Exploring ASX Growth Companies With High Insider Ownership

As the ASX200 shows signs of stabilization after a period of decline, investor focus may shift towards sectors and companies with unique strengths. In this context, growth companies with high insider ownership can be appealing, as they often signal strong confidence in the company's future from those who know it best.

Top 10 Growth Companies With High Insider Ownership In Australia

Name | Insider Ownership | Earnings Growth |

Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

Cettire (ASX:CTT) | 28.7% | 29.9% |

Gratifii (ASX:GTI) | 15.6% | 112.4% |

Acrux (ASX:ACR) | 14.6% | 115.3% |

Doctor Care Anywhere Group (ASX:DOC) | 28.4% | 96.4% |

Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

Change Financial (ASX:CCA) | 26.6% | 85.4% |

Botanix Pharmaceuticals (ASX:BOT) | 11.4% | 120.9% |

Liontown Resources (ASX:LTR) | 16.4% | 63.9% |

Underneath we present a selection of stocks filtered out by our screen.

Ora Banda Mining

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ora Banda Mining Limited is an Australian company focused on the exploration, operation, and development of mineral properties, with a market capitalization of approximately A$631.24 million.

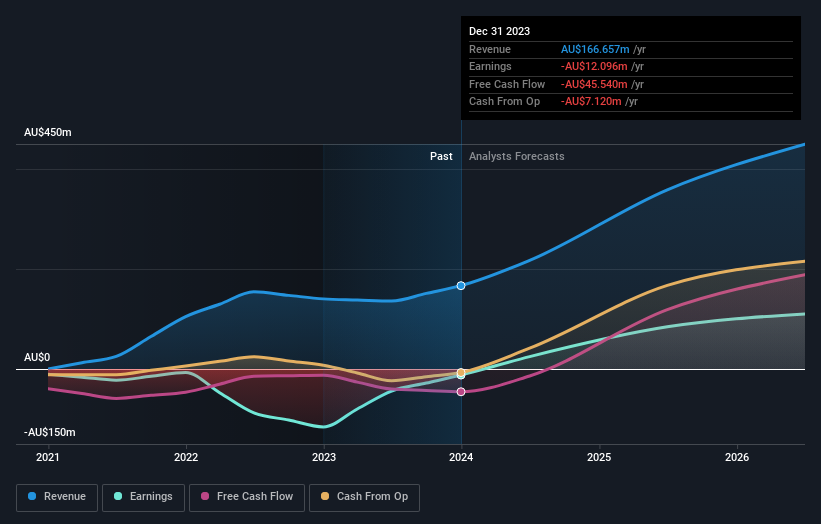

Operations: The company generates revenue primarily from gold mining, totaling approximately A$166.66 million.

Insider Ownership: 10.2%

Ora Banda Mining, an Australian growth company with high insider ownership, is expected to become profitable within the next three years, showcasing a significant turnaround from previous losses. The company's revenue is projected to increase by 41.9% annually, outpacing the broader Australian market's growth rate of 5.3%. Despite recent share dilution, Ora Banda trades at a substantial discount to its estimated fair value and has been added to the S&P/ASX All Ordinaries Index, underscoring its potential despite past challenges.

PWR Holdings

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PWR Holdings Limited specializes in the design, production, and sale of cooling products and solutions across Australia, the US, the UK, Italy, Germany, and other international markets with a market cap of approximately A$1.13 billion.

Operations: PWR Holdings Limited generates revenue primarily through two segments: PWR C&R, which contributed A$37.35 million, and PWR Performance Products, contributing A$104.44 million.

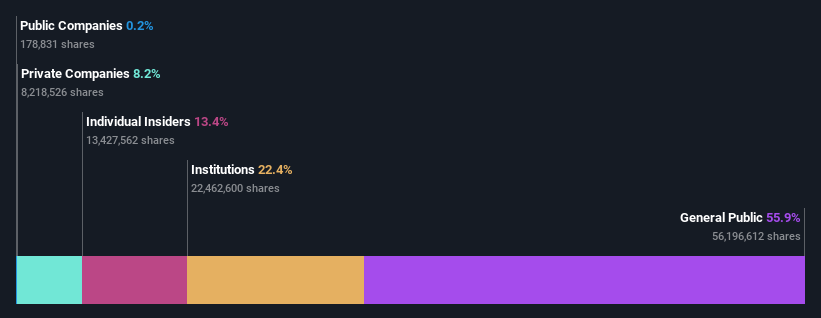

Insider Ownership: 13.4%

PWR Holdings, an Australian growth company, demonstrates promising financial trends with insider confidence. Its revenue and earnings are forecast to grow annually at 14.4% and 17% respectively, outperforming the Australian market averages of 5.3% and 13.8%. Recent months saw more insider buying than selling, though not in large volumes, reflecting cautious optimism among those closest to the company. Additionally, PWR's projected Return on Equity is high at 30.6%, indicating robust future profitability.

SiteMinder

Simply Wall St Growth Rating: ★★★★★☆

Overview: SiteMinder Limited, operating both in Australia and internationally, develops and markets an online guest acquisition platform and commerce solutions for accommodation providers, with a market capitalization of approximately A$1.33 billion.

Operations: The company generates revenue primarily through its software and programming segment, totaling approximately A$171.70 million.

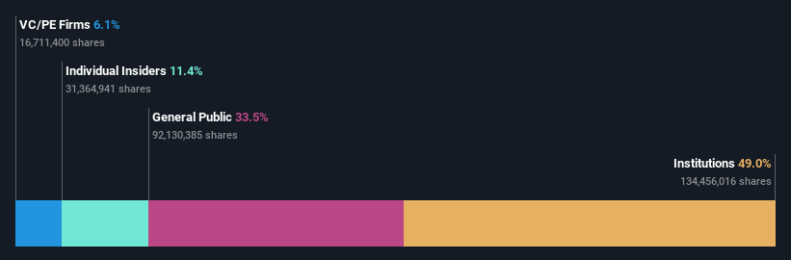

Insider Ownership: 11.3%

SiteMinder, a growth-focused firm in Australia, is trading at 45.9% below its estimated fair value, signaling potential undervaluation. The company's revenue growth forecast at 19.7% per year is poised to outpace the Australian market average of 5.3%. Although not yet profitable, SiteMinder is expected to reach profitability within three years with earnings predicted to surge by 72.7% annually. Recently, it was added to the S&P/ASX 200 Index, reflecting its increasing market presence and stability.

Navigate through the intricacies of SiteMinder with our comprehensive analyst estimates report here.

Where To Now?

Reveal the 91 hidden gems among our Fast Growing ASX Companies With High Insider Ownership screener with a single click here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ASX:OBM ASX:PWH and ASX:SDR.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance