Exploring Undervalued Stocks On Euronext Paris With Discounts Ranging From 33% To 48.5%

Amidst a backdrop of political uncertainty and fluctuating market indices, France's CAC 40 Index recently experienced a notable decline. In such an environment, identifying undervalued stocks can offer investors potential opportunities for growth as the market stabilizes.

Top 10 Undervalued Stocks Based On Cash Flows In France

Name | Current Price | Fair Value (Est) | Discount (Est) |

Vente-Unique.com (ENXTPA:ALVU) | €15.60 | €29.81 | 47.7% |

Kaufman & Broad (ENXTPA:KOF) | €27.20 | €52.86 | 48.5% |

Lectra (ENXTPA:LSS) | €27.70 | €43.09 | 35.7% |

Wavestone (ENXTPA:WAVE) | €55.00 | €88.85 | 38.1% |

Groupe OKwind Société anonyme (ENXTPA:ALOKW) | €19.60 | €34.20 | 42.7% |

Vivendi (ENXTPA:VIV) | €9.772 | €15.51 | 37% |

MEMSCAP (ENXTPA:MEMS) | €5.42 | €8.55 | 36.6% |

Tikehau Capital (ENXTPA:TKO) | €21.65 | €32.29 | 33% |

Thales (ENXTPA:HO) | €154.35 | €257.89 | 40.1% |

Groupe Airwell Société anonyme (ENXTPA:ALAIR) | €3.76 | €6.69 | 43.8% |

We'll examine a selection from our screener results

Kaufman & Broad

Overview: Kaufman & Broad S.A. is a property developer and builder in France, with a market capitalization of approximately €561.08 million.

Operations: The company operates primarily in property development and building within France.

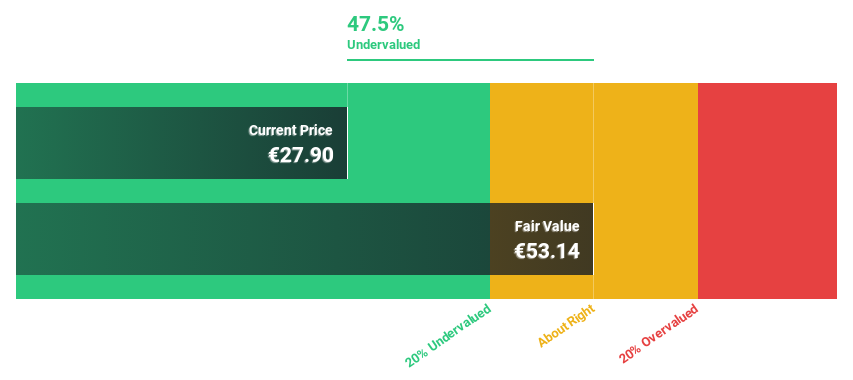

Estimated Discount To Fair Value: 48.5%

Kaufman & Broad S.A., currently priced at €27.2, is trading significantly below its estimated fair value of €52.86, suggesting a potential undervaluation based on discounted cash flow analysis. Despite a recent downturn in quarterly performance with sales and net income declining to €228 million and €11.05 million respectively, the company's long-term outlook remains positive. Earnings are expected to grow by 13.41% annually, outpacing the French market's forecast of 11%, while projected revenue growth also exceeds market averages at 8.7% per year compared to 5.8%.

Lectra

Overview: Lectra SA, with a market cap of €1.05 billion, offers industrial intelligence solutions across the fashion, automotive, and furniture sectors in regions including Northern Europe, Southern Europe, the Americas, and Asia Pacific.

Operations: The company generates revenue from the Americas and Asia-Pacific regions, totaling €170.33 million and €110.28 million respectively.

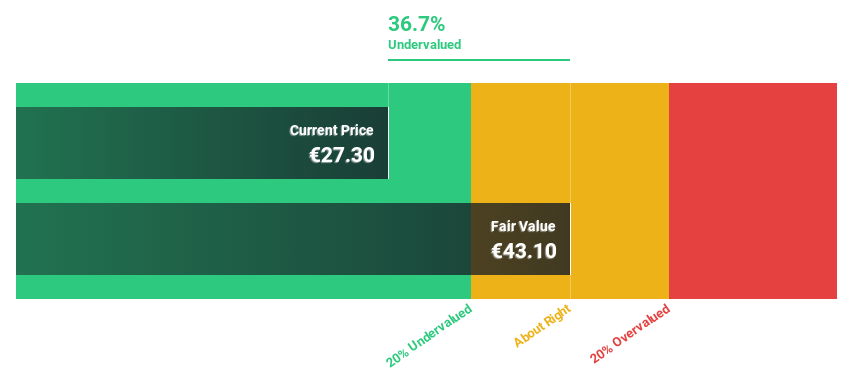

Estimated Discount To Fair Value: 35.7%

Lectra SA, with a current price of €27.7, appears undervalued based on a discounted cash flow analysis, suggesting its market price is 35.7% below the estimated fair value of €43.09. Despite recent earnings showing a slight decline to €7.17 million from last year's €7.63 million, the company's revenue growth outpaces the French market at 11.3% per year versus 5.8%. Analysts expect significant earnings growth over the next three years and forecast an increase in stock price by 28.9%.

Tikehau Capital

Overview: Tikehau Capital is a private equity and venture capital firm that specializes in a variety of financing products such as senior secured loans, equity, and mezzanine; it has a market capitalization of approximately €3.75 billion.

Operations: The firm generates revenue primarily through two segments: Investment Activities, which brought in €179.19 million, and Asset Management Activities, contributing €322.32 million.

Estimated Discount To Fair Value: 33%

Tikehau Capital, priced at €21.65, trades significantly below its fair value of €32.29, marking a 33% undervaluation. Expected to outperform with earnings growth at 31% annually and revenue increases forecasted at 19.9% per year—both exceeding the French market projections. However, its dividend coverage by cash flows is weak, and projected Return on Equity in three years is modest at 12.7%. Recent actions include a dividend increase to €0.75 per share and an extension of their buyback plan.

Turning Ideas Into Actions

Access the full spectrum of 15 Undervalued Euronext Paris Stocks Based On Cash Flows by clicking on this link.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:KOF ENXTPA:LSS and ENXTPA:TKO.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance