Establishment Labs Holdings Inc. (NASDAQ:ESTA) Q1 2024 Earnings Call Transcript

Establishment Labs Holdings Inc. (NASDAQ:ESTA) Q1 2024 Earnings Call Transcript May 9, 2024

Establishment Labs Holdings Inc. isn’t one of the 30 most popular stocks among hedge funds at the end of the third quarter (see the details here).

Operator: Good afternoon. Welcome to Establishment Labs First Quarter 2024 Earnings Call. [Operator Instructions] As a reminder, today’s call is being recorded. I will now turn the call over to Raj Denhoy, Chief Financial Officer. Please go ahead.

Raj Denhoy: Thank you, operator and thank you everyone for joining us. With me today is Juan Jose Chacon Quiros, our Chief Executive Officer. Following our prepared remarks, we’ll take your questions. Before we begin, I would like to remind you that comments made by management during this call will include forward-looking statements within the meaning of federal securities laws. These include statements on Establishment Labs’ financial outlook and the company’s plans and timing for product development and sales. These forward-looking statements are based on management’s current expectations and involve risks and uncertainties. For a discussion of the principal risk factors and uncertainties that may affect our performance or cause actual results to differ materially from these statements, I encourage to review our most recent annual and quarterly reports on Form 10-K and Form 10-Q as well as other SEC filings, which are available on our website at establishmentlabs.com.

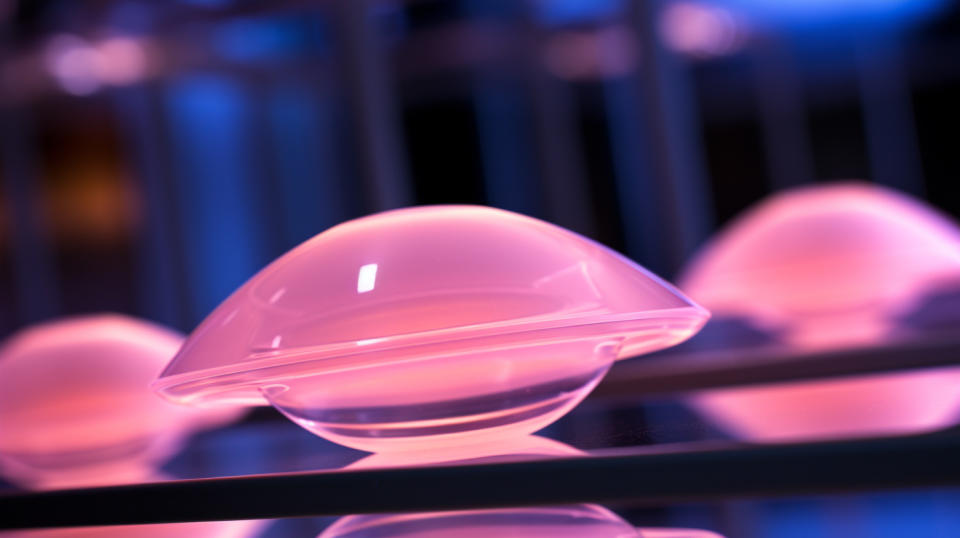

I’d also like to remind you that our comments may include certain non-GAAP financial measures with respect to our performance, including, but not limited to, sales results, which can be stated on a constant currency basis or profitability of the company’s business, which can be stated as EBITDA or adjusted EBITDA. Reconciliations to comparable GAAP financial measures for non-GAAP measures, if available, may be found in today’s press release, which is available on our website. Please also note that Establishment Labs receive an investigational device exemption from the FDA for Motiva Implants and is undergoing a clinical trial to support regulatory approval in the United States. We continually seek to expand the geographies in which our products are regulatory approved.

Please check with your local authority for product availability. The content of this conference call contains time-sensitive information accurate only as of the date of this live broadcast, May 8, 2024. Except as required by law Establishment Labs undertakes no obligation to revise or otherwise update any statement to reflect events or circumstances after the day of this call. With that, it is my pleasure to turn the call over to our CEO, Juan Jose.

Juan Jose Chacon Quiros: Thank you, Raj, and good afternoon, everyone. Revenue in the first quarter of 2024 totaled $37.2 million. Our markets continue to stabilize, and we are seeing improving demand. All of our global regions showed sequential improvement in the first quarter. We saw this in both our direct and distributor markets, and we expect to see continued improvement throughout 2024. Our first quarter also showed the tangible results of the cost reduction and efficiency improvement activities we undertook in the second half of last year. Adjusted EBITDA improved to a loss of less than $4 million. This was a notable improvement from the loss of $17 million last quarter. We are off to a busy start in 2024. Over the past several months, we launched Motiva implants in China in our Flora tissue expander in the United States.

We are also making significant progress to our approval of Motiva implants in the United States. This number of clinics offering me around the world is growing, and the feedback on this transformative breast technology continues to surpass even our own expectations. We are well positioned for multiyear growth while steadily improving our margin structure in achieving the necessary scale to reach cash flow profitability in 2025. Raj will provide more on our financial results and outlook in a moment. But first, I want to highlight several recent events. Last week, we announced two important developments on our path to U.S. approval. The 4-year data from our Motiva U.S. IDE study was presented at the Aesthetic Meeting on May 2 by Dr. Caroline Glicksman, the Medical Director is a principal investigator of the study.

As Dr. Glicksman highlighted, it is particularly notable that our rates of Baker Grade 3 and 4 capsular contracture and rupture have not changed for the past 2 years. At year 4, there continues to be only 2 patients with capsular contracture and only 1 patient with a suspected rupture, which were the exact same numbers at 2 years and at 3 years. These low complication rates are a confirmation of a new standard for breast implants, and we expect plastic surgeons will adopt our products given their technological superiority and performance. While these are not comparative studies, it is worth noting that at 4 years, the FDA data from the two largest competitors in the U.S. showed that between 1 in 7 and 1 in 12 women developed a Baker Grade 3 or 4 capsular contracture.

In the Motiva study, it was 1 in 200 women. We also announced last week that Jeff Ehrhardt will lead our North American business. Jeff most recently ran the plastic and reconstruction division of Allergan Aesthetics and was responsible for the Breast Products portfolio. Jeff is a strong commercial leader with over 25 years of experience in this industry. I cannot imagine anyone better suited to introduce Motiva to the U.S. market. Jeff is already building an experienced team with a successful track record in this industry, including Anne Pugh, who will head our U.S. sales team and Ben Newcott, who is Director of Surgeon Engagement and Business Development, will lead our outreach to the plastic surgeon community. This is truly an all-star team.

At the Annual Meeting of The Aesthetic Society in Vancouver this past weekend, Establishment Labs and Motiva were the talk of the conference. Plastic surgeons are overwhelmingly enthusiastic about our new hires and the launch of Motiva in the United States might be the most anticipated launch of an aesthetic product in decades. Surgeons and investors alike want to know when Motiva will be available in the United States. And while the second quarter inspection of our facilities is a critical point in the process, we will continue not to predict an exact time line for both competitor and regulatory reasons. That said, the conversations with the FDA are highly constructive, and we have high confidence that we will be on market in 2024. While we wait for the approval of Motiva Flora, our unique tissue expander continues to gain traction in the U.S. market.

Flora has many important and novel features, including our patented SmoothSilk surface technology as well as an RFID-enabled nonmagnetic port and is labeled as MR conditional by the FDA. This is a distinct advantage to Flora as all other commercially available breast tissue expanders include magnets. We had many surgeons come by our booth in Vancouver to learn about the advantages of Flora in reconstruction, and we expect adoption of this technology will continue throughout the course of 2024. We have completed the VAC process at a number of the premier cancer centers in the United States and more are pending. As the benefits of this device in breast reconstruction are being demonstrated and shared in the clinical community, the number of hospitals providing Flora to patients will grow in the U.S. Mia Femtech is creating an entirely new minimally invasive category within breast aesthetics in the list of cities across the world where Mia is available continues to grow.

In Q1, we added Mia centers in two new geographies, Middle East and Latin America. We now have centers certified to provide the Mia experience in Riyadh, Jeddah, Dubai, Abu Dhabi, Beirut and our hometown of San Jose. In total, we have 55 clinics signed up for Mia Femtech partnership, of which 33 are operating in 22 new clinics in the process of being onboarded for medical education and practice development. In addition, we have 37 clinics under negotiation. Mia consumers are sharing their experiences on social media, highlighting the convenience and aesthetic outcomes of the breath harmonization journey, confirming our conviction that word of mouth will ultimately be the biggest growth driver for Mia Femtech. It is still early in the launch of Mia, but we are seeing proof points that we are creating and capturing new consumer demand in this new category in breast aesthetics.

In China, the reception of our recent launch has been strong. Chinese plastic surgeons and consumers have a strong appreciation for Motiva as the latest in innovation, science and technology and there is a willingness to pay a premium for such offerings in this market. Our exclusive distribution partner is pursuing an aggressive strategy of medical education and marketing events in Tier 1 and Tier 2 cities across China. The early results give us confidence that our market position in China over the next few years will match what we have seen in surrounding markets in Asia, where we are market leaders. I will now turn over the call to Raj.

Raj Denhoy: Thank you, Juan Jose. Total revenue for the first quarter was $37.2 million, a decline of 20% from the year ago period. Direct sales in the first quarter were approximately 39% of implant sales, while distributors made up the balance. From a regional perspective, sales in Europe, Middle East and Africa were approximately 55% of the global total, Asia Pacific, 21%; and Latin America, 23%; Brazil, which is our largest market globally, accounted for approximately 11% of total quarterly sales. Our gross profit for the first quarter was $24.4 million or 65.6% of revenue, compared to $30.1 million or 64.7% of revenue for the same period in 2023. Our gross profit in the first quarter reflected an increase in average selling prices year-over-year, offset somewhat by higher overhead and labor costs.

Changes in foreign exchange rates between the U.S. dollar and the Costa Rican colón also continued to be a headwind. As we report in U.S. dollars, the continued strengthening of the colón has resulted in higher operating costs. SG&A expenses for the first quarter declined approximately $2.8 million to $28.9 million compared to $31.7 million in the first quarter of 2023. SG&A expenses also declined approximately $8 million from the $36.9 million reported in the fourth quarter. R&D expenses for the first quarter declined approximately $2.2 million from the same quarter a year ago to $4.3 million and were down $1.5 million sequentially. Total operating expenses for the first quarter were $33.2 million, a decrease of approximately $5 million in the year ago period and declined approximately $9.5 million from the fourth quarter due primarily to cost reduction initiatives.

The decrease in operating expenses in the first quarter was primarily the result of the cost reduction initiatives we undertook in the second half of 2023 and into 2024 as well as the timing of certain planned expenses this year. Net loss from operations for the first quarter was $8.8 million, compared to a net loss of $8.2 million in the same period in 2023 and $22.1 million in the fourth quarter. Adjusted EBITDA was a loss of $3.7 million in the quarter. This compared to a loss of $17.3 million in the fourth quarter and a loss of $4 million in the year ago period. Our cash position on March 31 was $73 million, compared to $40 million at the end of 2023. Excluding the proceeds from our January $50 million private placement, underlying cash used in the first quarter was $16.8 million.

As a reminder, we have two remaining tranches on our debt facility, which totaled $50 million. We can access the first $25 million on U.S. FDA approval of Motiva implants and the second with the additional milestone of achieving $195 million in trailing 12-month sales. For 2024, our revenue guidance continues to exclude the contribution of Motiva implants in the United States. Our guidance remains at $174 million to $184 million, representing growth of 5% to 11%. We expect currency to have a minimal impact on our sales results this year. We continue to expect gross margins in 2024 to be approximately 100 basis points higher than 2023 to a range of 65.5% to 66%. The pacing of operating expenses this year is going to be fluid given the timing of approval of Motiva implants in the U.S. Our increasing confidence in approval this year has led us to begin making some key hires and to begin limited activities to prepare for the launch.

As such, we expect operating expenses will increase modestly from first quarter levels. We remain focused on managing operating expenses and cash use. And excluding investments in the U.S., we’re targeting positive adjusted EBITDA by the end of 2024 and positive cash flow by the end of 2025. The timing of U.S. commercialization will effect when we achieve these targets. However, the additional capital, which becomes available to us will more than fully support our current launch plans. Also given the strong ASPs in the United States, our North America business achieved profitability very quickly. We are very focused on ensuring that the cash we currently have on hand and which is accessible to us under our credit facility or properly fund our business profitability without the need for additional capital.

I will now turn the call back to Juan Jose.

Juan Jose Chacon Quiros: Thank you, Raj. 2024 is off to a very good start. We are seeing steady recovery in our markets and our differentiated technologies continue to support our progress globally. The work we did at the end of last year in restructuring and refocusing organization is allowing us to invest in growth, while we progress towards profitability. Our goals of being adjusted EBITDA positive by the end of the year and cash flow positive next year, excluding investments in the U.S. remain firmly intact and are a key focus for us as an organization and management team. Early this year, we entered China, the second largest market for our technologies globally. Flora is pushing us deeper into breast reconstruction while establishing a new standard of care.

Our most recent family of implants ergonomics, too, supporting exciting new program offerings like JOY and of course, Mia Femtech, which is creating an entirely new category in breast aesthetics and which will lead to real market expansion over time. The rest of the year will be even more exciting. The pending launch of Motiva in the United States is a culmination of years of work at Establishment Labs, and we cannot wait to introduce our story to women and surgeons in the largest market in the world. As a company focused on women’s health, we are building on a solid foundation and have a clear path to further establish ourselves as the leader globally in breast aesthetics and reconstruction. I will now turn the call over to the operator for your questions.

Operator: [Operator Instructions] Our first question is from Harrison Parsons with Stephens Inc. Please proceed.

See also

16 Biggest Publicly Traded AI Companies in the World and

25 Largest Companies in Mexico by Revenue.

To continue reading the Q&A session, please click here.

Yahoo Finance

Yahoo Finance