Equifax (EFX) Gains From Diversification Amid Low Liquidity

Equifax EFX has had an impressive run over the past year. The stock has gained 21.6%, outperforming the 17.2% rally of the industry it belongs to.

EFX reported mixed first-quarter 2024 results. Adjusted earnings (excluding 50 cents from non-recurring items) were $1.5 per share, beating the Zacks Consensus Estimate by 4.2% and increasing 4.9% from the year-ago quarter. Total revenues of $1.4 billion missed the consensus estimate by a slight margin but increased 6.7% from the year-ago quarter.

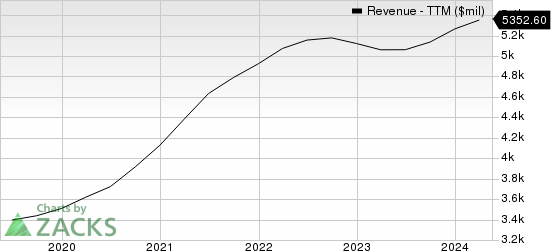

Equifax, Inc. Revenue (TTM)

Equifax, Inc. revenue-ttm | Equifax, Inc. Quote

How Is Equifax Doing?

Equifax provides diversified services that include finance, mortgage, consumer, employee, telecommunications and automotive. This broad client base is highly advantageous as it helps lessen vulnerabilities in any sector by capitalizing on strengths in others. The company focuses on expanding and strengthening its customer base by actively delivering multi-data solutions that involves the expansion of its unique data assets and improvements in its analytics capabilities.

Offerings provided by the company are crucial for its customers as they use the credit information, and related analytical services and data to process applications for new credit cards, automobile loans, home and equity loans and other consumer loans. The company uses advanced statistical techniques and tools to evaluate all available data, creating bespoke insights, decision-making solutions and processing services. This assists customers to understand, manage and protect their clients’ data, and make sound financial decisions.

EFX’s core business is being supplemented by strategic acquisitions. Acquisitions have enabled the company to deliver a broad insight into consumer performance, financial status, customers’ capabilities and market opportunities. Recently, the company has acquired Efficient Hire, which enables it to expand its portfolio of employer and HR-focused solutions, supporting its ability to assist clients in managing their hiring and employment requirements.

The company’s global presence is reflected by the fact that it conducts its operations in currencies other than the U.S. dollar. Such exposure makes it susceptible to the fluctuation of forex rates that significantly influences different aspects. Foreign exchange fluctuations have reduced the company’s revenues by $51.2 million, $94.9 million and $50.4 million in 2023, 2022 and 2021, respectively.

Equifax's current ratio at the end of first-quarter 2024 was pegged at 0.73, lower than 0.77 in the year-ago quarter. A current ratio of less than 1 indicates that the company may have problems paying off its short-term obligations.

Zacks Rank & Stocks to Consider

Equifax currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Zacks Business Services sector are mentioned below.

AppLovin APP sports a Zacks Rank of 1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

APP has a long-term earnings growth expectation of 20%. It delivered a trailing four-quarter earnings surprise of 60.9%, on average.

Aptiv APTV currently flaunts a Zacks Rank of 1. APTV has a long-term earnings growth expectation of 16.4%.

APTV delivered a trailing four-quarter earnings surprise of 12.2%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Equifax, Inc. (EFX) : Free Stock Analysis Report

AppLovin Corporation (APP) : Free Stock Analysis Report

Aptiv PLC (APTV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance