Exploring Three Top Dividend Stocks On The ASX

Amid a generally subdued day on the ASX with most sectors finishing in the red, investors continue to navigate through mixed economic signals, including a surprising uptick in consumer spending. With the federal budget announcement looming and its potential implications for various sectors, understanding what constitutes a resilient dividend stock becomes increasingly pertinent in these fluctuating market conditions.

Top 10 Dividend Stocks In Australia

Name | Dividend Yield | Dividend Rating |

Fiducian Group (ASX:FID) | 3.92% | ★★★★★☆ |

Nick Scali (ASX:NCK) | 4.86% | ★★★★★☆ |

Centuria Capital Group (ASX:CNI) | 6.82% | ★★★★★☆ |

Charter Hall Group (ASX:CHC) | 3.69% | ★★★★★☆ |

Premier Investments (ASX:PMV) | 4.64% | ★★★★★☆ |

Fortescue (ASX:FMG) | 7.81% | ★★★★★☆ |

Diversified United Investment (ASX:DUI) | 3.23% | ★★★★★☆ |

Ricegrowers (ASX:SGLLV) | 7.89% | ★★★★☆☆ |

New Hope (ASX:NHC) | 9.17% | ★★★★☆☆ |

Macquarie Group (ASX:MQG) | 3.37% | ★★★★☆☆ |

Click here to see the full list of 31 stocks from our Top ASX Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

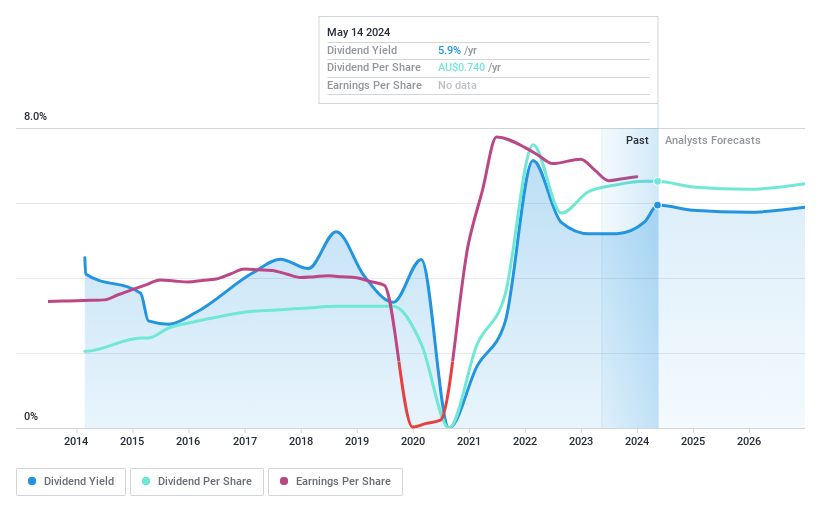

Eagers Automotive

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Eagers Automotive Limited is an automotive retail company that operates motor vehicle dealerships in Australia and New Zealand, with a market capitalization of A$3.22 billion.

Operations: Eagers Automotive Limited generates A$9.85 billion from car retailing.

Dividend Yield: 5.9%

Eagers Automotive reported a full-year revenue of A$9.85 billion, up from A$8.54 billion, though net income dipped to A$281.1 million from A$308.17 million. Despite this decline, the company maintains a dividend payout ratio of 66.8% and a cash payout ratio of 56%, indicating dividends are well-covered by both earnings and cash flow. However, its dividend yield at 5.94% trails behind the top quartile in the Australian market, and its dividend history shows volatility over the past decade.

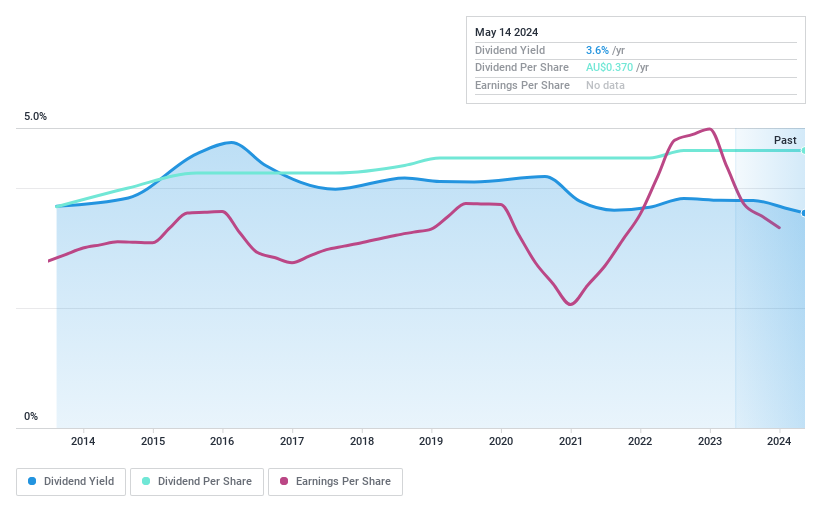

Australian United Investment

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Australian United Investment Company Limited, a publicly owned investment manager, operates with a market capitalization of approximately A$1.29 billion.

Operations: Australian United Investment Company Limited generates its revenue primarily from investments, totaling approximately A$58.33 million.

Dividend Yield: 3.6%

Australian United Investment's dividend yield of 3.58% is below the top quartile in Australia, and its high payout ratio of 92.4% suggests dividends are not well covered by earnings, despite being supported by cash flows (cash payout ratio at 87.6%). The company has shown consistent dividend payments with growth over the past decade, but recent financials indicate a drop in net income from A$30.06 million to A$24.31 million and a decrease in earnings per share from A$0.239 to A$0.192 as of December 2023.

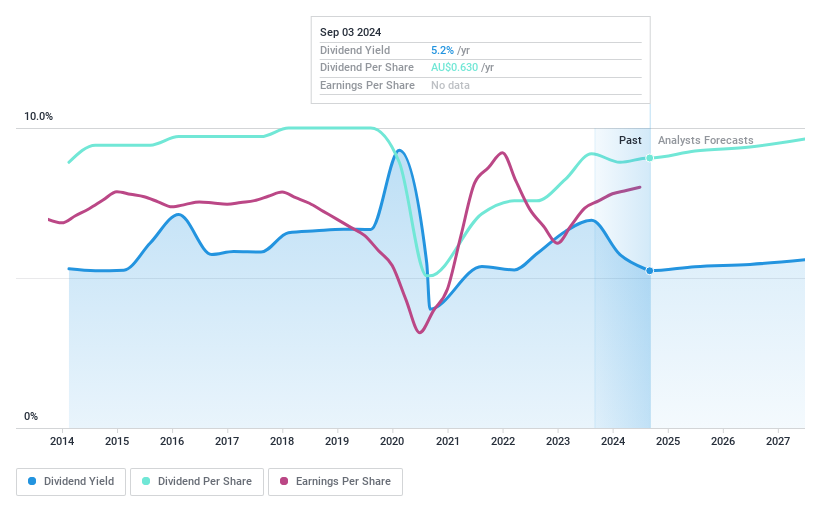

Bendigo and Adelaide Bank

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bendigo and Adelaide Bank Limited offers banking and financial services primarily to retail customers and small to medium-sized enterprises in Australia, with a market capitalization of approximately A$5.62 billion.

Operations: Bendigo and Adelaide Bank Limited generates revenue through its Consumer segment at A$1.44 billion and Business & Agribusiness segment at A$0.58 billion.

Dividend Yield: 6.2%

Bendigo and Adelaide Bank's dividend yield of 6.25% ranks well within the top quartile of Australian dividend payers, although its history shows a lack of growth and volatility in payments over the past decade. Despite trading at 20.2% below perceived fair value and earnings growing by 27.5% last year, dividends have been inconsistently covered by earnings with a current payout ratio of 66.2%. Recent activities include two fixed-income offerings totaling A$550 million, aimed at bolstering financial flexibility.

Taking Advantage

Embark on your investment journey to our 31 Top ASX Dividend Stocks selection here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:APEASX:AUI and ASX:BEN

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance