Exploring James Halstead And Two More Top Dividend Stocks In The UK

Amidst a backdrop of fluctuating global markets, the United Kingdom's FTSE 100 is poised for its first weekly gain after three consecutive weeks of losses. This recent shift in market sentiment provides an opportune moment to explore the resilience and potential of dividend-paying stocks, such as James Halstead and two other top performers in the UK market. In times like these, investors often look towards stocks that can provide not only stability but also consistent returns through dividends.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

Record (LSE:REC) | 8.15% | ★★★★★★ |

Impax Asset Management Group (AIM:IPX) | 6.30% | ★★★★★☆ |

Keller Group (LSE:KLR) | 3.58% | ★★★★★☆ |

Dunelm Group (LSE:DNLM) | 7.14% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 6.02% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 3.65% | ★★★★★☆ |

Grafton Group (LSE:GFTU) | 3.61% | ★★★★★☆ |

Rio Tinto Group (LSE:RIO) | 6.10% | ★★★★★☆ |

NWF Group (AIM:NWF) | 4.08% | ★★★★★☆ |

Hargreaves Services (AIM:HSP) | 6.36% | ★★★★★☆ |

Click here to see the full list of 59 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

James Halstead

Simply Wall St Dividend Rating: ★★★★★☆

Overview: James Halstead plc is a UK-based manufacturer and supplier of flooring products for both commercial and domestic applications, operating globally with a market capitalization of approximately £0.79 billion.

Operations: James Halstead plc generates £290.38 million in revenue from the manufacture and distribution of flooring products.

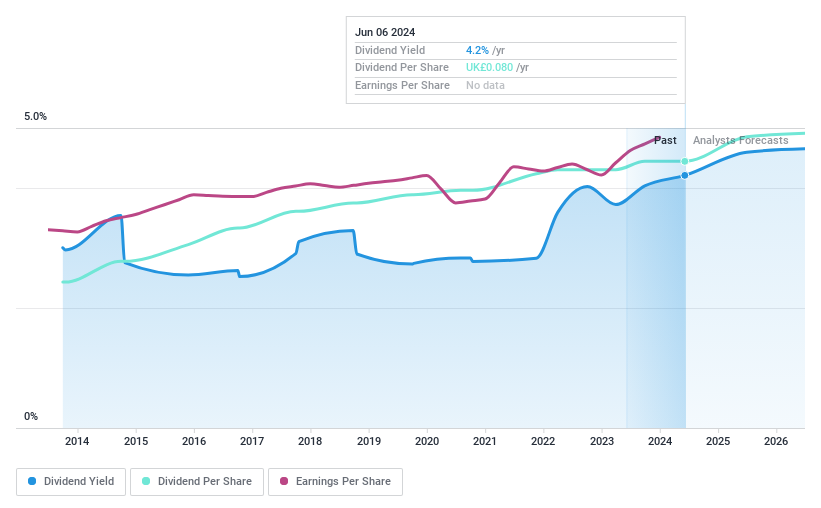

Dividend Yield: 4.2%

James Halstead has maintained a stable dividend payout with a 4.21% yield, though it's lower than the UK market's top quartile at 5.56%. The company's dividends are well-supported by both earnings and cash flows, with a payout ratio of 77.4% and a cash payout ratio of 62.8%. Over the past decade, dividends have shown reliability and growth, including an 11.1% increase in the latest interim dividend to £0.025 per share payable on June 14, 2024. Despite recent sales decline from £149.64 million to £136.45 million year-over-year, net income rose to £20.08 million from £18.04 million.

Bank of Georgia Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank of Georgia Group PLC operates primarily in the banking and financial services sectors, focusing on the Georgian and Armenian markets, with a market capitalization of approximately £1.66 billion.

Operations: Bank of Georgia Group PLC generates its revenue primarily from banking and financial services in the Georgian and Armenian markets.

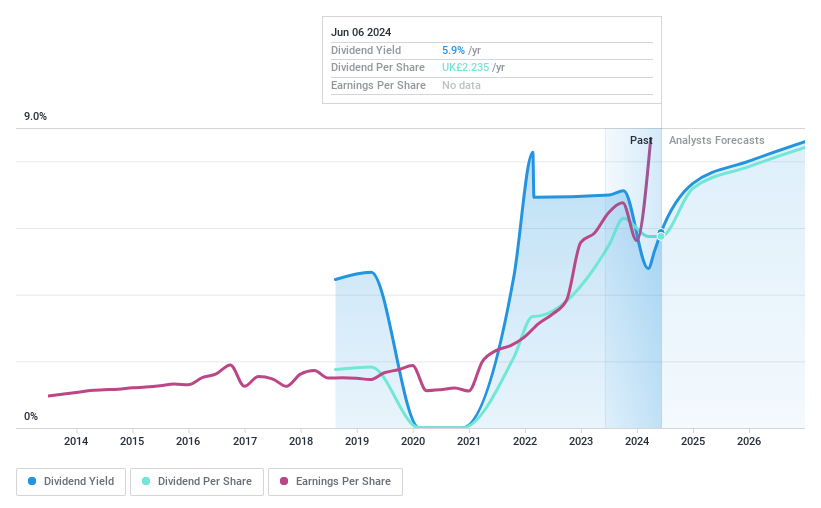

Dividend Yield: 5.9%

Bank of Georgia Group PLC has shown a significant increase in Q1 2024 net income to GEL 1.04 billion from GEL 300.05 million year-over-year, with substantial growth in earnings per share as well. Despite this performance, the company's dividend history is marked by instability; the proposed final dividend for FY 2023 is GEL 4.94 per share, pending shareholder approval at the upcoming AGM. Analysts predict a potential stock price rise of 49.2%, though dividends have been historically unreliable and volatile over the past six years, reflecting an unpredictable return for dividend-focused investors.

DCC

Simply Wall St Dividend Rating: ★★★★★☆

Overview: DCC plc operates globally, offering sales, marketing, and support services with a market capitalization of approximately £5.66 billion.

Operations: DCC plc's revenue is primarily generated from three segments: DCC Energy at £14.22 billion, DCC Healthcare at £0.86 billion, and DCC Technology at £4.77 billion.

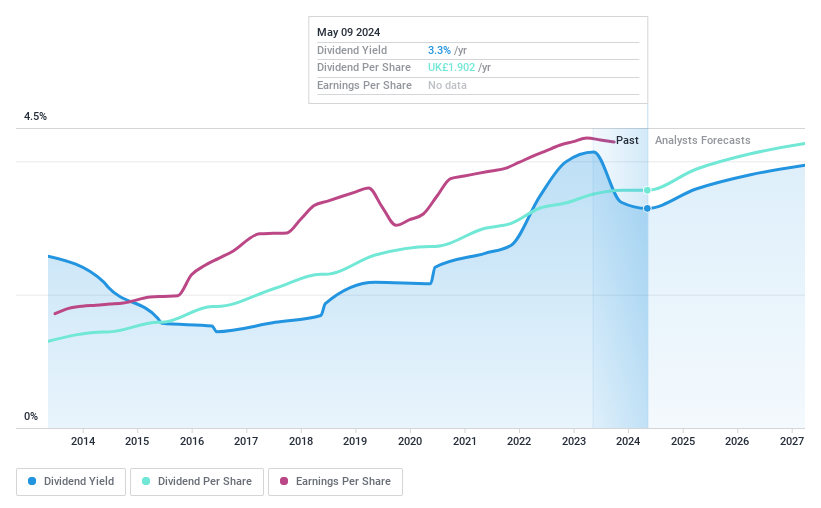

Dividend Yield: 3.4%

DCC's dividend yield stands at 3.44%, lower than the UK market's top quartile, but its dividends are well-supported with a 59.5% earnings payout ratio and a 39.5% cash flow payout ratio, ensuring sustainability. Dividends have shown growth and stability over the past decade, recently proposing a 5% increase to 196.57 pence per share for FY2024, covered 2.3 times by adjusted earnings per share despite a slight decline in annual net income to £326.26 million from £334.02 million last year.

Summing It All Up

Take a closer look at our Top Dividend Stocks list of 59 companies by clicking here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:JHD LSE:BGEO and LSE:DCC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance