures, particularly higher input costs, have been concerning for players in the home improvement industry. Such increased input costs are likely to put pressure on margins. A deflation in lumber prices is also expected to hurt the performances of participating companies. Some companies have provided conservative views for 2024 based on assumptions of lower consumer spending trends, normalized transactions and continued investments to capture market share. The industry is expected to witness a gradual normalization in transactions as consumer spending has shifted from goods to services.

Zacks Industry Rank Indicates Bright Prospects

The Building Products – Retail industry is housed within the broader Zacks Retail-Wholesale sector. The industry currently carries a Zacks Industry Rank #94, which places it in the top 38% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates bright near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s position in the top 50% of the Zacks-ranked industries is a result of a positive earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are gradually gaining confidence in this group’s earnings growth potential.

Before we present a few stocks that you may want to consider for your portfolio, let us look at the industry’s recent stock-market performance and the valuation picture.

Industry Vs. Broader Market

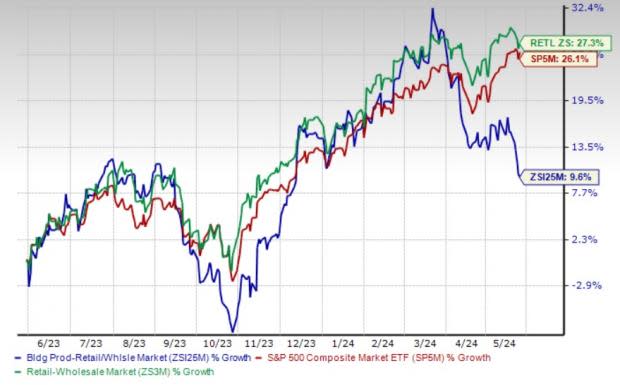

The Zacks Building Products – Retail industry has underperformed the broader Zacks Retail-Wholesale sector and the Zacks S&P 500 in the past year.

The industry has risen 9.6% in the past year compared with the broader sector’s growth of 27.3% and the S&P 500’s rally of 26.1%.

One-Year Price Performance

Industry's Current Valuation

On the basis of the forward 12-month price-to-earnings (P/E) ratio, which is the commonly used multiple for valuing Retail-Wholesale stocks, the industry is currently trading at 18.96X compared with the S&P 500’s 21.1X. Further, the sector’s forward-12-month P/E stands at 22.1X.

Over the last five years, the industry traded as high as 23.43X and as low as 14.25X, the median being 19.56X, as the chart below shows.

Price-to-Earnings Ratio (Past 5 Years)

5 Building Products Stocks to Watch

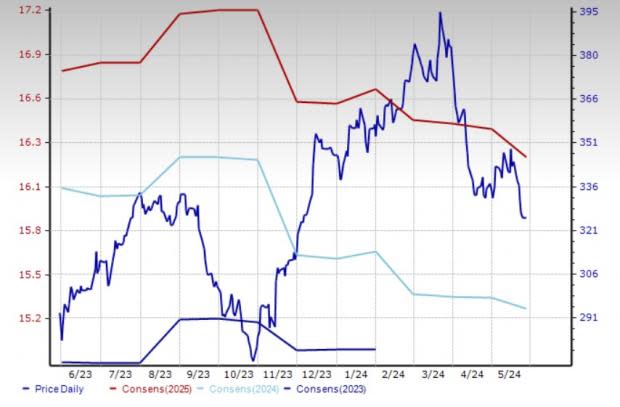

GMS: The Tucker, GA-based leading North American specialty building product distributor has been gaining from robust customer service in a solid residential market, coupled with an inflationary pricing environment and successful platform expansion activities. Inflationary pricing, healthy residential end markets, strong performance from complementary products and the recent acquisitions have been sales drivers for GMS.

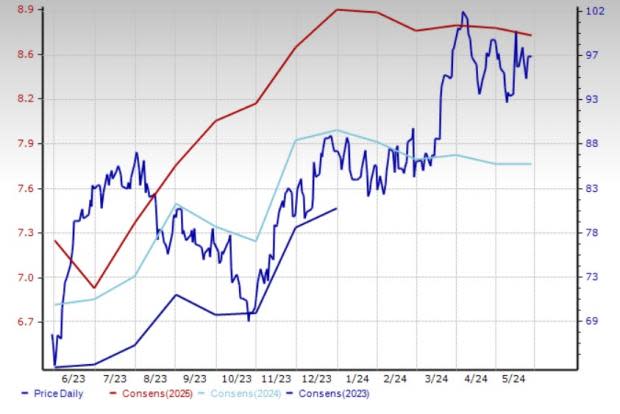

The Zacks Rank #2 (Buy) company has rallied 42.8% in a year. The Zacks Consensus Estimate for the company’s current fiscal-year sales indicates growth of 3.3% from the prior-year period’s reported figure. The consensus estimate for current fiscal-year earnings has been unchanged in the past 30 days at $8.36 per share. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Price and Consensus: GMS

Home Depot: The Atlanta, GA-based company is the world’s largest home improvement specialty retailer, based on net sales. Home Depot is poised to benefit from ongoing investments. Continued strength in the Pro and DIY categories, and its digital momentum have been the key drivers. The company’s interconnected retail strategy and underlying technology infrastructure have helped consistently boost web traffic for the past few quarters, aiding digital sales.

HD is witnessing significant benefits from the execution of its One Home Depot plan, which focuses on supply-chain expansion, technology investments and digital enhancements. The Zacks Rank #3 (Hold) company has rallied 11% in a year. The Zacks Consensus Estimate for HD’s current fiscal-year sales and earnings indicates year-over-year growth of 1% and 1.3%, respectively. The consensus estimate for current fiscal-year earnings has moved down 0.4% in the past 30 days.

Price and Consensus: HD

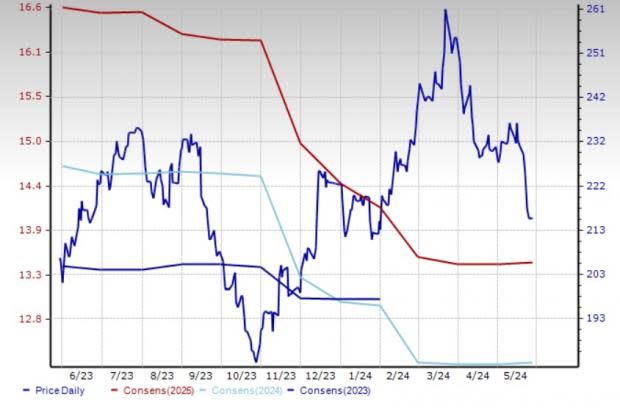

Lowe’s: The Mooresville, NC-based leading home improvements retailer has been gaining from strong growth in its Pro business. The company has been enhancing the experience of its pro customers by upgrading pro-focused brands and revamping the pro-service business’s website. LOW has also been well-positioned to capitalize on the demand for the home improvement market, backed by investments in the technology and merchandise category. Gains from the Total Home strategy and the execution of the Perpetual Productivity Improvement initiative are likely to drive the company’s results in the near and long terms. The Total Home strategy has been resonating well with Pro and DIY customers for a while.

LOW has been progressing well with advancements in the digital channel. Lowe's is investing in enhancing omni-channel retailing capabilities. Management is also committed to enhancing the Pro offerings, expanding the company’s market share and driving the operating margin. The Zacks Consensus Estimate for its current fiscal year’s sales and earnings indicates declines of 2.1% and 7.4%, respectively, from the year-ago quarter’s actuals. The consensus estimate for current fiscal-year earnings has moved up 0.2% in the past seven days. Shares of the Zacks Rank #3 company have risen 4.2% in a year.

Price and Consensus: LOW

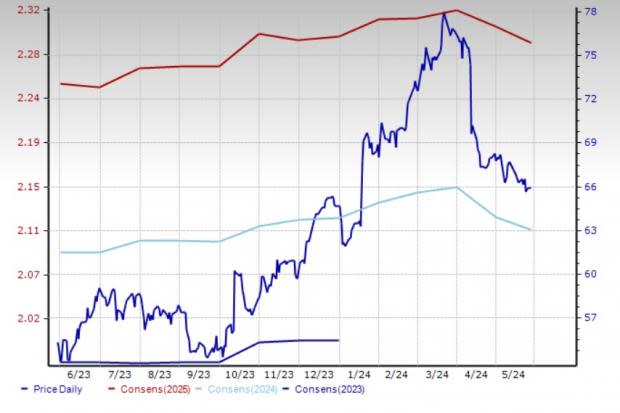

Fastenal: The Winona, MN-based wholesale distributor of industrial and construction products has been benefiting from strong demand for manufacturing and construction equipment, as well as supplies. The company’s focus on virtual platforms to boost customer engagement is improving sales and driving growth. Cost-control strategies like automating warehouses, increasing delivery efficiency through its trucking network and selling more private-level products with higher margins are aiding FAST to improve efficiency, thereby increasing returns.

Industrial vending is one of the primary growth drivers for FAST, and has the potential to significantly increase sales and profits. The Zacks Rank #3 company is striving to boost its onsite location portfolio, in which a mini-Fastenal shop is located in a customer’s facility. The FAST stock has risen 19.7% in a year. The Zacks Consensus Estimate for Fastenal’s current fiscal-year sales and earnings indicates year-over-year growth of 5.1% and 4.5%, respectively. The consensus estimate for current fiscal-year earnings has moved down by a penny in the past 30 days.

Price and Consensus: FAST

Beacon Roofing: The Herndon, VA-based company is the largest publicly traded distributor of residential and non-residential roofing materials, and complementary building products in the United States and Canada. BECN has been gaining from several strategic initiatives undertaken to drive its long-term ambition of growing and enhancing customer experience; expanding the top line and the margin; and boosting value for customers, suppliers, employees and shareholders. The company is focused on its Ambition 2025 targets (announced on Feb 24, 2022), which emphasize operational excellence, above-market growth trajectory and accelerated stockholder value creation. Beacon Roofing remains focused on four key strategic initiatives — organic growth, digital, OTC (On-Time and Complete) and branch operating performance — which have been boosting sales and helping improve operating profitability.

BECN is focused on improving sales and the operating performance at exterior and interior branches, and intends to enhance the overall customer experience with increased scope and scale of business. Shares of the Zacks Rank #3 company have rallied 44.4% in a year. The Zacks Consensus Estimate for Beacon Roofing’s current fiscal year’s sales and earnings indicates growth of 5.6% and 0.5%, respectively, from the year-ago quarter’s actuals. The consensus estimate for current fiscal-year earnings has been unchanged in the past 30 days.

Price and Consensus: BECN

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Home Depot, Inc. (HD) : Free Stock Analysis Report

Fastenal Company (FAST) : Free Stock Analysis Report

Lowe's Companies, Inc. (LOW) : Free Stock Analysis Report

Beacon Roofing Supply, Inc. (BECN) : Free Stock Analysis Report

GMS Inc. (GMS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance