Exploring Top Dividend Stocks In The UK For May 2024

As the FTSE 100 shows signs of opening higher, buoyed by a less hawkish Federal Reserve and key earnings reports in focus, the United Kingdom's financial markets remain a hub of activity and anticipation. This dynamic backdrop sets an intriguing stage for investors considering dividend stocks, where stability and consistent returns become particularly appealing amidst fluctuating market conditions.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

Record (LSE:REC) | 8.31% | ★★★★★★ |

Keller Group (LSE:KLR) | 3.99% | ★★★★★☆ |

DCC (LSE:DCC) | 3.48% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 6.11% | ★★★★★☆ |

Grafton Group (LSE:GFTU) | 3.99% | ★★★★★☆ |

Rio Tinto Group (LSE:RIO) | 6.18% | ★★★★★☆ |

NWF Group (AIM:NWF) | 3.59% | ★★★★★☆ |

James Latham (AIM:LTHM) | 3.03% | ★★★★★☆ |

Hargreaves Services (AIM:HSP) | 6.27% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 4.11% | ★★★★★☆ |

Click here to see the full list of 55 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

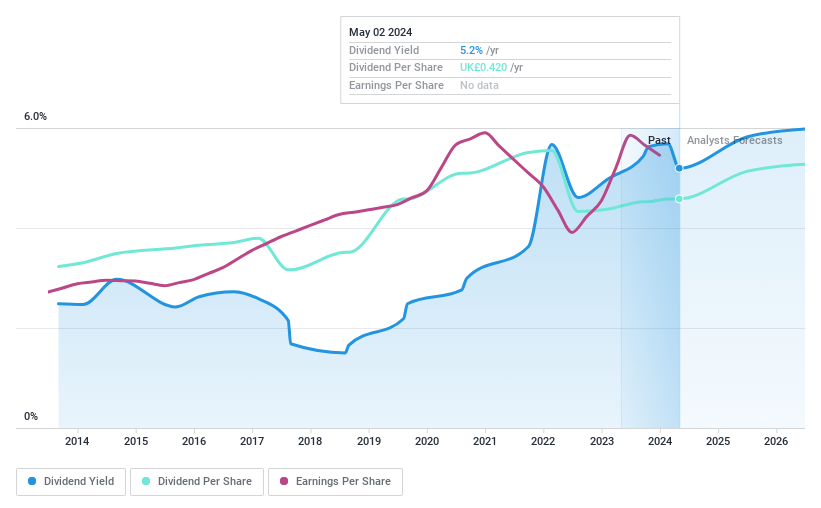

Hargreaves Lansdown

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hargreaves Lansdown plc is a UK-based company offering investment services to individuals and corporates, with a market capitalization of approximately £3.83 billion.

Operations: Hargreaves Lansdown plc generates £753.30 million in revenue from its asset management services.

Dividend Yield: 5.2%

Hargreaves Lansdown has demonstrated a mixed performance in terms of dividend reliability, with a history of volatile payouts despite a recent increase to 13.2 pence per share as declared on February 22, 2024. The company's dividends are adequately covered by both earnings and cash flows, each at approximately 66%. However, its dividend yield of 5.2% trails the top UK payers. Recent executive appointments and digital transformation initiatives indicate strategic shifts that could impact future performance and sustainability of dividends.

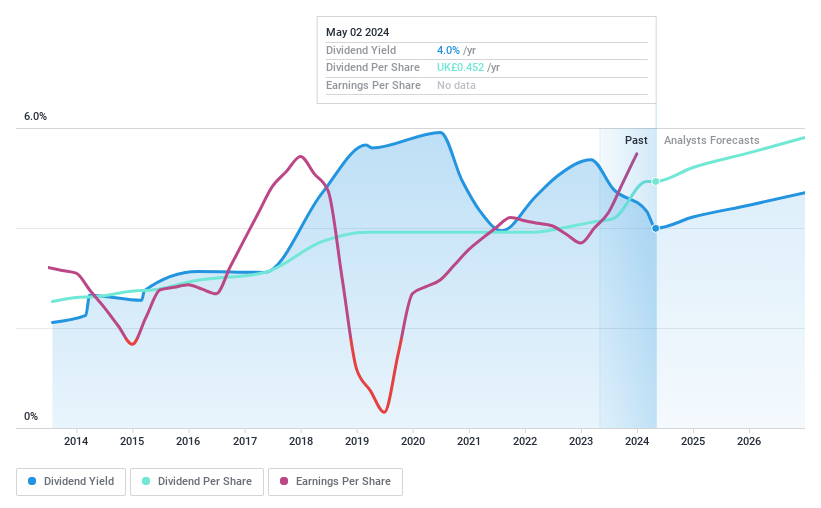

Keller Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Keller Group plc is a company that specializes in geotechnical services across North America, Europe, Asia-Pacific, the Middle East, and Africa, with a market capitalization of approximately £0.83 billion.

Operations: Keller Group plc generates its revenue primarily from specialist geotechnical services, totaling £2.97 billion.

Dividend Yield: 4%

Keller Group's dividend yield stands at 3.99%, which is modest compared to the UK market's top quartile at 5.78%. Nevertheless, the company maintains a solid track record of stable and growing dividends over the past decade, supported by a payout ratio of 36.8% and a cash payout ratio of 32.2%, indicating sound earnings and cash flow coverage. Recent financials show significant earnings growth, with net income rising to £89.4 million in 2023 from £46 million the previous year, alongside strategic plans for targeted acquisitions and operational refinements aimed at sustaining future growth.

Click to explore a detailed breakdown of our findings in Keller Group's dividend report.

Upon reviewing our latest valuation report, Keller Group's share price might be too pessimistic.

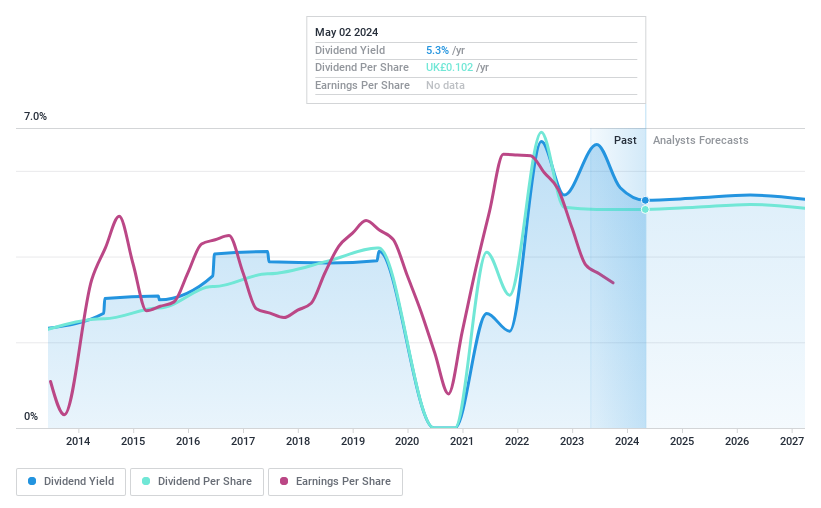

Norcros

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Norcros plc, a company operating in the United Kingdom and South Africa, specializes in developing, manufacturing, and marketing bathroom and kitchen products with a market capitalization of approximately £172.04 million.

Operations: Norcros plc generates £422.70 million in revenue from its building products segment.

Dividend Yield: 5.3%

Norcros plc anticipates its underlying operating profit for the fiscal year ended March 31, 2024, to meet market expectations with total revenue around £390 million, a decrease from the previous year. Despite this dip, Norcros maintains a stable dividend coverage with a payout ratio of 60.2% and cash payout ratio of 30.4%, suggesting dividends are well-supported by both earnings and cash flow. However, its dividend yield at 5.31% is below the top UK quartile and historical payments have shown volatility over the past decade.

Delve into the full analysis dividend report here for a deeper understanding of Norcros.

Our valuation report unveils the possibility Norcros' shares may be trading at a discount.

Taking Advantage

Unlock our comprehensive list of 55 Top Dividend Stocks by clicking here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:HL. LSE:KLR and LSE:NXR.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance