Exploring Three UK Exchange Stocks With Estimated Discounts Ranging From 21.6% To 49%

As the United Kingdom prepares for a pivotal general election, the financial markets remain a focal point of attention, with recent performances reflecting both local and global economic dynamics. In this climate, identifying undervalued stocks becomes crucial for investors looking to potentially capitalize on market discrepancies during uncertain times.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

Name | Current Price | Fair Value (Est) | Discount (Est) |

TBC Bank Group (LSE:TBCG) | £25.80 | £48.90 | 47.2% |

Halfords Group (LSE:HFD) | £1.472 | £2.78 | 47.1% |

LSL Property Services (LSE:LSL) | £3.28 | £6.50 | 49.6% |

WPP (LSE:WPP) | £7.158 | £13.95 | 48.7% |

Mercia Asset Management (AIM:MERC) | £0.328 | £0.62 | 46.8% |

Entain (LSE:ENT) | £6.186 | £12.24 | 49.4% |

Auction Technology Group (LSE:ATG) | £4.575 | £9.01 | 49.2% |

Ibstock (LSE:IBST) | £1.628 | £3.19 | 49% |

Ricardo (LSE:RCDO) | £4.86 | £9.52 | 49% |

Accsys Technologies (AIM:AXS) | £0.55 | £1.05 | 47.5% |

Let's explore several standout options from the results in the screener

FRP Advisory Group

Overview: FRP Advisory Group plc operates as a business advisory firm, offering services to companies, lenders, investors, and stakeholders with a market capitalization of approximately £285.13 million.

Operations: The firm generates its revenue primarily through the provision of specialist business advisory services, amounting to £104 million.

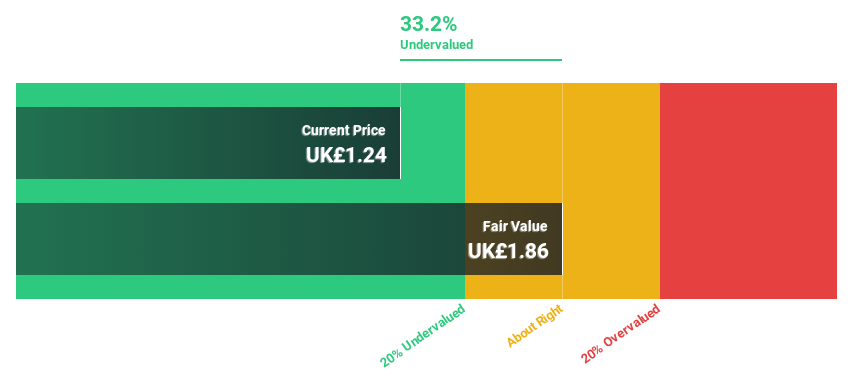

Estimated Discount To Fair Value: 33.2%

FRP Advisory Group's recent activities, including a follow-on equity offering raising £26.07 million and the acquisition of Hilton-Baird Group for up to £8.4 million, underscore its aggressive expansion strategy. Financially, FRP is poised with a revenue forecast of £128 million for FY 2024, reflecting a robust 23% year-over-year growth. Despite this positive outlook and trading at 33.2% below estimated fair value, concerns linger as its dividend coverage by cash flows remains weak, indicating potential financial stress or prioritization of growth over shareholder returns.

GB Group

Overview: GB Group plc operates globally, offering digital identity products and services across the UK, USA, Australia, and other countries, with a market capitalization of approximately £0.85 billion.

Operations: The company's revenue is segmented into Fraud, Identity, and Location services, generating £40.20 million, £156.06 million, and £81.07 million respectively.

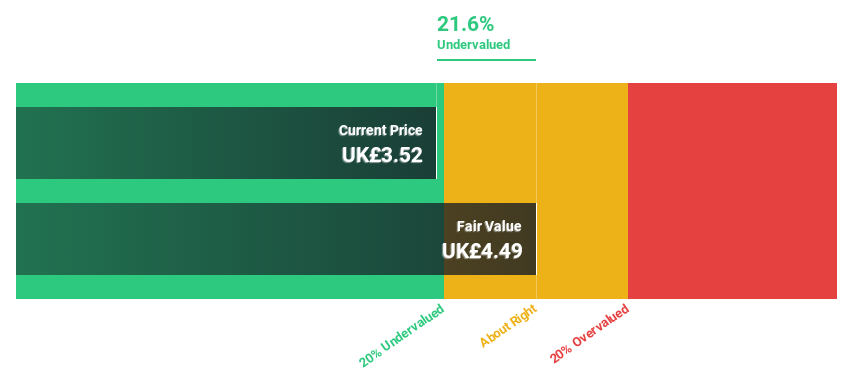

Estimated Discount To Fair Value: 21.6%

GB Group, trading at £3.52, is perceived as undervalued based on cash flow analyses, with its market price sitting 21.6% below the estimated fair value of £4.49. Despite a challenging fiscal year with a net loss reduction to £48.58 million from £119.79 million and a basic loss per share improvement, GB Group forecasts becoming profitable within three years alongside mid-single-digit revenue growth expectations for FY 2025 driven by operational efficiencies gained in FY24. This outlook aligns with an anticipated revenue growth rate of 6.7% per year, outpacing the UK market's 3.5%.

Ibstock

Overview: Ibstock plc is a UK-based manufacturer and seller of clay and concrete building products, primarily serving the residential construction sector, with a market capitalization of approximately £607.46 million.

Operations: The company generates its revenue from two main segments: clay products, contributing £292.22 million, and concrete products, adding £113.62 million.

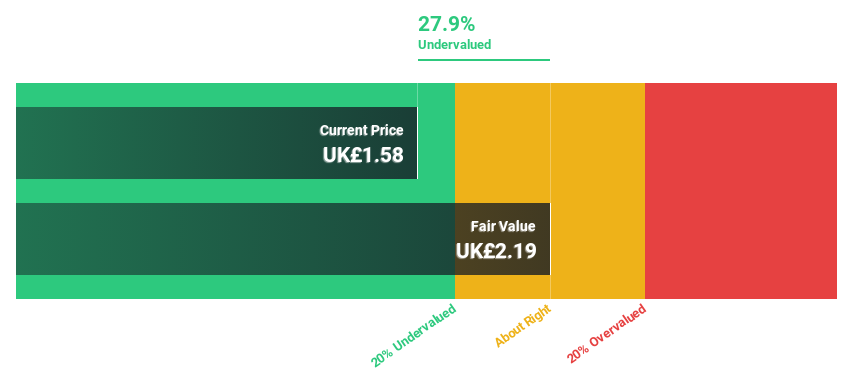

Estimated Discount To Fair Value: 49%

Ibstock, priced at £1.63, trades significantly below its calculated fair value of £3.19, indicating a potential undervaluation based on discounted cash flow (DCF) analysis. Despite a recent dividend cut to 3.6 pence per share, the company's earnings are expected to grow robustly by 26.9% annually over the next three years, outstripping UK market projections of 12.5%. However, its profit margins have declined from last year's 16.9% to 5.2%, and dividends aren't well supported by earnings or cash flows.

Turning Ideas Into Actions

Investigate our full lineup of 59 Undervalued UK Stocks Based On Cash Flows right here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:FRP AIM:GBG and LSE:IBST.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance