Discovering May 2024's Top US Growth Companies With High Insider Ownership

As of May 2024, the U.S. stock market is experiencing an uplift influenced by a favorable interest rate outlook, with technology and consumer sectors showing notable gains. In this context, growth companies with high insider ownership can be particularly compelling, as significant insider stakes often align management’s interests with those of shareholders, potentially driving stronger performance in these buoyant market conditions.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.2% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 20.9% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

EHang Holdings (NasdaqGM:EH) | 33% | 101.9% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

ZKH Group (NYSE:ZKH) | 17.7% | 102.8% |

BBB Foods (NYSE:TBBB) | 23.6% | 92.4% |

Spotify Technology (NYSE:SPOT) | 18% | 40.3% |

Let's explore several standout options from the results in the screener.

Byrna Technologies

Simply Wall St Growth Rating: ★★★★★☆

Overview: Byrna Technologies Inc. operates as a non-lethal defense technology company, offering alternative solutions for law enforcement and private security, with a market capitalization of approximately $275.34 million.

Operations: The company generates its revenue primarily from the aerospace and defense sector, amounting to $50.89 million.

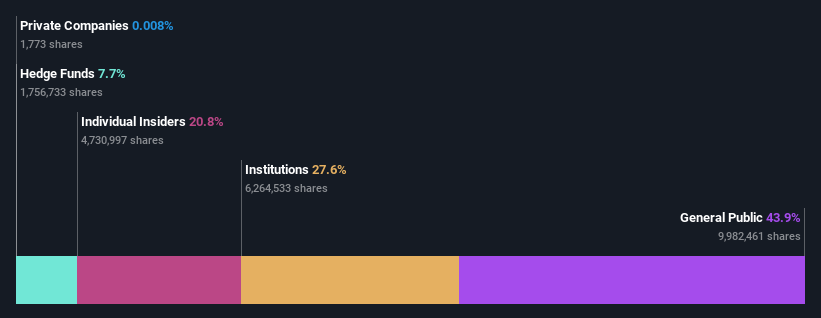

Insider Ownership: 20.8%

Revenue Growth Forecast: 22.7% p.a.

Byrna Technologies, a company with high insider ownership, has shown promising growth with a recent surge in sales to US$16.65 million, doubling year-over-year. This growth is supported by significant contracts such as the sale of 10,000 launchers to the Córdoba Provincial Police in Argentina. The promotion of John Brasseur to COO could further enhance operational efficiencies and product development. Despite this progress and strong revenue forecasts, shareholder dilution over the past year and a highly volatile share price pose challenges for potential investors.

PubMatic

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PubMatic, Inc. is a technology firm that offers a cloud infrastructure platform facilitating real-time programmatic advertising transactions globally, with a market capitalization of approximately $1.19 billion.

Operations: The company generates its revenue primarily from internet information providers, totaling approximately $278.31 million.

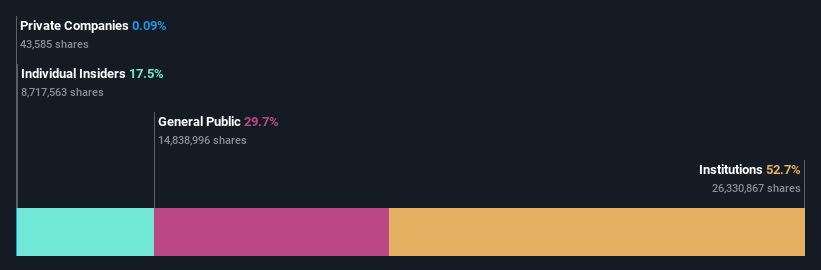

Insider Ownership: 17.5%

Revenue Growth Forecast: 10.8% p.a.

PubMatic, with substantial insider ownership, is poised for notable growth, forecasting a 34.1% annual earnings increase and a 10.8% revenue rise per year, outpacing the US market. Despite improved quarterly sales reaching US$66.7 million and reduced losses, profit margins have dipped to 4.4%. The firm's strategic partnerships aim to enhance programmatic advertising reach and efficiency while maintaining user privacy, reflecting its commitment to innovation in a challenging digital landscape.

Altus Power

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Altus Power, Inc. is a clean electrification company that specializes in developing, owning, constructing, and operating photovoltaic solar energy generation and storage systems on roofs, grounds, and carports, with a market capitalization of approximately $629.91 million.

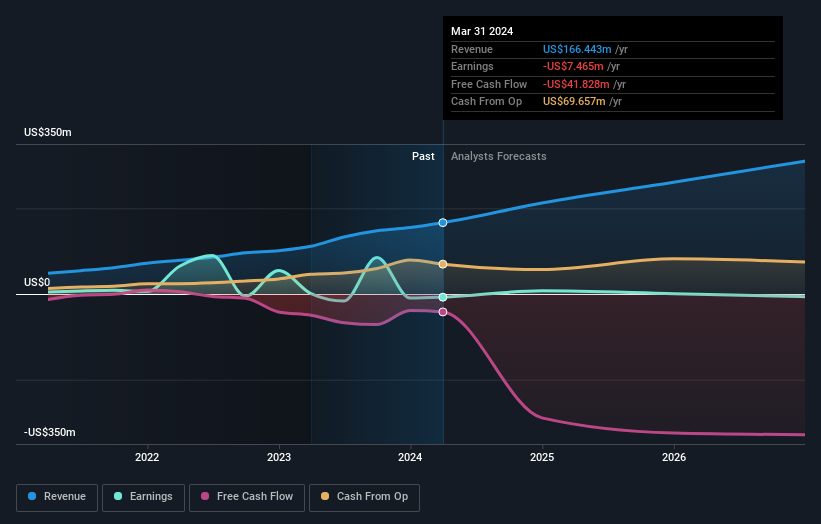

Operations: The company generates its revenues primarily through electric utilities, totaling approximately $166.44 million.

Insider Ownership: 36.1%

Revenue Growth Forecast: 18.8% p.a.

Altus Power, with high insider ownership, shows a promising outlook despite recent executive changes. The company reported a substantial increase in quarterly sales to US$40.66 million and net income to US$7.51 million. Analysts expect Altus Power's revenue to grow at 18.8% annually, outpacing the US market's 8.4%, with profitability anticipated within three years. However, its share price has been highly volatile recently, and return on equity is forecasted low at 0.2%.

Summing It All Up

Unlock our comprehensive list of 177 Fast Growing US Companies With High Insider Ownership by clicking here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqCM:BYRN NasdaqGM:PUBM and NYSE:AMPS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance