Exploring iDreamSky Technology Holdings And Two More Undervalued Small Caps With Insider Buying

Amidst a backdrop of mixed global economic signals, the Hong Kong market has shown resilience with the Hang Seng Index experiencing a notable rise. This dynamic environment presents an intriguing opportunity for investors to explore potentially undervalued small-cap stocks, such as iDreamSky Technology Holdings, which may benefit from current market conditions and insider buying trends.

Top 10 Undervalued Small Caps With Insider Buying In Hong Kong

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Far East Consortium International | NA | 0.3x | 37.58% | ★★★★★☆ |

Xtep International Holdings | 11.4x | 0.8x | 39.79% | ★★★★☆☆ |

Nissin Foods | 14.7x | 1.3x | 37.51% | ★★★★☆☆ |

Tian Lun Gas Holdings | 7.4x | 0.5x | 19.82% | ★★★★☆☆ |

China Lesso Group Holdings | 4.3x | 0.3x | 3.02% | ★★★★☆☆ |

Abbisko Cayman | NA | 93.1x | 37.24% | ★★★★☆☆ |

China Jinmao Holdings Group | NA | 0.1x | 5.76% | ★★★★☆☆ |

Giordano International | 8.8x | 0.8x | 34.13% | ★★★☆☆☆ |

China Overseas Grand Oceans Group | 3.3x | 0.1x | -17.87% | ★★★☆☆☆ |

Xiabuxiabu Catering Management (China) Holdings | NA | 0.3x | -446.67% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

iDreamSky Technology Holdings

Simply Wall St Value Rating: ★★★☆☆☆

Overview: iDreamSky Technology Holdings is a company that operates in the gaming and information services sectors, including SaaS and related services.

Operations: Game and Information Services, including SaaS and related services, generated CN¥1.92 billion in revenue. The gross profit margin stood at 35.14%, reflecting the cost of goods sold which amounted to CN¥1.24 billion.

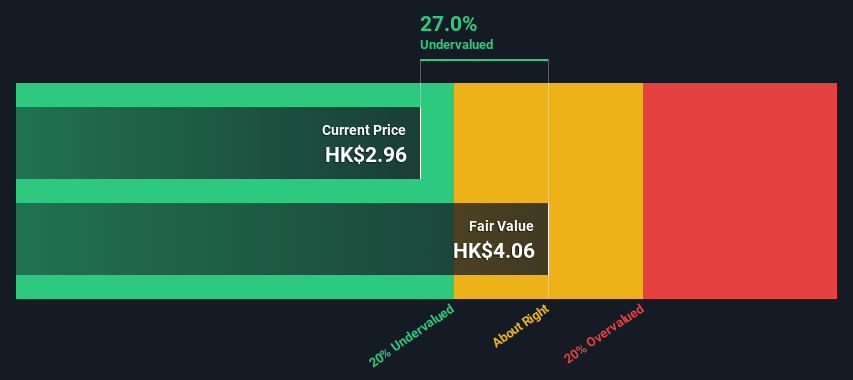

PE: -9.4x

iDreamSky Technology Holdings, reflecting a strategic pivot in Hong Kong's market, recently showcased insider confidence with a significant purchase by Xiangyu Chen, who acquired 1.08 million shares for HK$29.7 million. This move underscores a robust belief in the company's prospects amidst its financial recovery phase, as evidenced by a substantial reduction in net loss from HK$2.49 billion to HK$556.35 million year-over-year. With earnings expected to grow significantly and no share dilution over the past year, iDreamSky stands out for potential growth within the undervalued sector of Hong Kong's market landscape.

China Overseas Grand Oceans Group

Simply Wall St Value Rating: ★★★☆☆☆

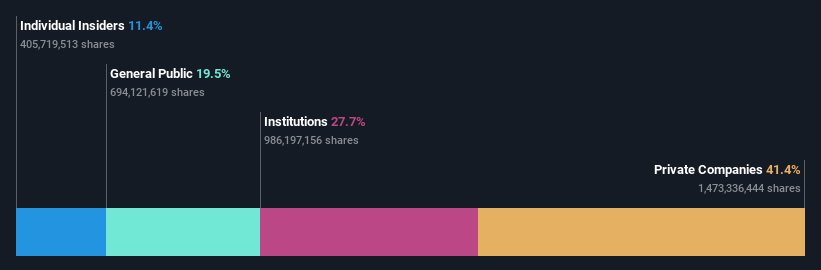

Overview: China Overseas Grand Oceans Group operates primarily in property investment and development, with additional interests in property leasing and other segments, boasting a market cap of approximately CN¥7.96 billion.

Operations: The company generates the majority of its revenue from property investment and development, contributing CN¥56.08 billion, supplemented by property leasing at CN¥242.46 million. Over recent periods, it has observed a gross profit margin trend ranging from 13.8% to 33.9%, reflecting varying profitability across different fiscal quarters.

PE: 3.3x

Recently, China Overseas Grand Oceans Group Limited demonstrated insider confidence as Hancheng Zhou acquired 350,000 shares, signaling a robust belief in the company's prospects. Despite a challenging environment with declining sales and earnings forecasts suggesting a 2.3% drop annually over the next three years, strategic insider purchases suggest potential unrecognized strengths within the firm. This action aligns with broader financial assessments indicating high debt levels yet significant one-off impacts on recent financial results. With ongoing adjustments in executive leadership and operational strategies evident from recent board changes and monthly performance reports, this entity embodies a dynamic yet cautiously optimistic investment landscape within Hong Kong's lesser-known equities.

Ferretti

Simply Wall St Value Rating: ★★★★★☆

Overview: Ferretti specializes in the design, construction, and marketing of yachts and recreational boats.

Operations: The business primarily generates its revenue from the design, construction, and marketing of yachts and recreational boats, achieving €1.23 billion in its latest reporting period. It has observed a gross profit margin increase from 23.23% in 2016 to 37.08% in the most recent fiscal year, reflecting enhanced operational efficiency over time.

PE: 12.5x

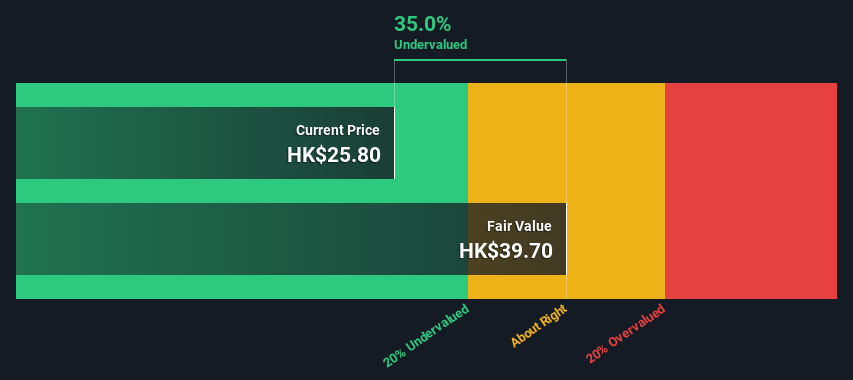

Ferretti's recent financial trajectory, marked by a robust increase in net income from €60.27 million to €83.05 million, underscores its potential amidst undervalued entities in Hong Kong’s market landscape. With earnings anticipated to climb by 12.46% annually, the firm's reliance on external borrowing reflects a bold but calculated approach to fueling growth. Insider confidence shone through recently as they bolstered their stakes, affirming belief in the company’s strategy and future prospects. This move coupled with an approved dividend hike further signals Ferretti's strengthening financial health and commitment to shareholder value.

Take a closer look at Ferretti's potential here in our valuation report.

Explore historical data to track Ferretti's performance over time in our Past section.

Key Takeaways

Take a closer look at our Undervalued Small Caps With Insider Buying list of 14 companies by clicking here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1119 SEHK:81 and SEHK:9638.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance