Exploring Accent Group And Two More ASX Dividend Stocks

As the ASX200 shows a modest uptick ahead of the King's birthday public holiday, with notable strength in the Consumer Discretionary sector buoyed by global interest rate cuts, investors might find this an opportune moment to consider dividend stocks. In such a market environment, dividend-paying stocks like Accent Group can offer potential stability and regular income streams, aligning well with current economic dynamics.

Top 10 Dividend Stocks In Australia

Name | Dividend Yield | Dividend Rating |

Lindsay Australia (ASX:LAU) | 6.90% | ★★★★★☆ |

Fiducian Group (ASX:FID) | 3.99% | ★★★★★☆ |

Nick Scali (ASX:NCK) | 4.97% | ★★★★★☆ |

Centuria Capital Group (ASX:CNI) | 6.67% | ★★★★★☆ |

Charter Hall Group (ASX:CHC) | 3.48% | ★★★★★☆ |

Eagers Automotive (ASX:APE) | 7.30% | ★★★★★☆ |

Premier Investments (ASX:PMV) | 4.70% | ★★★★★☆ |

Fortescue (ASX:FMG) | 8.31% | ★★★★★☆ |

Diversified United Investment (ASX:DUI) | 3.13% | ★★★★★☆ |

New Hope (ASX:NHC) | 8.62% | ★★★★☆☆ |

Click here to see the full list of 27 stocks from our Top ASX Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

Accent Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Accent Group Limited operates in the retail, distribution, and franchise of lifestyle footwear, along with apparel and accessories in Australia and New Zealand, boasting a market capitalization of approximately A$1.12 billion.

Operations: Accent Group Limited generates A$1.40 billion in revenue primarily through its multi-channel retail operations focusing on performance and lifestyle footwear.

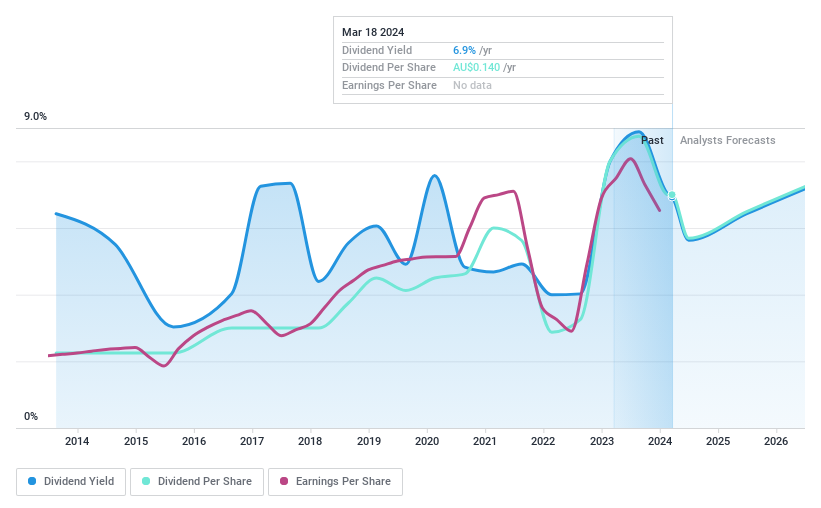

Dividend Yield: 7.1%

Accent Group's dividend yield stands at 7.05%, positioning it in the top 25% of Australian dividend payers. Despite a decade of increasing dividends, payments have shown volatility and are poorly covered by earnings with a payout ratio of 107.2%. However, cash flows are healthier, covering dividends with a cash payout ratio of 39%. Looking forward, earnings are expected to grow by 11.86% annually, yet the sustainability of payouts from earnings remains questionable as they currently exceed both earnings and some cash flows.

Click here to discover the nuances of Accent Group with our detailed analytical dividend report.

Our valuation report here indicates Accent Group may be undervalued.

QBE Insurance Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: QBE Insurance Group Limited specializes in underwriting general insurance and reinsurance risks across the Australia Pacific, North America, and other international markets, with a market capitalization of A$27.91 billion.

Operations: QBE Insurance Group Limited generates revenue through its operations in North America (A$11.12 billion), internationally (A$9.56 billion), and the Australia Pacific (A$5.97 billion).

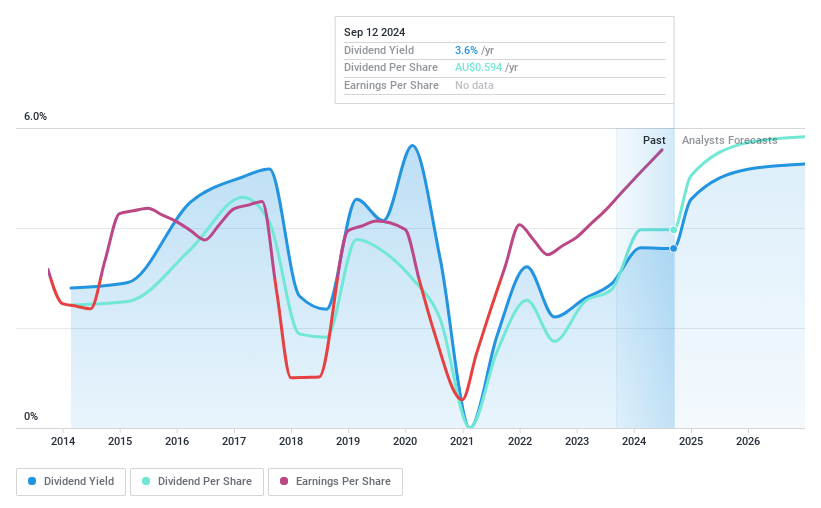

Dividend Yield: 3.2%

QBE Insurance Group has demonstrated a capacity to cover its dividend payments, with both earnings and cash flows maintaining reasonable payout ratios of 48.3% and 44.7%, respectively. However, the company's dividend history shows volatility over the past decade, indicating some instability in payouts. Despite this, dividends have trended upwards over the same period. Recently, QBE confirmed stable earnings guidance for 2024 and underwent board changes that could influence future governance and strategy.

Ricegrowers

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ricegrowers Limited, operating under the brand SunRice, is a global rice food company based in Australia with a market capitalization of approximately A$457.71 million.

Operations: Ricegrowers Limited generates revenue from several key segments: Riviana at A$219.12 million, Cop Rice at A$253.52 million, Rice Food at A$115.93 million, Rice Pool at A$487 million, and International Rice at A$821.54 million.

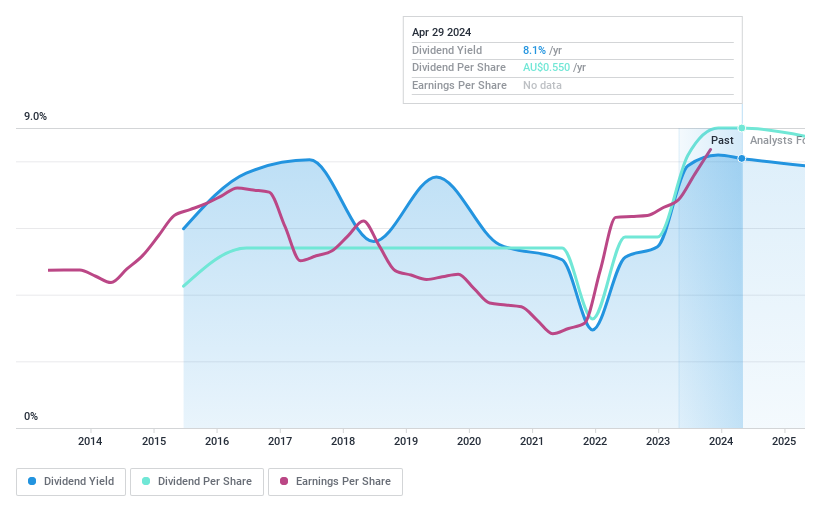

Dividend Yield: 7.7%

Ricegrowers Limited, trading at a 51.1% discount to its estimated fair value, offers a dividend yield of 7.74%, placing it in the top quartile of Australian dividend payers. The company has increased its dividends over the past nine years despite some volatility; annual drops have exceeded 20%. Its dividends are supported by earnings and cash flows with payout ratios of 53.9% and 43.1% respectively, suggesting sustainability despite an unstable track record. At the recent Australasian AgFood Conference, CFO Dimitri Christopher Courtelis highlighted these financial strategies.

Dive into the specifics of Ricegrowers here with our thorough dividend report.

Our valuation report unveils the possibility Ricegrowers' shares may be trading at a discount.

Turning Ideas Into Actions

Discover the full array of 27 Top ASX Dividend Stocks right here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:AX1ASX:QBE ASX:SGLLV and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance