Embecta Corp (EMBC) Surpasses Analyst Revenue Forecasts in Q2 Fiscal 2024

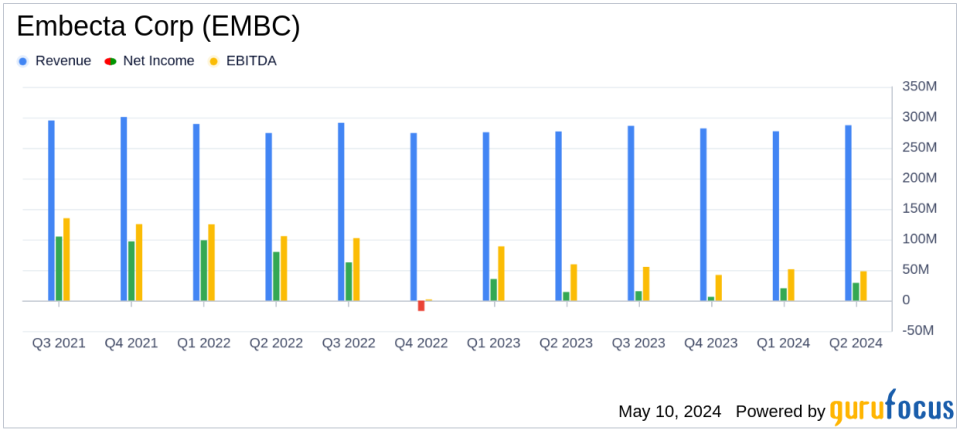

Revenue: $287.2 million, up 3.6% year-over-year, surpassing estimates of $283.78 million.

Net Income: $28.9 million, below estimates of $32.03 million.

Earnings Per Share (EPS): Reported at $0.50, below the estimated $0.55.

Gross Margin: Decreased to 64.6% from 68.5% in the prior year period.

Operating Margin: Dropped to 13.6% from 20.1% in the prior year period, indicating higher operational costs or lower efficiency.

Dividend: Announced a quarterly dividend of $0.15 per share, maintaining shareholder returns.

Guidance: Raised fiscal 2024 revenue outlook to $1,111 - $1,116 million from a previous range of $1,094 - $1,116 million, reflecting positive business expectations.

On May 9, 2024, Embecta Corp (NASDAQ:EMBC), a prominent player in the global diabetes care market, released its financial results for the second quarter of fiscal year 2024, revealing a performance that exceeded analyst expectations in terms of revenue. The detailed financial outcomes were disclosed in their latest 8-K filing.

Embecta Corp, known for its innovative diabetes care solutions, reported a revenue of $287.2 million for the quarter, marking a 3.6% increase on a reported basis and a 4.5% rise on a constant currency basis. This performance surpasses the estimated revenue of $283.78 million projected by analysts. The company's strategic efforts, including significant advancements in their insulin patch pump and a robust international market presence, contributed to this growth.

Financial Performance Insights

The company's net income stood at $28.9 million with earnings per diluted share of $0.50, which, although showing substantial growth from the previous year's $14.0 million and $0.24 respectively, fell slightly short of the estimated earnings per share of $0.55. The adjusted net income was reported at $38.9 million, with adjusted earnings per diluted share at $0.67, down from the previous year's $0.75.

Embecta's gross profit margin slightly declined to 64.6% from 68.5% in the prior year, reflecting the competitive pressures and cost dynamics in the medical devices and instruments industry. The operating income also saw a reduction, posting $39.2 million with a margin of 13.6%, compared to $55.6 million and a margin of 20.1% in the same quarter of the previous year.

Strategic and Operational Highlights

Embecta has been focusing on strengthening its base business, completing significant ERP implementations, and making strides in product development and regulatory progress. The company's successful transition of approximately 85% of its revenue to its own ERP system and the ongoing FDA review of its insulin patch pump are testaments to its operational capabilities and strategic foresight.

The company also highlighted its commitment to growth and innovation by continuing the development of a type 2 closed loop insulin delivery system, which has received Breakthrough Device Designation from the FDA. These initiatives are crucial for maintaining competitive advantage and driving future revenue growth.

Updated Financial Guidance and Future Outlook

Encouraged by the strong performance in the first half of the fiscal year, Embecta has raised and tightened its fiscal 2024 outlook. The company now expects revenues to be between $1,111 million and $1,116 million, with adjusted earnings per diluted share anticipated to be in the range of $2.20 to $2.30. This updated guidance reflects the company's confidence in its ongoing business strategies and market position.

In conclusion, Embecta Corp's second quarter results demonstrate a resilient and progressing business amidst a challenging market environment. With strategic investments in technology and a clear focus on operational excellence, Embecta is well-positioned to continue its growth trajectory and enhance shareholder value.

For detailed financial figures and future projections, stakeholders and interested investors are encouraged to review the full earnings report and participate in the upcoming earnings conference call scheduled for today at 8:00 a.m. Eastern Time.

Explore the complete 8-K earnings release (here) from Embecta Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance