Etsy Inc (ETSY) Q1 2024 Earnings: Revenue Slightly Surpasses Estimates Amidst Challenges

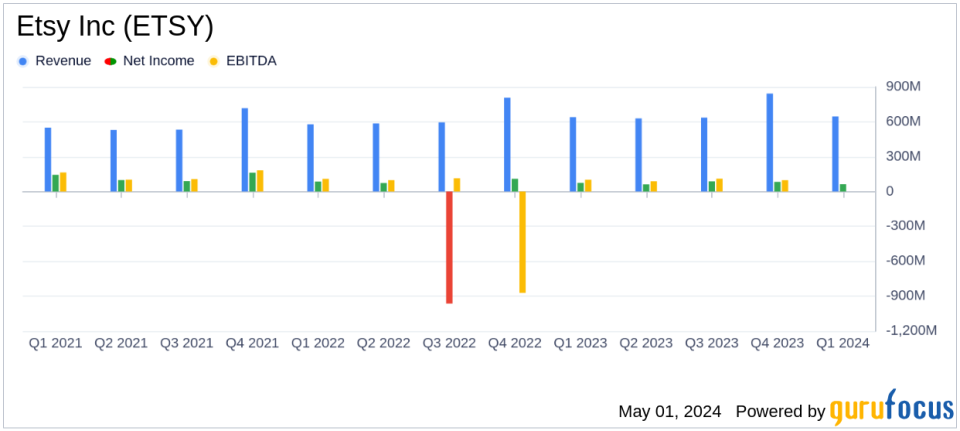

Revenue: Reported at $646.0 million, marking a slight increase of 0.8% year-over-year, closely aligning with estimates of $646.33 million.

Net Income: Totaled $63.0 million, down 15.5% from the previous year, falling short of the estimated $66.14 million.

Earnings Per Share (EPS): Achieved $0.48, below the expected $0.50 per share.

Gross Merchandise Sales (GMS): Declined by 3.7% year-over-year to $3.0 billion, indicating a challenging macroeconomic environment impacting consumer discretionary spending.

Active Buyers: Grew modestly by 1.9% year-over-year to 91.6 million, showing continued engagement despite broader market challenges.

Adjusted EBITDA: Reached $167.9 million, with a margin of 26.0%, slightly down from 26.6% the previous year.

Stock Repurchase: Under the stock repurchase program, repurchased approximately $158 million worth of shares, demonstrating ongoing confidence in the company's value.

Etsy Inc (NASDAQ:ETSY) released its 8-K filing on May 1, 2024, revealing a mixed financial performance for the first quarter ended March 31, 2024. Despite a challenging environment for consumer discretionary products, the company reported a slight revenue increase, aligning closely with analyst expectations for the quarter.

Etsy, a leading e-commerce marketplace in the U.S. and U.K., connects over 96 million buyers with 9 million sellers globally, offering a platform for vintage and craft goods. The company's diverse revenue streams include listing fees, commissions, advertising services, and payment processing.

Financial Performance Overview

The company's consolidated Gross Merchandise Sales (GMS) declined by 3.7% year-over-year to $3.0 billion, influenced by a tough macroeconomic climate and a divestiture from the previous year. Despite this, Etsy's consolidated revenue slightly grew by 0.8% to $646 million, surpassing the estimated $646.33 million. This growth was primarily driven by increases in payments and advertising revenues.

However, net income saw a decrease, falling 15.5% to $63 million, slightly missing the analyst's expectation of $66.14 million. The diluted net income per share stood at $0.48, just below the forecasted $0.50. Etsy's CEO, Josh Silverman, acknowledged the pressures but remained optimistic about enhancing customer experience to drive future growth.

Strategic Initiatives and Market Challenges

Despite the revenue growth, Etsy faces significant challenges, including a decline in marketplace GMS and a decrease in habitual buyers. The company is actively addressing these issues by launching new features like Gift Mode and improving search functionalities to enhance user engagement and value perception.

"Our first quarter performance, while in line with our guidance, was pressured by the challenging environment for consumer discretionary products, which continues to be a headwind to Etsy marketplace growth," said Josh Silverman, Etsy, Inc. Chief Executive Officer.

These strategic initiatives are crucial as they aim to differentiate Etsy in a competitive e-commerce landscape, focusing on unique value propositions and improving buyer retention.

Operational Highlights and Future Outlook

Etsy's operational strategies in Q1 2024 included enhancing the AI-driven Gift Mode, refining Etsy Ads, and implementing a new seller setup fee to reduce fraud. Looking ahead, the company expects the decline in Q2 GMS to mirror Q1's performance, with potential for modest acceleration later in the year. Revenue growth is anticipated to outpace GMS growth, maintaining robust adjusted EBITDA margins.

The company's balance sheet remains strong with $1.1 billion in cash and investments, supporting ongoing stock repurchases and strategic investments. In Q1, Etsy repurchased approximately $158 million worth of its common stock.

Conclusion

While Etsy navigates through economic turbulence and competitive pressures, its focus on enhancing platform capabilities and buyer experience positions it well for potential recovery and growth. Investors and stakeholders will likely watch closely how Etsy's strategic initiatives unfold in the coming quarters.

For detailed insights and ongoing updates, investors and interested parties are encouraged to follow Etsy's filings and announcements via the company's investor relations website.

Explore the complete 8-K earnings release (here) from Etsy Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance