Euronext Paris Growth Companies With High Insider Ownership And Up To 101% Earnings Growth

Amid a backdrop of rising optimism in European markets, with France's CAC 40 Index showing a notable increase of 3.29%, investors are keenly observing trends that may influence their strategies. In this climate, growth companies with high insider ownership in France present an interesting focal point, especially those demonstrating robust earnings growth, as they often signal strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In France

Name | Insider Ownership | Earnings Growth |

VusionGroup (ENXTPA:VU) | 13.3% | 25.8% |

Groupe OKwind Société anonyme (ENXTPA:ALOKW) | 24.8% | 37.7% |

WALLIX GROUP (ENXTPA:ALLIX) | 19.9% | 101.4% |

La Française de l'Energie (ENXTPA:FDE) | 20.1% | 37.6% |

OSE Immunotherapeutics (ENXTPA:OSE) | 25.1% | 92.9% |

Adocia (ENXTPA:ADOC) | 12.9% | 104.5% |

Icape Holding (ENXTPA:ALICA) | 30.2% | 30% |

Arcure (ENXTPA:ALCUR) | 21.6% | 41.7% |

Munic (ENXTPA:ALMUN) | 29.2% | 150% |

MedinCell (ENXTPA:MEDCL) | 16.6% | 68.8% |

We'll examine a selection from our screener results.

OVH Groupe

Simply Wall St Growth Rating: ★★★★☆☆

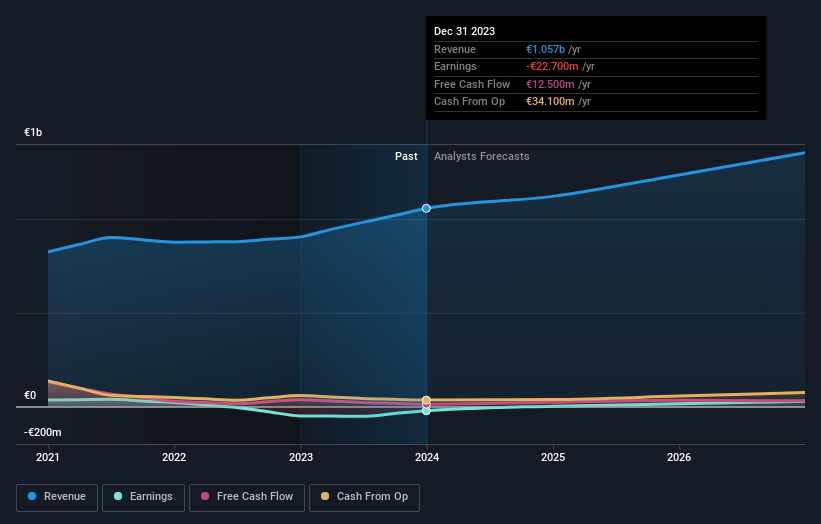

Overview: OVH Groupe S.A. is a global provider of public and private cloud services, shared hosting, and dedicated server solutions, with a market capitalization of approximately €1.22 billion.

Operations: The company generates revenue through its public cloud (€140.71 million), private cloud (€514.59 million), and web cloud services (€179.45 million).

Insider Ownership: 10.5%

Earnings Growth Forecast: 101.5% p.a.

OVH Groupe S.A., a French growth company with substantial insider ownership, is expected to become profitable within the next three years, outpacing average market growth. Despite a volatile share price recently, its revenue is projected to grow at 11.3% annually. Recent strategic leadership changes and international expansion efforts underscore its development ambitions and focus on innovation in cloud solutions, enhancing its profile in dynamic markets like North America.

Solutions 30

Simply Wall St Growth Rating: ★★★★★☆

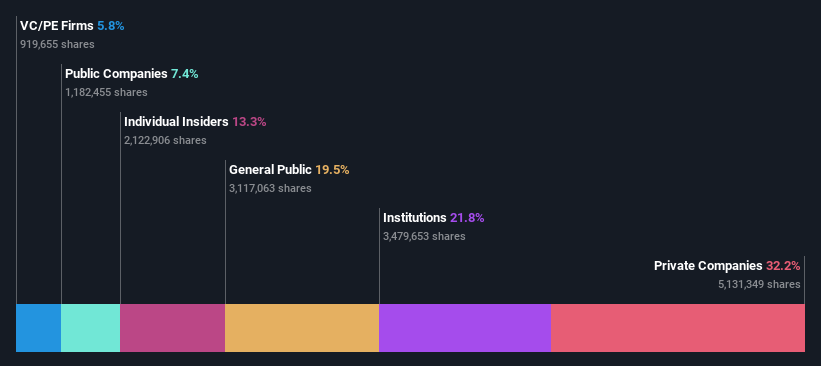

Overview: Solutions 30 SE offers support solutions for new digital technologies across several European countries, including France, Italy, Germany, the Netherlands, Belgium, Luxembourg, Poland, and Spain, with a market capitalization of approximately €237.82 million.

Operations: The company generates €1.06 billion from its computer services segment across multiple European countries.

Insider Ownership: 16.2%

Earnings Growth Forecast: 99.8% p.a.

Solutions 30 SE, despite its recent financial struggles with a net loss reported in the previous fiscal year, has reaffirmed its earnings guidance for 2024, signaling potential recovery and growth, particularly in Germany, Italy, and Belgium. The company's revenue is expected to grow faster than the French market average. Moreover, a significant contract with Fluvius to upgrade Flanders' electricity network underlines its strategic positioning in essential infrastructure developments. However, the stock remains highly volatile and is trading below analyst price targets.

Take a closer look at Solutions 30's potential here in our earnings growth report.

Our valuation report unveils the possibility Solutions 30's shares may be trading at a discount.

VusionGroup

Simply Wall St Growth Rating: ★★★★★★

Overview: VusionGroup S.A. is a company that offers digitalization solutions for commerce across Europe, Asia, and North America, with a market capitalization of approximately €2.63 billion.

Operations: The company generates its revenue by providing digitalization solutions across three key regions: Europe, Asia, and North America.

Insider Ownership: 13.3%

Earnings Growth Forecast: 25.8% p.a.

VusionGroup S.A. has demonstrated robust growth, with revenue increasing to €801.96 million and net income surging to €79.77 million last year, reflecting a significant rise from previous figures. The company's earnings per share also saw a substantial increase. Predictions indicate that VusionGroup's revenue and earnings will continue to outpace the French market significantly, with expected annual growth rates of 24.3% and 25.8% respectively. Despite these strong financials, the company’s share price has been highly volatile recently.

Where To Now?

Click this link to deep-dive into the 21 companies within our Fast Growing Euronext Paris Companies With High Insider Ownership screener.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ENXTPA:OVH ENXTPA:S30 and ENXTPA:VU.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance