Exploring Three TSX Growth Companies With High Insider Ownership

Amid fluctuating market conditions and evolving economic trends, Canadian investors continue to navigate through a landscape marked by both challenges and opportunities. High insider ownership in growth companies on the TSX often signals strong confidence in the company's future prospects, making such stocks particularly noteworthy in the current environment.

Top 10 Growth Companies With High Insider Ownership In Canada

Name | Insider Ownership | Earnings Growth |

goeasy (TSX:GSY) | 21.7% | 15.9% |

Payfare (TSX:PAY) | 15% | 58.5% |

Aritzia (TSX:ATZ) | 19% | 51.6% |

Aya Gold & Silver (TSX:AYA) | 10.2% | 43.6% |

Allied Gold (TSX:AAUC) | 22.4% | 63.2% |

ROK Resources (TSXV:ROK) | 16.6% | 135.9% |

Silver X Mining (TSXV:AGX) | 14.3% | 133.8% |

Ivanhoe Mines (TSX:IVN) | 13.1% | 38% |

Almonty Industries (TSX:AII) | 12.6% | 82.1% |

UGE International (TSXV:UGE) | 35.4% | 63.5% |

We'll examine a selection from our screener results.

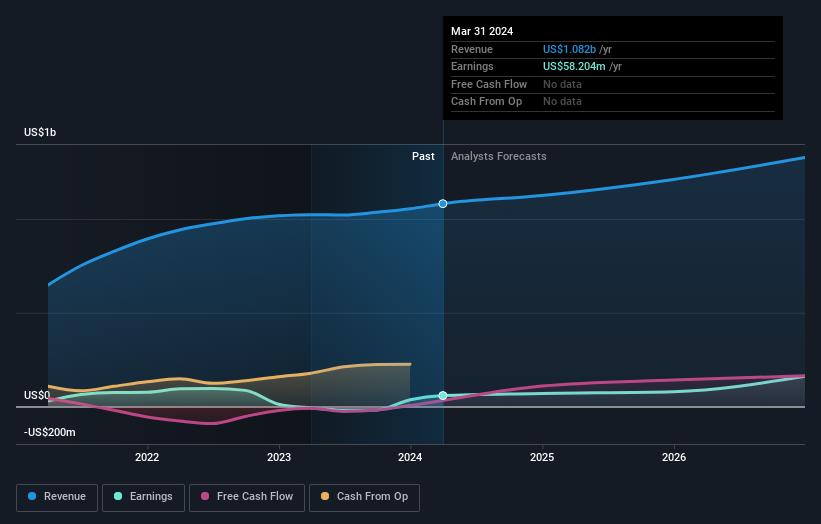

Green Thumb Industries

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Green Thumb Industries Inc., operating in the United States, engages in the manufacturing, distribution, marketing, and sale of cannabis products for both medical and adult use, with a market capitalization of approximately CA$4.20 billion.

Operations: The company generates revenue through the manufacture, distribution, marketing, and sale of cannabis products for medical and recreational purposes in the U.S.

Insider Ownership: 10.9%

Earnings Growth Forecast: 24% p.a.

Green Thumb Industries, a growth-oriented company with significant insider ownership, is trading 33.6% below its estimated fair value and has shown robust financial performance with a substantial increase in net income from US$9.14 million to US$31.08 million year-over-year as of Q1 2024. Despite this strong earnings growth, forecasted at 23.98% annually, its return on equity is expected to remain low at 7.5%. Insider transactions have not been substantial in recent months, indicating potential caution among insiders despite the company's expansion and profitability improvements.

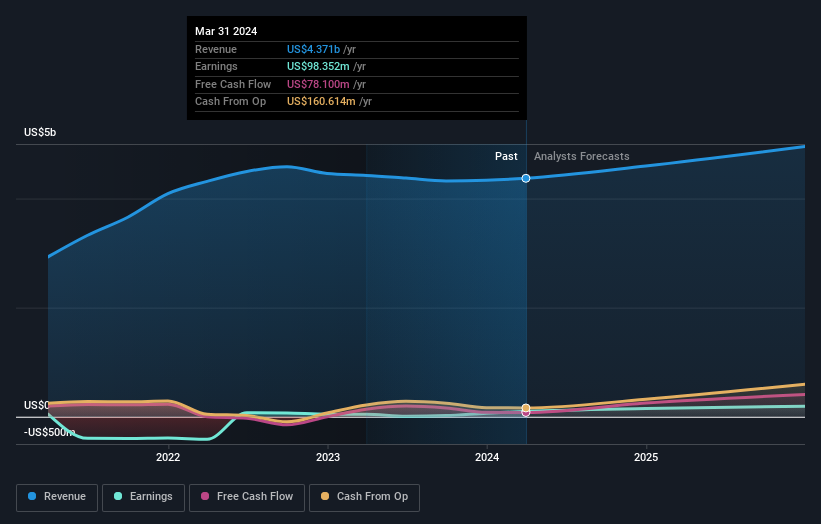

Colliers International Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Colliers International Group Inc. operates globally, offering commercial real estate professional and investment management services with a market capitalization of approximately CA$7.99 billion.

Operations: The company generates revenue primarily through its operations in the Americas (CA$2.53 billion), followed by Europe, the Middle East & Africa (CA$0.73 billion), Asia Pacific (CA$0.62 billion), and Investment Management services (CA$0.49 billion).

Insider Ownership: 14.2%

Earnings Growth Forecast: 36% p.a.

Colliers International Group, a Canadian growth company with high insider ownership, is poised for substantial earnings growth, projected at 36% annually over the next three years. Despite trading at 59.1% below its estimated fair value, concerns persist as debt is poorly covered by operating cash flow. Recent activities include a dividend declaration and a successful equity offering raising US$300 million aimed at funding acquisitions and growth initiatives, reflecting strategic moves to leverage insider confidence and financial flexibility.

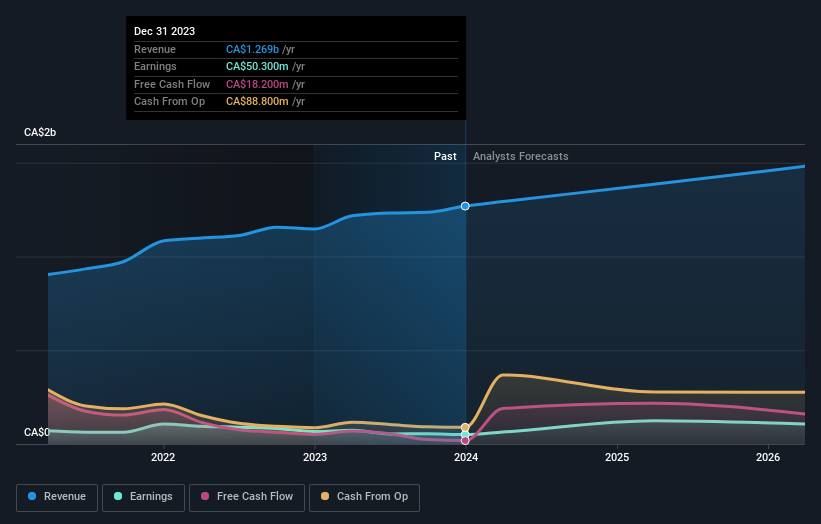

Canada Goose Holdings

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Canada Goose Holdings Inc. operates globally, designing, manufacturing, and selling performance luxury apparel across multiple regions, with a market capitalization of approximately CA$1.50 billion.

Operations: The company generates revenue primarily through its Wholesale and Direct-To-Consumer segments, with CA$316.40 million from Wholesale and CA$906.70 million from Direct-To-Consumer sales.

Insider Ownership: 20.7%

Earnings Growth Forecast: 31% p.a.

Canada Goose Holdings, a Canadian growth company with significant insider ownership, recently reported a positive shift in its financials with fourth-quarter sales increasing to CA$358 million and net income reaching CA$5 million, reversing a loss from the previous year. Despite this improvement and expectations of low-single-digit revenue growth for fiscal 2025, the company's forecasted earnings growth is robust at 31% per year. However, it faces challenges with lower profit margins compared to last year and interest payments not well covered by earnings. Recent executive reshuffles aim to enhance operational efficiency and support these growth efforts.

Turning Ideas Into Actions

Access the full spectrum of 33 Fast Growing TSX Companies With High Insider Ownership by clicking on this link.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include CNSX:GTIITSX:CIGI TSX:GOOS and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance