EchoStar (SATS) Receives $2.7B IDIQ Contract From U.S. Navy

EchoStar Corporation SATS announced that it has received an indefinite delivery, indefinite quantity (IDIQ) contract from the U.S. Naval Supply Systems Command Spiral 4 wireless products and services purchasing program.

EchoStar's subsidiaries, Hughes Network Systems and Boost Mobile will provide 5G wireless services and devices to support the Department of Defense (DoD) across all 50 states and U.S. territories and for international travel on temporary duty.

The Spiral 4 program is managed by the U.S. Navy and is accessible to the DoD and other federal agencies. Spiral 4 includes the delivery of mobile devices and service plan task orders. It also include tablets, IoT devices, and other 5G-enabled equipment. The program encompasses device hardware, service plans, customer service, support, and reporting via an online portal.

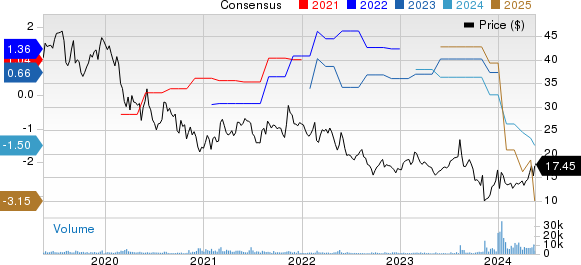

EchoStar Corporation Price and Consensus

EchoStar Corporation price-consensus-chart | EchoStar Corporation Quote

Spiral 4 necessitates Radio Access Networks with support for Radio over Internet Protocol and Citizen Band Radio Services. The program starts in May 2024 with a base year, followed by nine optional one-year periods, extending through 2034. The program could be worth up to $2.7 billion over 10 years if all options are exercised.

Headquartered in Englewood, CO, EchoStar is a global provider of satellite service operations, video delivery services, broadband satellite technologies and broadband Internet services. The company also offers innovative network technologies, managed services, and various communications solutions for aeronautical, enterprise and government customers.

In April, EchoStar’s subsidiary, Hughes Network Systems LLC, clinched a production contract from General Atomics Aeronautical Systems, Inc. The contract involves the production of a vital component of the advanced satellite communications system for the MQ-1C Gray Eagle 25M Unmanned Aircraft System.

Prior to that, the company announced that Nilesat would be implementing Hughes JUPITER System Gateway and terminals for Nilesat 301 satellite to deliver cost-effective and high-powered broadband services to its subscribers.

Currently, EchoStar carries a Zacks Rank #3 (Hold). Shares of SATS have gained 6.9% in the past year against the sub-industry’s decline of 38.6%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the broader technology space are Woodward WWD, Arista Networks ANET and Super Micro Computer SMCI. Each stock presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Woodward’s fiscal 2024 earnings per share (EPS) has moved up 9.3% in the past 60 days to $5.76. WWD’s long-term earnings growth rate is 16.3%.

Woodward’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, delivering an average surprise of 26.1%. WWD shares have risen 62% in the past year.

The Zacks Consensus Estimate for ANET’s 2024 EPS has increased 0.9% in the past 60 days to $7.53. ANET’s long-term earnings growth rate is 17.5%.

Arista Networks’ earnings beat the Zacks Consensus Estimate in each of the last four quarters, delivering an average earnings surprise of 13.3%. Shares of ANET have gained 127.3% in the past year.

The Zacks Consensus Estimate for Super Micro Computer’s fiscal 2024 EPS has improved 8.3% in the past 60 days to $23.51. SMCI’s long-term earnings growth rate is 52.3%.

SMCI’s earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 6.9%. Shares of SMCI have risen 481% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

EchoStar Corporation (SATS) : Free Stock Analysis Report

Super Micro Computer, Inc. (SMCI) : Free Stock Analysis Report

Woodward, Inc. (WWD) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance