Donnelley Financial Solutions Inc (DFIN) Q1 2024 Earnings: Surpasses Analyst Revenue Forecasts

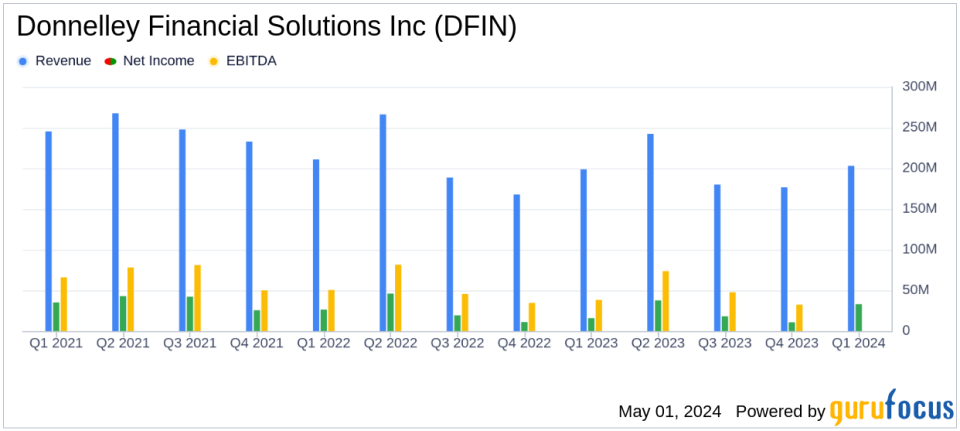

Net Sales: Reported at $203.4 million, marking a 2.4% increase from the previous year, and slightly below the estimated $213.05 million.

Net Earnings: Reached $33.3 million, significantly surpassing the estimated $22.33 million, with earnings per share at $1.09, exceeding the estimate of $0.78.

Adjusted EBITDA: Grew by 30.2% to $55.2 million, demonstrating strong operational efficiency and cost management.

Free Cash Flow: Improved to ($40.2 million) from ($62.1 million) in the prior year, indicating better cash management despite remaining negative.

Software Solutions Sales: Increased by 14.6% to $80.3 million, now representing 39.5% of total net sales, driven by strong growth in tech offerings.

Operating Cash Flow: Showed significant improvement, up $23.6 million to ($27.9 million), reflecting enhanced working capital management.

Share Repurchase: Executed repurchases of 139,893 shares for approximately $8.8 million, highlighting ongoing shareholder return efforts.

On May 1, 2024, Donnelley Financial Solutions Inc (NYSE:DFIN) announced its first-quarter results for the fiscal year 2024, revealing significant improvements in both revenue and net earnings, surpassing analyst expectations. The detailed financial outcomes are disclosed in the company's 8-K filing.

DFIN, a global provider of risk and compliance solutions, reported first-quarter net sales of $203.4 million, a 2.4% increase from the previous year, slightly below the estimated $213.05 million. However, the company's net earnings reached $33.3 million, significantly surpassing the estimated $22.33 million, and showcasing a remarkable 110.8% increase from the first quarter of 2023. Earnings per share stood at $1.09, exceeding the analyst estimate of $0.78.

Operational Highlights and Financial Performance

The growth was primarily driven by a 16.0% increase in organic software solutions sales, notably from Venue, DFIN's virtual dataroom product, which alone grew by approximately 43%. The software solutions segment now represents 39.5% of total net sales, up from 35.3% in the previous year, reflecting a strategic shift towards high-margin, tech-enabled services.

Adjusted EBITDA for the quarter was $55.2 million, up 30.2% year-over-year, with an Adjusted EBITDA margin expansion of 580 basis points to 27.1%. This improvement underscores effective cost management and an enhanced sales mix. Furthermore, DFIN reported significant improvements in cash flows; operating cash flow and free cash flow improved by $23.6 million and $21.9 million, respectively.

Strategic Moves and Market Positioning

DFIN's President and CEO, Daniel N. Leib, emphasized the company's ongoing transformation towards software solutions and tech-enabled services, aiming for a more recurring sales mix. The company also continued its shareholder-friendly activities, repurchasing approximately $8.8 million worth of shares during the quarter.

The company's balance sheet remains robust, with gross leverage at 0.9x and net leverage at 0.7x as of March 31, 2024. These indicators highlight DFIN's strong financial health and its ability to manage debt effectively.

Looking Forward

DFIN remains focused on driving growth through strategic investments in its software solutions and managing costs effectively. The company's leadership is optimistic about maintaining a trajectory of robust financial performance and delivering long-term value to its stakeholders.

Investors and stakeholders can access more detailed financial information and future outlooks during DFIN's conference call and webcast scheduled for May 1, 2024. This event promises further insights into the company's strategies and operational tactics moving forward.

For more detailed financial analysis and continuous updates on DFIN and other market movers, stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from Donnelley Financial Solutions Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance