Exploring China Hongqiao Group And Two More Leading Dividend Stocks

Amidst a backdrop of fluctuating global markets, with the Hang Seng Index recently experiencing significant declines, investors are increasingly attentive to stable income streams. Dividend stocks, such as those from China Hongqiao Group and other leading entities in Hong Kong, offer potential resilience and steady returns in these uncertain times.

Top 10 Dividend Stocks In Hong Kong

Name | Dividend Yield | Dividend Rating |

China Construction Bank (SEHK:939) | 7.58% | ★★★★★★ |

Chongqing Rural Commercial Bank (SEHK:3618) | 8.25% | ★★★★★★ |

CITIC Telecom International Holdings (SEHK:1883) | 9.73% | ★★★★★★ |

Consun Pharmaceutical Group (SEHK:1681) | 8.96% | ★★★★★☆ |

S.A.S. Dragon Holdings (SEHK:1184) | 9.02% | ★★★★★☆ |

China Electronics Huada Technology (SEHK:85) | 7.84% | ★★★★★☆ |

Bank of China (SEHK:3988) | 6.74% | ★★★★★☆ |

China Mobile (SEHK:941) | 6.48% | ★★★★★☆ |

Sinopharm Group (SEHK:1099) | 4.20% | ★★★★★☆ |

International Housewares Retail (SEHK:1373) | 8.62% | ★★★★★☆ |

Click here to see the full list of 93 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

China Hongqiao Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Hongqiao Group Limited, primarily engaged in manufacturing and selling aluminum products in the People's Republic of China and Indonesia, has a market capitalization of approximately HK$120.91 billion.

Operations: China Hongqiao Group Limited generates CN¥133.62 billion from the manufacture and sales of aluminum products.

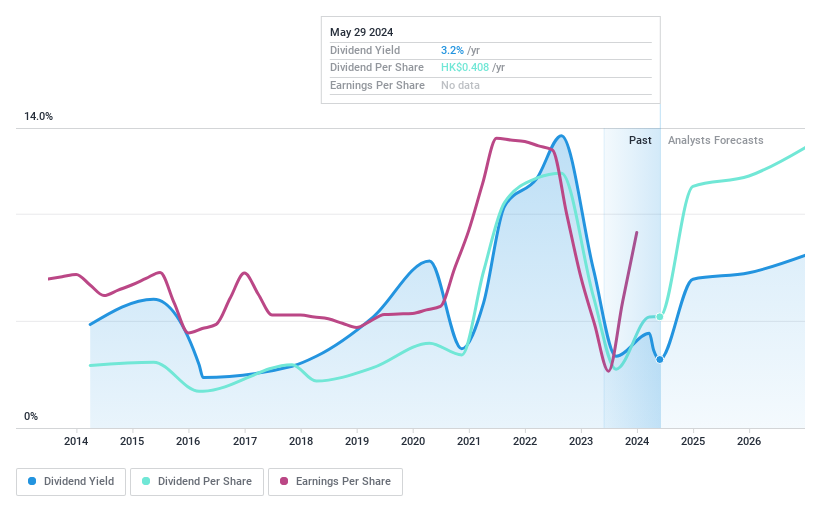

Dividend Yield: 3.2%

China Hongqiao Group's dividend history shows volatility, with payments not consistently growing over the past decade. Recently, shareholders approved a final dividend of 29 HK cents per share for 2023 at the AGM on May 14, 2024. Despite this instability, both earnings and cash flows adequately cover the dividends, with payout ratios of 30.8% and cash payout ratios of 21.9%, respectively. However, its current yield of 3.2% is low relative to Hong Kong's top dividend payers at 7.5%.

First Tractor

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: First Tractor Company Limited specializes in the research, development, manufacture, and sale of agricultural and power machinery along with related spare parts globally, with a market capitalization of approximately HK$17.36 billion.

Operations: First Tractor Company Limited generates its revenue primarily through the development, manufacturing, and sales of agricultural machinery and power equipment.

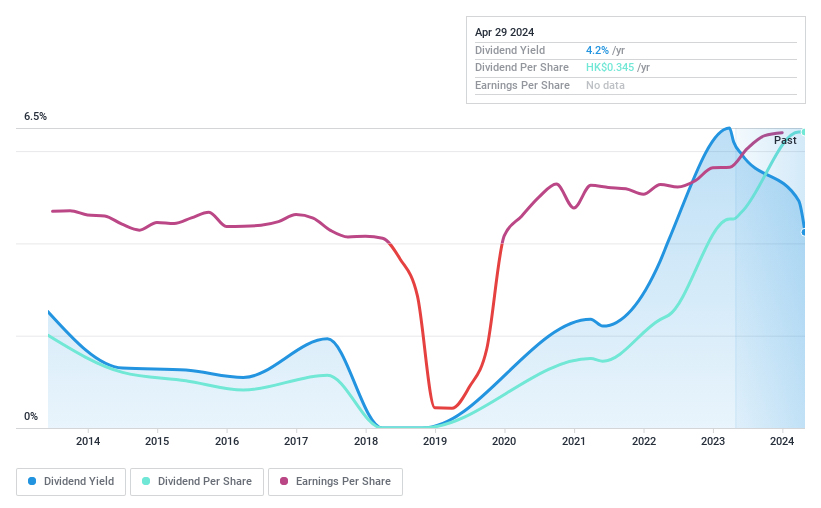

Dividend Yield: 3.8%

First Tractor's recent dividend of HK$0.352 per share, approved on May 29, 2024, reflects its ongoing commitment to shareholder returns despite a history of unstable and unreliable payouts over the past decade. The company's financial performance shows improvement with a significant earnings increase reported in Q1 2024. Although First Tractor trades at a favorable P/E ratio of 8.4x below Hong Kong’s market average and has manageable payout ratios (32.3% from earnings and 34.5% from cash flows), its dividend yield remains modest at 3.85%, which is lower than the top quartile of Hong Kong dividend stocks at 7.5%.

China Medical System Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Medical System Holdings Limited operates as an investment holding company that manufactures, sells, markets, and promotes pharmaceutical products in the People’s Republic of China, with a market capitalization of approximately HK$17.03 billion.

Operations: China Medical System Holdings Limited generates revenue primarily through the marketing, promotion, sales, and manufacturing of pharmaceutical products, totaling CN¥8.01 billion.

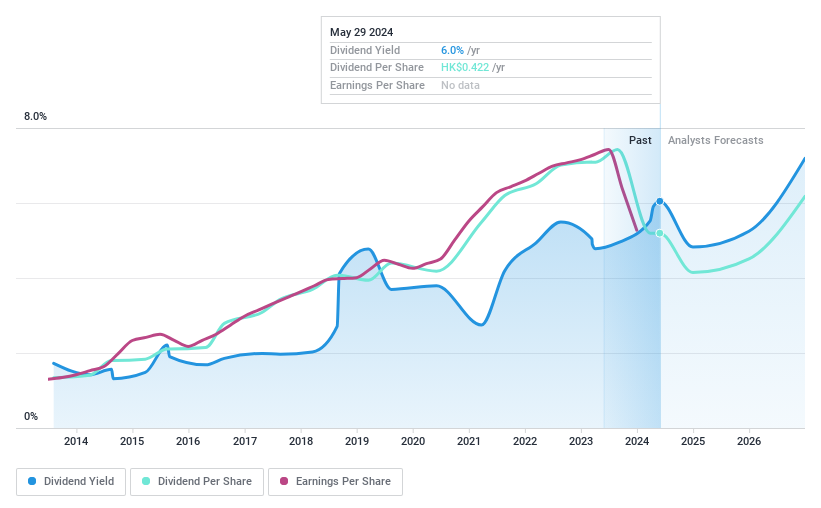

Dividend Yield: 6%

China Medical System Holdings' dividend history is marked by inconsistency, with a recent decrease approved at the AGM on May 9, 2024, setting the dividend at HK$0.086 per share for 2023—a significant drop from the previous year. The company's payout ratios are relatively low (40% from earnings and 43.4% from cash flows), suggesting financial capacity to sustain dividends despite volatility in payments. Additionally, while trading below estimated fair value by 21.2%, its dividend yield of 6.05% is lower than many top Hong Kong payers, indicating less attractiveness for high-yield seekers.

Taking Advantage

Click here to access our complete index of 93 Top Dividend Stocks.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1378SEHK:38 and SEHK:867.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance