Diamondback Energy Inc (FANG) Q1 2024 Earnings: Solid Performance with Key Financial Highlights

Net Income: Reported at $768 million, slightly below the estimated $784.2 million.

Earnings Per Share (EPS): Achieved $4.28 per diluted share, falling short of the estimated $4.43.

Revenue: Totaled $2.101 billion, exceeding the estimated $2.09194 billion.

Free Cash Flow: Generated $791 million during the quarter.

Dividends: Declared a base cash dividend of $0.90 per share and a variable cash dividend of $1.07 per share for Q1 2024.

Stock Repurchase: Repurchased 279,266 shares of common stock for approximately $42 million.

Merger Update: Announced a merger with Endeavor Energy Resources, L.P., approved by stockholders, expected to close in Q4 2024.

Diamondback Energy Inc (NASDAQ:FANG) released its 8-K filing on April 30, 2024, detailing its financial and operational performance for the first quarter ended March 31, 2024. The company, a prominent independent oil and gas producer in the Permian Basin, reported significant achievements and strategic advancements during this period.

Financial Performance Overview

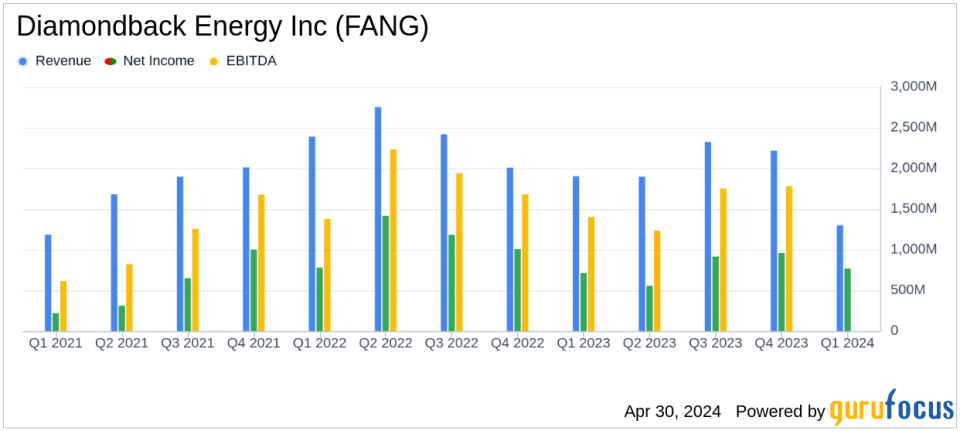

Diamondback Energy Inc reported a net income of $768 million, or $4.28 per diluted share, slightly underperforming against the estimated earnings per share of $4.43. However, adjusted net income stood at $809 million, or $4.50 per diluted share, aligning closely with analyst expectations. The company's revenue for the quarter was $2,101 million from oil, natural gas, and natural gas liquids sales, surpassing the estimated revenue of $2091.94 million.

The company demonstrated robust financial health with net cash provided by operating activities reaching $1.3 billion and a substantial Free Cash Flow of $791 million. Total cash capital expenditures were reported at $609 million for the quarter.

Operational Highlights

In terms of operations, Diamondback drilled 69 gross wells in the Midland Basin and 10 in the Delaware Basin, with 101 wells turned to production. The strategic focus on these key areas underscores the company's commitment to optimizing resource extraction and operational efficiency.

Strategic Initiatives and Dividend Declarations

Significantly, Diamondback announced a merger with Endeavor Energy Resources, L.P., enhancing its operational scale and resource base, pending regulatory approval. The company also declared a base cash dividend of $0.90 per share and a variable cash dividend of $1.07 per share for Q1 2024, reflecting a strong commitment to returning value to shareholders.

Market Position and Future Outlook

With $876 million in standalone cash and no borrowings under its revolving credit facility as of March 31, 2024, Diamondback is well-positioned to navigate future market dynamics effectively. The company's strategic initiatives, including the ongoing merger and robust dividend policy, are set to bolster its market position and shareholder value.

Conclusion

Diamondback Energy Inc's first-quarter results reflect a solid financial and operational performance, with strategic mergers and consistent shareholder returns highlighting the quarter. As the company continues to leverage its strong presence in the Permian Basin and navigate the complexities of the energy market, it remains a significant player in the industry.

For detailed insights into Diamondback Energy Inc's performance and strategic direction, investors and stakeholders are encouraged to view the full 8-K filing.

Explore the complete 8-K earnings release (here) from Diamondback Energy Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance