DigitalOcean Holdings Inc (DOCN) Q1 2024 Earnings Report: A Robust Start with Enhanced Revenue ...

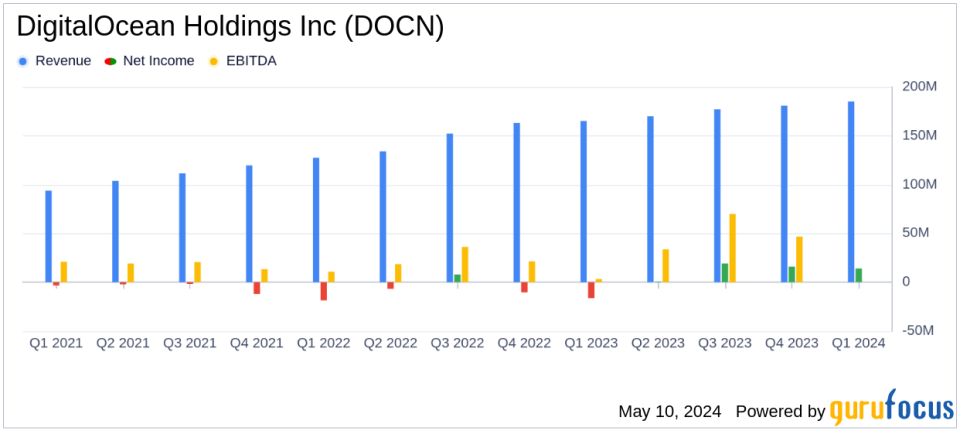

Revenue: $185 million, up 12% year-over-year, surpassing estimates of $182.58 million.

Net Income: $14 million with a net income margin of 8%, below estimates of $38.60 million.

Earnings Per Share (EPS): Non-GAAP diluted net income per share was $0.43, exceeding the estimated $0.38.

Adjusted EBITDA: $74 million, an increase of 33% year-over-year, with an adjusted EBITDA margin of 40%.

Free Cash Flow: Adjusted free cash flow was $34 million, up from $26 million in the first quarter of 2023.

Gross Margin: Gross profit reached $112 million, representing 61% of revenue and a 20% increase year-over-year.

Annual Run-Rate Revenue (ARR): Ended the quarter at $749 million, marking a 12% growth year-over-year.

On May 10, 2024, DigitalOcean Holdings Inc (NYSE:DOCN) released its 8-K filing, revealing a promising start to the year with significant revenue growth and improved profitability. The company, a leading cloud computing platform tailored for startups and growing technology businesses, reported a 12% increase in revenue year-over-year, reaching $185 million for the first quarter of 2024. This performance surpasses the analyst's estimated revenue of $182.58 million.

Company Overview

DigitalOcean Holdings Inc provides on-demand infrastructure and platform tools for developers, startups, and small to medium-sized businesses. Its services are widely utilized across various applications including web and mobile applications, website hosting, e-commerce, media and gaming, and more. DigitalOcean operates globally, with a presence in North America, Europe, Asia, and other regions.

Financial and Operational Highlights

The company's net income for Q1 2024 stood at $14 million, translating to a net income margin of 8%. This marks a significant turnaround from a net loss in the previous year, aligning closely with the estimated earnings per share of $0.38. The adjusted EBITDA was reported at $74 million, showing a robust year-over-year increase of 33%, with an impressive adjusted EBITDA margin of 40%.

DigitalOcean's operational efficiency is also reflected in its cash flow performance, with net cash from operating activities reported at $67 million, up from $36 million in the first quarter of 2023. The company's balance sheet remains strong with cash and cash equivalents of $419 million as of March 31, 2024.

Strategic Developments and Market Position

The first quarter saw DigitalOcean focusing on enhancing its core cloud services and expanding its AI platform capabilities. According to CEO Paddy Srinivasan, the quarter's results demonstrate solid performance and highlight the potential of their expanding AI platform. The company also reported a net dollar retention rate of 97%, indicating strong customer retention and satisfaction.

Moreover, DigitalOcean is actively managing its capital, as evidenced by the repurchase of 200,258 shares during the quarter. Looking ahead, the company provided a positive outlook for Q2 2024, projecting revenue between $188 million and $189 million and an adjusted EBITDA margin of 37% to 38%.

Analysis and Future Outlook

Despite the competitive nature of the cloud computing market, DigitalOcean's strategic focus on startups and digital businesses, combined with its simplified solutions, positions it well for sustained growth. The company's robust financial health and proactive management strategies are likely to support its continued expansion and ability to capitalize on emerging technology trends.

Investors and stakeholders may look forward to a year of growth as DigitalOcean continues to execute its business strategies effectively, with a keen focus on enhancing shareholder value and expanding its market reach.

Conclusion

DigitalOcean's Q1 2024 results not only exceeded revenue expectations but also showcased significant profitability improvements. With a solid financial foundation and strategic initiatives in place, DigitalOcean is poised for further growth, making it a noteworthy entity in the cloud computing landscape.

For detailed financial figures and future projections, you can access the full earnings report here.

Explore the complete 8-K earnings release (here) from DigitalOcean Holdings Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance