Euro Luxury Rental Growth Double of High-street Level, Says Cushman & Wakefield

LONDON — Average prime rental growth on luxury high streets in Europe was almost double that for mass market-facing high streets, said Cushman & Wakefield in its inaugural European Luxury Retail report released Thursday.

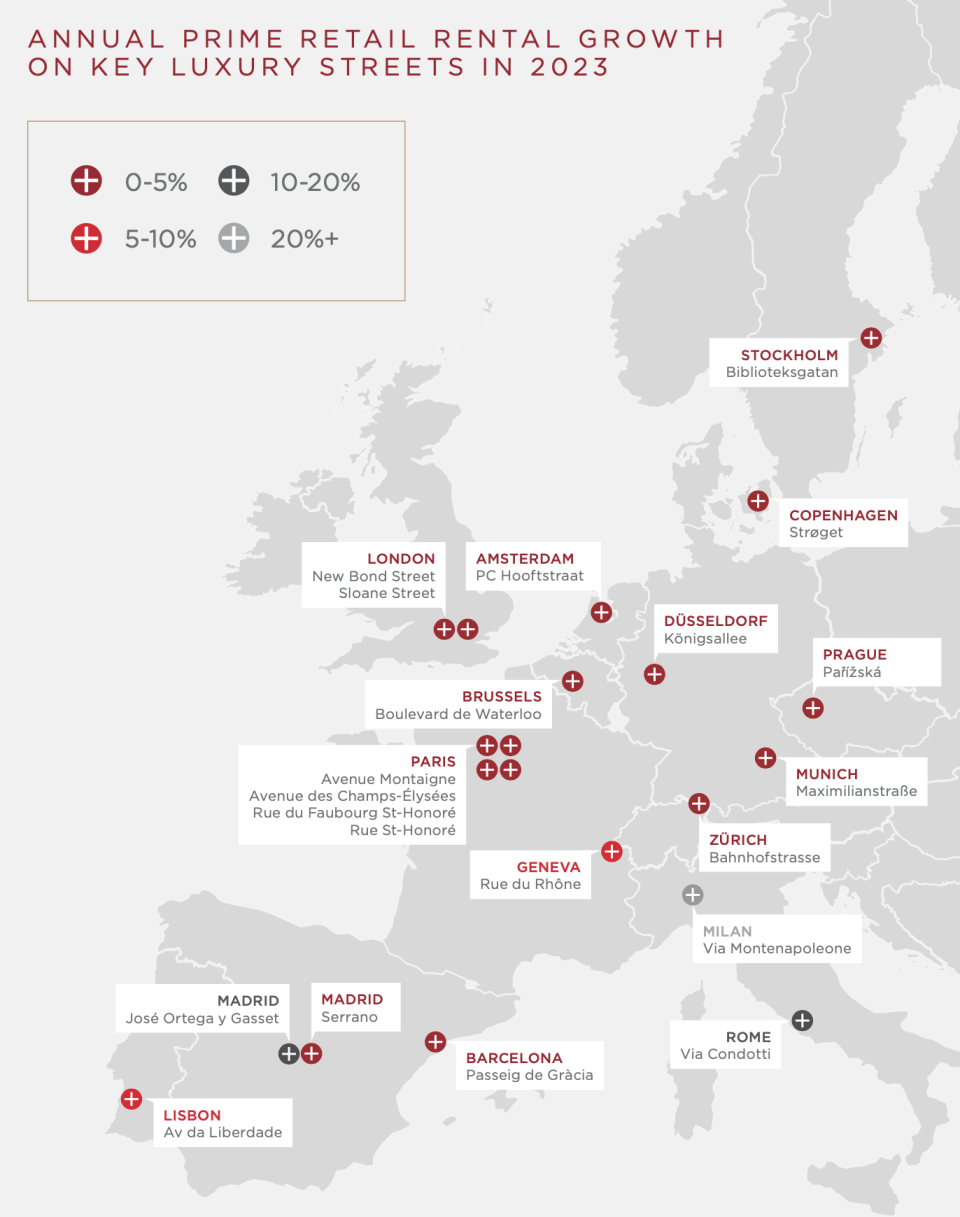

Based on an analysis of 107 openings — 60 percent fashion and accessories, and 20 percent jewelry and watches — on 20 key luxury retail streets in 16 cities across 12 European nations last year, the report found that luxury rentals performed better as players in the sectors are hyper-focused on location.

More from WWD

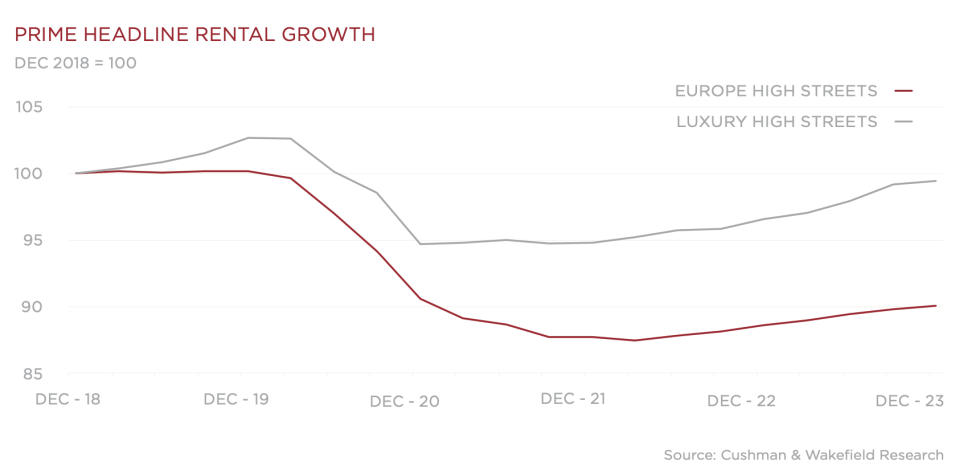

The average annual rental growth for luxury streets reached 3 percent in 2023, while for all high streets, rental growth was 1.6 percent on average. Rental levels on high streets across Europe remain 10 percent below their end-2018 levels over the past five years. Rents on luxury high streets have returned to end-2018 levels, the report said.

London remains a top player in luxury retail with New Bond Street seeing eight openings in the last year, several of which are brands relocating to larger stores. Prime pitch vacancy in the midstreet area is close to zero percent.

Robert Travers, head of Europe, Middle East and Africa retail, said retailers’ opportunities to secure space, particularly for in-demand larger stores, continue to be constrained, as physical stores remain crucial amid a normalizing period following years of explosive growth.

The report said luxury retailers have increasingly recognized the significance of integrating their brands into more areas of their clientele’s lifestyles by expanding into the hospitality sector like hotels, restaurants and cafés.

Christian Louboutin last June partnered with hotel group Marugal to open a boutique hotel on Portugal’s Alentejo coast. Louis Vuitton, Versace, Gucci and Breitling have recently opened restaurants in global destinations, notably Dubai, Seoul and Tokyo. Ralph Lauren expanded its coffee concept to Paris last year with a location on Boulevard Saint-Germain.

Presence in key luxury resort towns in beach and alpine settings has also been vital in creating deeper engagement with their customers in seasonal settings. Moncler, for example, opened a 3,200-square-foot store in St. Moritz in December while Valentino took over the cliffside luxury hotel Palazzo Avino on the Amalfi Coast in Italy in the summer.

The report anticipated that following the current normalization period, European luxury retail sales growth is expected to slow to more modest levels.

Therefore retailers will remain focused on core luxury locations and will also continue to seek out opportunities to expand the size of their stores, especially to increase the range of products that can be carried in a single store and to offer more private and exclusive spaces for local VIPs and big spenders from China and the Middle East.

An example of this is Dior’s revamped mega store at 30 Avenue Montaigne in Paris, which includes retail space, the Monsieur Dior restaurant, a haute couture workshop, an area for customized jewelry, and La Suite Dior, a private apartment only available to VIP guests, who must apply to be able to book a stay.

The appetite to invest in real estate assets, especially by the largest luxury retail players, for long-term strategic positioning, albeit on a selective basis, will continue to be strong, said the report.

Both LVMH Moët Hennessy Louis Vuitton and Kering have recently acquired real estate assets in Paris, particularly close to core luxury retail locations. In June 2023, LVMH acquired the building housing its flagship Louis Vuitton store at 101 Avenue de Champs-Élysées. In December 2023, LVMH then acquired 150 Avenue de Champs-Élysées.

Kering, meanwhile, purchased two buildings in Paris in 2023 — 35 Avenue Montaigne, home to its Saint Laurent flagship as well as offices, and 235 Rue St-Honoré, where it is opening a giant Gucci store. The group also acquired Via Montenapoleone 8 — a five-story building that houses its Saint Laurent store as well as other brands and office space last month.

In London, the Swatch Group last year acquired 171 New Bond Street, home to its Harry Winston brand in October 2023, as well as 32-33 Old Bond Street — home to Kering’s Saint Laurent Bond Street store.

Cushman & Wakefield believed that rental levels would see further upward movement across many key European luxury streets, with an average annual rental growth of between 1 and 2 percent per annum between 2024 and 2027.

Best of WWD

Yahoo Finance

Yahoo Finance