Dillard's (DDS) Q1 Earnings Beat, Retail Challenges Hurt Stock

Dillard's Inc. DDS posted first-quarter fiscal 2024 results, wherein the top and bottom lines surpassed the Zacks Consensus Estimate. This marked the company’s 13th straight quarter of a bottom-line beat. However, DDS’s sales and earnings declined year over year. The declines can be attributed to the challenging retail environment, which impacted sales and comps, as well as higher operating expenses.

Earnings per share of $11.09 surpassed the Zacks Consensus Estimate of $9.25. However, the bottom line declined 5.8% from the year-ago quarter's adjusted earnings of $11.77 per share.

Net sales of $1.549 billion fell 1% from the prior-year quarter but beat the Zacks Consensus Estimate of $1.531 billion. Including service charges and other income, the company reported sales of $1.573 million, down 2.5% year over year.

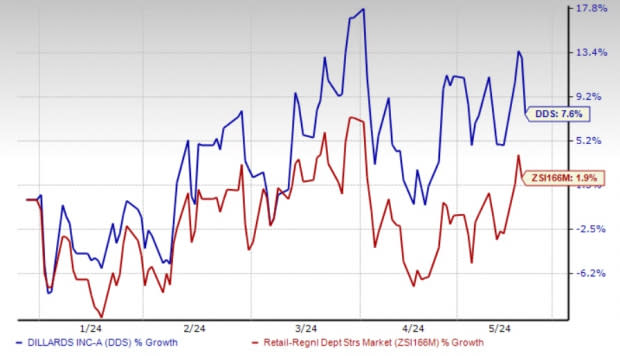

Dillard’s shares declined 4.7% on May 16 following the year-over-year declines in the top and bottom lines in first-quarter fiscal 2024. Shares of the Zacks Rank #3 (Hold) company have gained 7.6% in the year-to-date period compared with the industry's growth of 1.9%.

Image Source: Zacks Investment Research

Q1 Details

Total retail sales (excluding CDI Contractors, LLC) declined 1.5% year over year to $1.493 billion. Comparable store sales also slipped 2% year over year. Retail sales were affected by the challenging sales environment in the quarter. Our model had predicted a comps decline of 3.7% for the fiscal first quarter.

The company witnessed robust sales in the cosmetics category in the quarter. On the flip side, men’s apparel and accessories was the weakest category.

The consolidated gross margin contracted 90 basis points (bps) year over year to 44.6% in the fiscal first quarter. The retail gross margin of 46.2% reflected year-over-year growth of 60 bps, driven by moderate gross margin expansions in home and furniture; ladies’ accessories and lingerie; men’s apparel and accessories; ladies’ apparel; and juniors’ and children’s apparel categories. However, the gross margin in the cosmetics and shoes categories was nearly flat.

Dillard's consolidated SG&A expenses (as a percentage of sales) expanded 180 bps to 27.5% from the prior-year quarter's 25.7%. In dollar terms, SG&A expenses (operating expenses) grew 5% to $426.7 million. The increase in operating expenses is mainly attributed to higher payroll and payroll-related expenses.

Our model had predicted SG&A expenses (as a percentage of sales) growth of 180 bps for the fiscal first quarter. In dollar terms, we expected SG&A expenses to increase 3.1% year over year to $418.9 million.

Dillard's, Inc. Price, Consensus and EPS Surprise

Dillard's, Inc. price-consensus-eps-surprise-chart | Dillard's, Inc. Quote

Financial Details

Dillard’s ended first-quarter fiscal 2024 with cash and cash equivalents of $817.8 million, a long-term debt of $321.5 million, and a total shareholders' equity of $1.875 billion. The company provided $244.4 million of net cash from operating activities as of May 4, 2024. Ending inventory declined 1.6% year over year as of May 4, 2024.

Capital expenditure for fiscal 2024 is likely to be $130 million, indicating a decline from the $133 million spent in fiscal 2023.

Store Update

In March 2024, the company opened a store at the Empire Mall location in Sioux Falls, SD. This marked the company’s entry into the state. As of May 4, 2024, DDS operated 274 full-line Dillard’s stores, including 29 clearance stores, across 30 states, as well as an online store at dillards.com.

In July 2024, the company plans to close its Eastwood Mall Clearance Center in Niles, OH.

Outlook

For fiscal 2024, Dillard’s expects depreciation and amortization of $185 million, whereas it reported $180 million in fiscal 2023. The company projects a net interest and debt income of $8 million, whereas it recorded an income of $5 million in fiscal 2023. DDS anticipates rentals of $22 million for fiscal 2024, in line with that reported in fiscal 2023.

Stocks to Consider

Here are some better-ranked stocks that you may want to consider, namely, Levi Strauss & Co. LEVI, Tractor Supply Co. TSCO and Abercrombie & Fitch ANF.

Levi Strauss, which designs and markets jeans, casual wear and related accessories for men, women and children, currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Levi Strauss’ current financial-year sales and earnings suggests growth of 2.9% and 15.5%, respectively, from the year-ago period’s actuals. LEVI has a trailing four-quarter earnings surprise of 16.4%, on average.

Tractor Supply, the largest retail farm and ranch store chain in the United States, presently carries a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for Tractor Supply’s 2024 sales and EPS indicate growth of 3% and 2.4%, respectively, from the year-ago period’s reported levels. It has a trailing four-quarter earnings surprise of 2.7%, on average.

Abercrombie, a specialty retailer of premium, high-quality casual apparel for men, women and kids, currently carries a Zacks Rank of 2.

The Zacks Consensus Estimate for Abercrombie’s fiscal 2024 sales and earnings indicates growth of 5.9% and 20.1%, respectively, from the year-ago reported numbers. ANF has a trailing four-quarter earnings surprise of 715.6%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dillard's, Inc. (DDS) : Free Stock Analysis Report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

Tractor Supply Company (TSCO) : Free Stock Analysis Report

Levi Strauss & Co. (LEVI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance