Exploring Top Glove Corporation Bhd And Two More Growth Stocks With Significant Insider Ownership

As global markets show signs of recovery with indices like the S&P 500 nearing record highs and various regions experiencing economic growth, investors are keenly observing market trends and potential opportunities. In this context, growth companies with high insider ownership can be particularly compelling, as significant insider stakes often signal confidence in the company's future from those who know it best.

Top 10 Growth Companies With High Insider Ownership

Name | Insider Ownership | Earnings Growth |

Medley (TSE:4480) | 34.1% | 23.6% |

Gaming Innovation Group (OB:GIG) | 22.8% | 36.2% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 49.9% |

Elliptic Laboratories (OB:ELABS) | 31.4% | 124.6% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

Nordic Halibut (OB:NOHAL) | 29.9% | 56.0% |

EHang Holdings (NasdaqGM:EH) | 33% | 97.1% |

La Française de l'Energie (ENXTPA:FDE) | 20.1% | 37.6% |

OSE Immunotherapeutics (ENXTPA:OSE) | 25.1% | 92.9% |

Adocia (ENXTPA:ADOC) | 12.9% | 104.5% |

We're going to check out a few of the best picks from our screener tool.

Top Glove Corporation Bhd

Simply Wall St Growth Rating: ★★★★★☆

Overview: Top Glove Corporation Bhd is a Malaysian investment holding company that specializes in manufacturing, trading, and selling gloves both domestically and internationally, with a market capitalization of approximately MYR 7.69 billion.

Operations: The company generates its revenue primarily from the gloves manufacturing industry, totaling approximately MYR 2.05 billion.

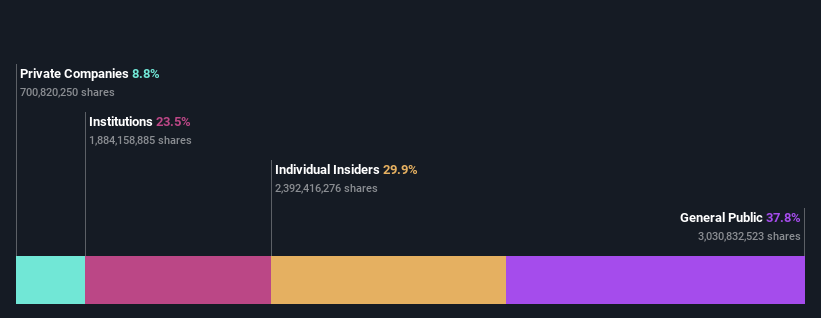

Insider Ownership: 29.9%

Earnings Growth Forecast: 116.0% p.a.

Top Glove Corporation Bhd, a company with high insider ownership, has recently seen substantial insider buying and no significant selling. This trend could indicate confidence from those closest to the company. Despite a challenging period with decreased sales and net losses in its latest reports, Top Glove is expected to return to profitability within three years. The forecasted revenue growth rate is significantly above the market average at 32.5% per year, highlighting potential for substantial growth ahead. Additionally, recent board changes include appointing experienced financial professionals which might strengthen governance and strategic planning.

Nordstrom

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nordstrom, Inc. is a fashion retailer offering apparel, shoes, beauty products, accessories, and home goods across various demographics, with a market capitalization of approximately $3.45 billion.

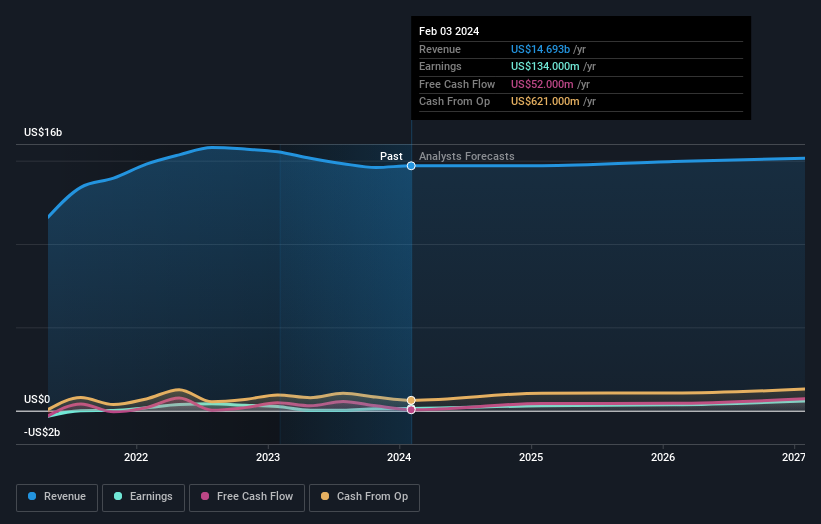

Operations: The company generates its revenue primarily from retail operations, which amounted to $14.22 billion.

Insider Ownership: 17.4%

Earnings Growth Forecast: 25.9% p.a.

Nordstrom, with substantial insider ownership, is trading at 75.1% below its estimated fair value, presenting a potential undervaluation. Despite this, the company faces challenges such as a high level of debt and large one-off items impacting financial results. Profit margins have decreased from last year, and dividend coverage is weak. However, Nordstrom's earnings are expected to grow significantly at 25.9% per year over the next three years, outpacing the US market forecast of 14.5%. Recent efforts to enhance customer experience include expanding Nordstrom Rack locations and strategic collaborations like with Destination XL Group to broaden market reach.

CD Projekt

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CD Projekt S.A., along with its subsidiaries, focuses on the development, publishing, and digital distribution of video games for personal computers and game consoles in Poland, with a market capitalization of PLN 14.29 billion.

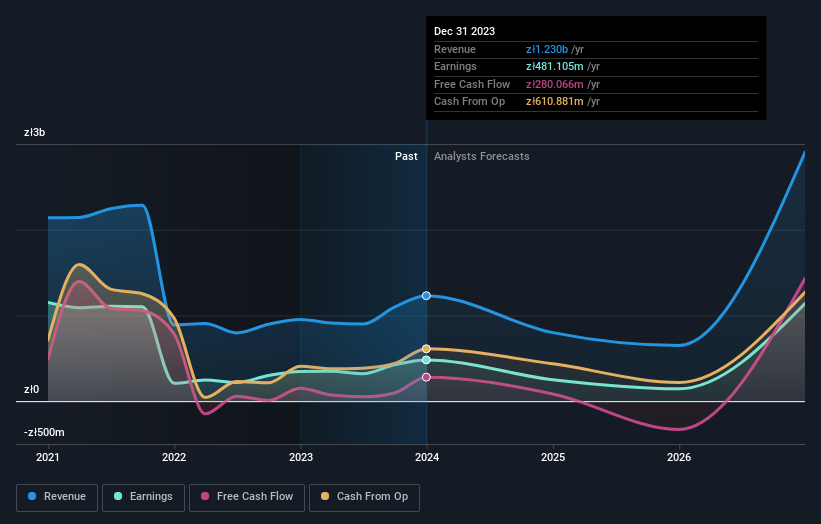

Operations: The company generates revenue through its segments, with GOG.Com contributing PLN 234.97 million and CD PROJEKT RED adding PLN 1.04 billion.

Insider Ownership: 35.2%

Earnings Growth Forecast: 23.6% p.a.

CD Projekt, characterized by high insider ownership, demonstrates robust financial growth with a significant 38.9% increase in earnings over the past year. The company's revenue is expected to grow at 16% per year, outpacing the Polish market's 4.1%. However, its revenue growth is below the general high-growth benchmark of 20% per year. Despite this, CD Projekt's earnings are projected to surge by 23.6% annually, exceeding Poland's average of 15.3%. Recently, they confirmed a consistent dividend payout and showcased their developments at key industry conferences.

Next Steps

Investigate our full lineup of 1504 Fast Growing Companies With High Insider Ownership right here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include KLSE:TOPGLOV NYSE:JWNWSE:CDR and .

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance