Discover Three High-Yielding Dividend Stocks In Hong Kong With Yields Up To 6.7%

Amidst a backdrop of fluctuating global markets, the Hong Kong stock market has shown resilience with the Hang Seng Index experiencing an uplift. This environment may pique the interest of investors looking for stable returns, making high-yielding dividend stocks particularly appealing as they offer potential income alongside capital appreciation opportunities.

Top 10 Dividend Stocks In Hong Kong

Name | Dividend Yield | Dividend Rating |

Chongqing Rural Commercial Bank (SEHK:3618) | 8.76% | ★★★★★★ |

CITIC Telecom International Holdings (SEHK:1883) | 9.73% | ★★★★★★ |

Consun Pharmaceutical Group (SEHK:1681) | 9.25% | ★★★★★☆ |

China Construction Bank (SEHK:939) | 7.62% | ★★★★★☆ |

S.A.S. Dragon Holdings (SEHK:1184) | 9.21% | ★★★★★☆ |

Playmates Toys (SEHK:869) | 8.70% | ★★★★★☆ |

Bank of China (SEHK:3988) | 6.72% | ★★★★★☆ |

China Mobile (SEHK:941) | 6.39% | ★★★★★☆ |

Sinopharm Group (SEHK:1099) | 3.92% | ★★★★★☆ |

International Housewares Retail (SEHK:1373) | 8.48% | ★★★★★☆ |

Click here to see the full list of 91 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

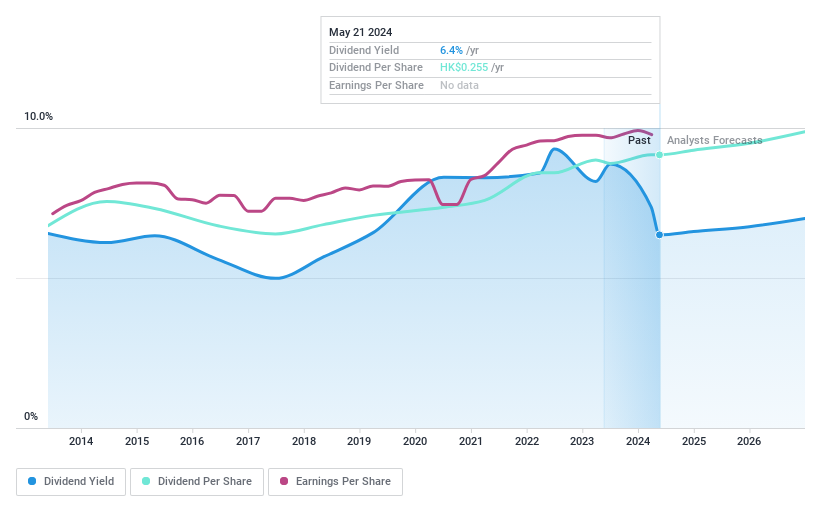

Bank of China

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank of China Limited operates globally, offering a wide range of banking and financial services, with a market capitalization of approximately HK$1.35 trillion.

Operations: Bank of China Limited generates its revenue from various banking and financial services across Chinese Mainland, Hong Kong, Macao, Taiwan, and internationally.

Dividend Yield: 6.7%

Bank of China's dividend profile shows a stable and increasing trend over the past decade, supported by a sustainable payout ratio of 32.6%, which is projected to remain nearly constant at 31.2% in three years, indicating reliable future coverage. Despite its solid dividend yield of 6.72%, it falls below Hong Kong's top quartile yielders. Recent strategic moves include significant fixed-income offerings totaling CNY 75 billion, enhancing financial flexibility but also reflecting substantial capital market dependencies that could influence future dividend reliability and growth stability.

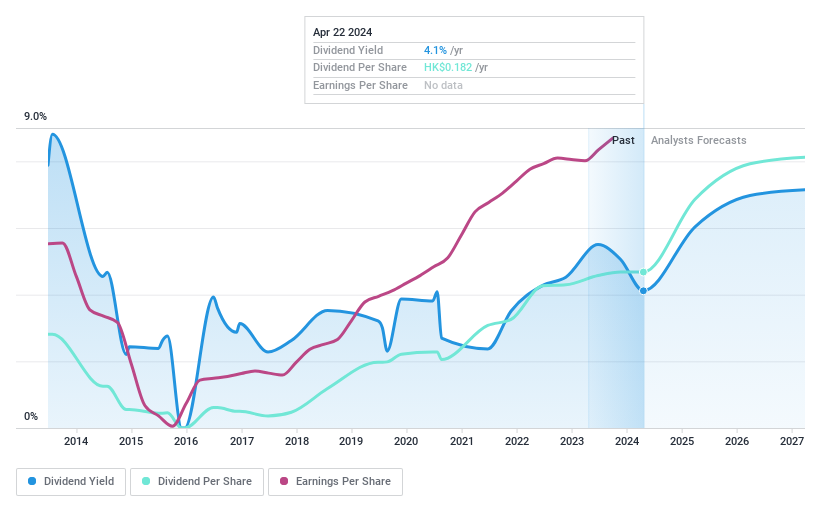

Bosideng International Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bosideng International Holdings Limited, based in the People's Republic of China, specializes in the research, design, development, manufacturing, marketing, and distribution of branded down apparel and non-down products as well as OEM services with a market capitalization of approximately HK$50.50 billion.

Operations: Bosideng International Holdings Limited generates revenue primarily from three segments: Down Apparels at CN¥14.69 billion, Ladieswear Apparels at CN¥755.43 million, and Diversified Apparels at CN¥237.53 million, alongside Original Equipment Manufacturing (OEM) Management contributing CN¥2.46 billion.

Dividend Yield: 3.9%

Bosideng International Holdings has shown modest earnings growth, with a 7.6% increase over the past year and projections for a 17.04% annual growth moving forward. Despite this, its dividend yield of 3.92% is relatively low compared to Hong Kong's top dividend payers at 7.64%. The company maintains a payout ratio of 76%, ensuring dividends are well-covered by earnings, though its dividend history has been marked by instability and volatility over the last decade. Significant insider selling in recent months could raise concerns about future performance and commitment to current dividend levels.

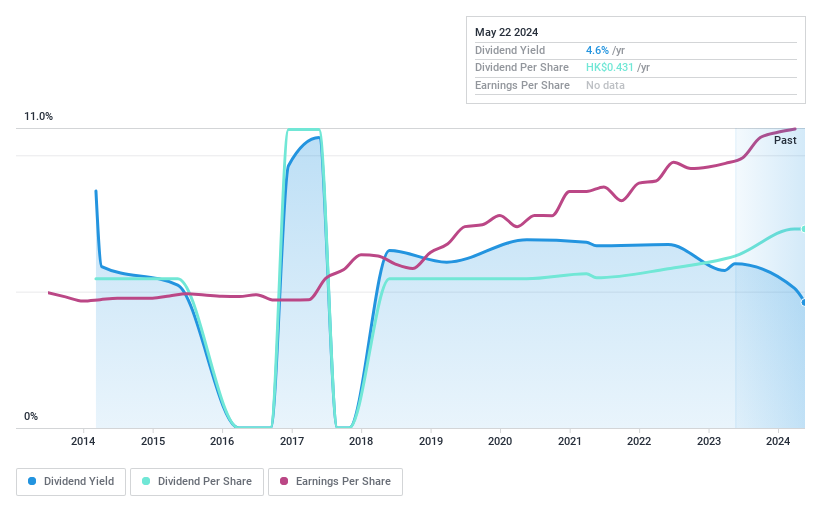

Xinhua Winshare Publishing and Media

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xinhua Winshare Publishing and Media Co., Ltd. operates in the publishing and distribution sectors within the People's Republic of China, with a market capitalization of approximately HK$16.54 billion.

Operations: Xinhua Winshare Publishing and Media Co., Ltd. generates its revenue primarily from publishing and distribution activities in the People's Republic of China.

Dividend Yield: 4.5%

Xinhua Winshare Publishing and Media Co., Ltd. recently declared a final dividend of RMB 0.40 per share for 2023, payable on July 19, 2024, to shareholders registered by May 30, 2024. This decision follows a year where net income rose to CNY 1.58 billion from CNY 1.40 billion in the previous year, indicating some level of earnings support for dividend payments despite a history of unstable dividends over the past decade. The company's recent AGM also saw significant governance changes including auditor and executive shifts which could impact future financial management and strategy.

Next Steps

Investigate our full lineup of 91 Top Dividend Stocks right here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:3988 SEHK:3998 and SEHK:811.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance