Entegris Inc (ENTG) Q1 2024 Earnings: Surpasses Analyst Revenue Forecasts with Strategic ...

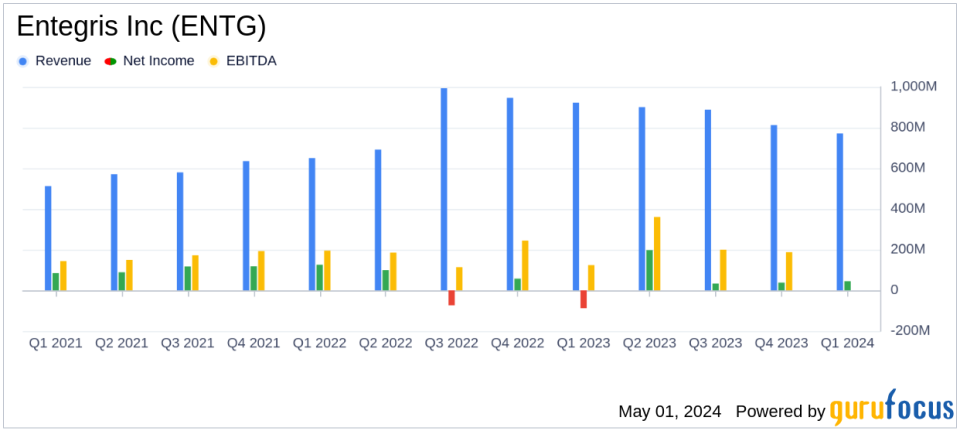

Revenue: Reported at $771 million, a decrease of 16% year-over-year and 5% sequentially, slightly above the estimated $769.28 million.

Net Income: Achieved $45.26 million, significantly below the estimated $93.06 million.

Earnings Per Share (EPS): GAAP EPS at $0.30, with non-GAAP EPS at $0.68, exceeding the estimated EPS of $0.62.

Gross Margin: Improved to 45.6% from 43.5% a year earlier, indicating enhanced profitability.

Operating Margin: GAAP operating margin rose to 15.3%, compared to just 1.5% in the same quarter last year.

Debt Reduction: Utilized proceeds from divestitures to pay down over $400 million in debt during the quarter.

Future Outlook: Expects Q2 sales between $790 million and $810 million, with non-GAAP EPS ranging from $0.68 to $0.73.

On May 1, 2024, Entegris Inc (NASDAQ:ENTG), a prominent supplier of materials and process solutions for the semiconductor and other high-technology industries, disclosed its financial results for the first quarter ended March 30, 2024. The company announced net sales of $771 million, which, while marking a 16% decrease from the previous year, still surpassed the analyst's revenue estimate of $769.28 million. Entegris released these figures in its 8-K filing.

Company Overview

Entegris operates through three main segments: Materials Solutions, Microcontamination Control, and Advanced Materials Handling. These divisions are crucial in providing a range of solutions from advanced filtration to materials handling, supporting critical areas of semiconductor manufacturing and other high-tech industries. The company's global presence spans several key markets including North America, Taiwan, South Korea, Japan, China, and Europe.

Quarterly Financial Highlights

The reported GAAP diluted earnings per share (EPS) stood at $0.30, while the non-GAAP diluted EPS was $0.68, exceeding the estimated EPS of $0.62. This performance demonstrates Entegris' operational resilience and effective cost management. The company's gross margin improved to 45.6%, reflecting enhanced operational efficiency.

Strategic Moves and Market Positioning

During the quarter, Entegris completed the sale of its Pipeline and Industrial Materials business, which is part of its strategy to focus on core operations and reduce debt. President and CEO Bertrand Loy highlighted the repayment of over $400 million in debt using proceeds from this sale, enhancing the company's financial stability. Loy also expressed confidence in the semiconductor market's recovery and Entegris' potential for growth, citing advancements in technology and increasing complexity in device manufacturing.

"We remain very optimistic about the long-term growth prospects for the semiconductor industry and Entegris," said Bertrand Loy. "Our core competencies in materials science and materials purity, coupled with our unique ability to co-optimize solutions that shorten time to yield, have become increasingly critical for our customers."

Future Outlook

Looking ahead to Q2 2024, Entegris expects sales between $790 million and $810 million, with non-GAAP diluted EPS ranging from $0.68 to $0.73. This guidance suggests a potential sequential sales increase of 8.5%, excluding impacts from divestitures, and reflects ongoing optimism about the company's performance and market conditions.

Financial Stability and Investor Confidence

The company's strategic divestitures and focus on debt reduction are pivotal in strengthening its balance sheet and positioning it for sustainable growth. These steps not only enhance investor confidence but also enable Entegris to capitalize on emerging opportunities in the dynamic semiconductor sector.

Entegris' commitment to innovation and market expansion, combined with its strategic financial management, aligns it well for continued success in the evolving tech landscape. Investors and stakeholders can anticipate Entegris' sustained outperformance and leadership in material science and contamination control solutions.

### END ###

Explore the complete 8-K earnings release (here) from Entegris Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance