Exploring Three German Dividend Stocks In May 2024

As of May 2024, the German market has shown robust performance, with the DAX index climbing by 4.28%, reflecting a broader European uptrend driven by better-than-expected corporate earnings and a growing sentiment that central banks may soon reduce interest rates. In this context, exploring dividend stocks becomes particularly intriguing as they can offer investors potential steady income streams in an environment where policy easing might become more prevalent. In considering what makes a good dividend stock, investors should look for companies with stable earnings, strong balance sheets, and a history of consistent dividend payments which are especially appealing in the current economic climate where cautious optimism prevails in the market.

Top 10 Dividend Stocks In Germany

Name | Dividend Yield | Dividend Rating |

Edel SE KGaA (XTRA:EDL) | 6.38% | ★★★★★★ |

Deutsche Post (XTRA:DHL) | 4.65% | ★★★★★★ |

Talanx (XTRA:TLX) | 3.40% | ★★★★★☆ |

FRoSTA (DB:NLM) | 3.08% | ★★★★★☆ |

DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 6.06% | ★★★★★☆ |

MLP (XTRA:MLP) | 5.15% | ★★★★★☆ |

SAF-Holland (XTRA:SFQ) | 4.85% | ★★★★★☆ |

Mercedes-Benz Group (XTRA:MBG) | 7.68% | ★★★★★☆ |

Uzin Utz (XTRA:UZU) | 3.17% | ★★★★★☆ |

Bijou Brigitte modische Accessoires (XTRA:BIJ) | 7.15% | ★★★★☆☆ |

Click here to see the full list of 30 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

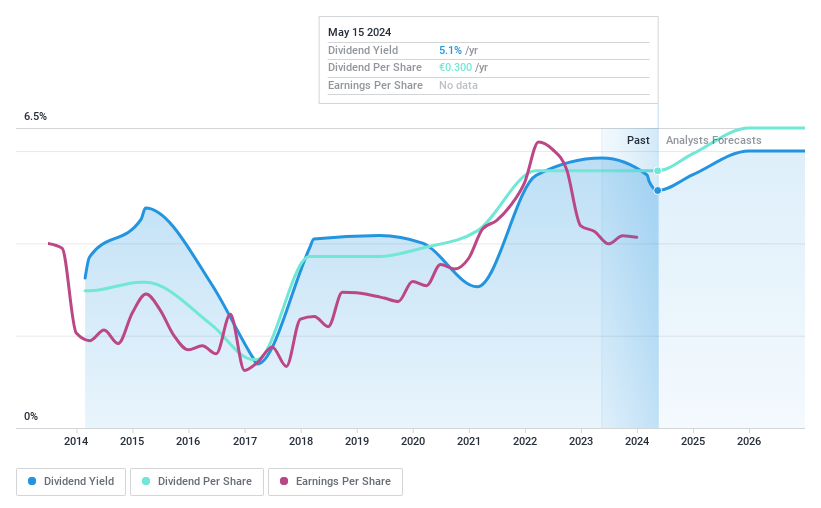

MLP

Simply Wall St Dividend Rating: ★★★★★☆

Overview: MLP SE operates as a financial services provider catering to private, corporate, and institutional clients in Germany, with a market capitalization of approximately €0.63 billion.

Operations: MLP SE generates its revenue primarily through financial consulting (€0.42 billion), FERI (€0.21 billion), banking (€0.18 billion), DOMCURA (€0.13 billion), Germany real estate (€0.06 billion), and industrial broker services (€0.03 billion).

Dividend Yield: 5.1%

MLP SE, recently added to the Germany SDAX Total Return Index, maintains a dividend of €0.30 per share. Despite a stable dividend reaffirmation, its financial performance shows some volatility with a slight decline in net income and earnings per share from the previous year. However, MLP's dividends appear sustainable with coverage from both earnings (67.4% payout ratio) and cash flows (32.6% cash payout ratio). The stock is also trading at 35.9% below estimated fair value, suggesting potential undervaluation despite an unstable dividend track record over the last decade.

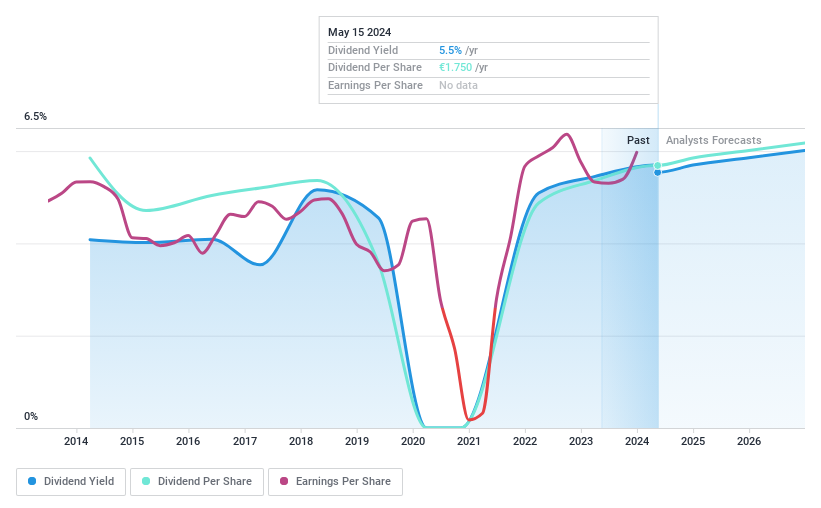

PWO

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PWO AG specializes in manufacturing and selling construction components made from steel and aluminum sheets for the mobility industry, operating across Germany, Czechia, Canada, Mexico, and China with a market capitalization of €98.75 million.

Operations: PWO AG generates €556.31 million from its Auto Parts & Accessories segment.

Dividend Yield: 5.5%

PWO AG reported a sales increase to €556.31 million and net income growth to €16.22 million for 2023, showing financial improvement. Its dividend yield of 5.54% ranks well in the German market, supported by a sustainable payout ratio of 33.7% from earnings and 41.3% from cash flows, indicating reliable coverage despite a high debt level and historical volatility in dividend payments over the past decade. Moreover, PWO trades at a 23.9% discount to its estimated fair value, offering potential value despite its unstable dividend history.

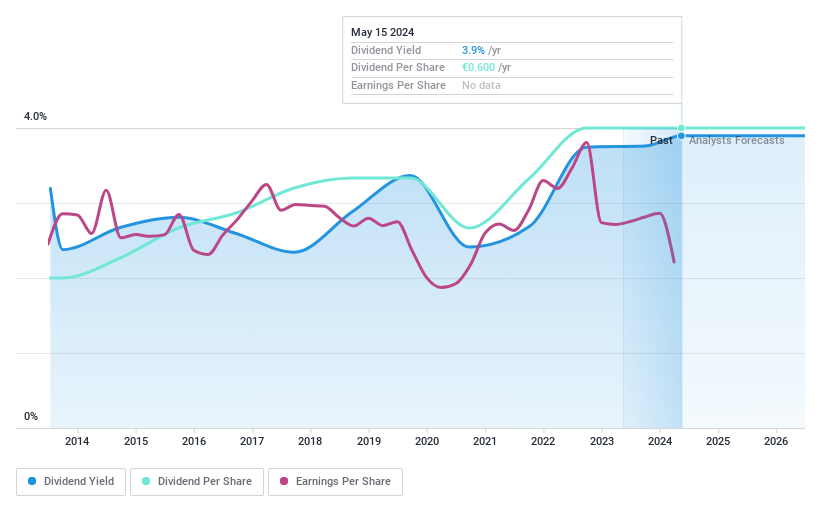

Schloss Wachenheim

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Schloss Wachenheim AG is a company that produces and distributes sparkling and semi-sparkling wines across Europe and internationally, with a market capitalization of approximately €121.97 million.

Operations: Schloss Wachenheim AG generates its revenues primarily through the production and sales of sparkling and semi-sparkling wines across various international markets.

Dividend Yield: 3.9%

Schloss Wachenheim AG has demonstrated consistent dividend growth over the past decade with a stable 3.9% yield, although this is below the top 25% of German dividend payers. Despite trading at 79.6% below its estimated fair value and analysts expecting a price increase, its dividends are poorly covered by cash flows (cash payout ratio of 113.1%) and recent financials show a troubling trend: Q3 sales increased to €87.13 million but it reported a net loss of €3.07 million, worsening from the previous year's €0.502 million loss.

Key Takeaways

Unlock more gems! Our Top Dividend Stocks screener has unearthed 27 more companies for you to explore.Click here to unveil our expertly curated list of 30 Top Dividend Stocks.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include XTRA:MLP XTRA:SWA and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance