Dayforce (NYSE:DAY) Q1 Earnings: Leading The HR Software Pack

Wrapping up Q1 earnings, we look at the numbers and key takeaways for the hr software stocks, including Dayforce (NYSE:DAY) and its peers.

Modern HR software has two powerful benefits: cost savings and ease of use. For cost savings, businesses large and small much prefer the flexibility of cloud-based, web-browser-delivered software paid for on a subscription basis rather than the hassle and complexity of purchasing and managing on-premise enterprise software. On the usability side, the consumerization of business software creates seamless experiences whereby multiple standalone processes like payroll processing and compliance are aggregated into a single, easy-to-use platform.

The 6 HR software stocks we track reported a slower Q1; on average, revenues beat analyst consensus estimates by 0.7%. while next quarter's revenue guidance was 0.5% below consensus. Stocks, especially growth stocks where cash flows further in the future are more important to the story, had a good end of 2023. But the beginning of 2024 has seen more volatile stock performance due to mixed inflation data, and while some of the HR software stocks have fared somewhat better than others, they collectively declined, with share prices falling 1.4% on average since the previous earnings results.

Best Q1: Dayforce (NYSE:DAY)

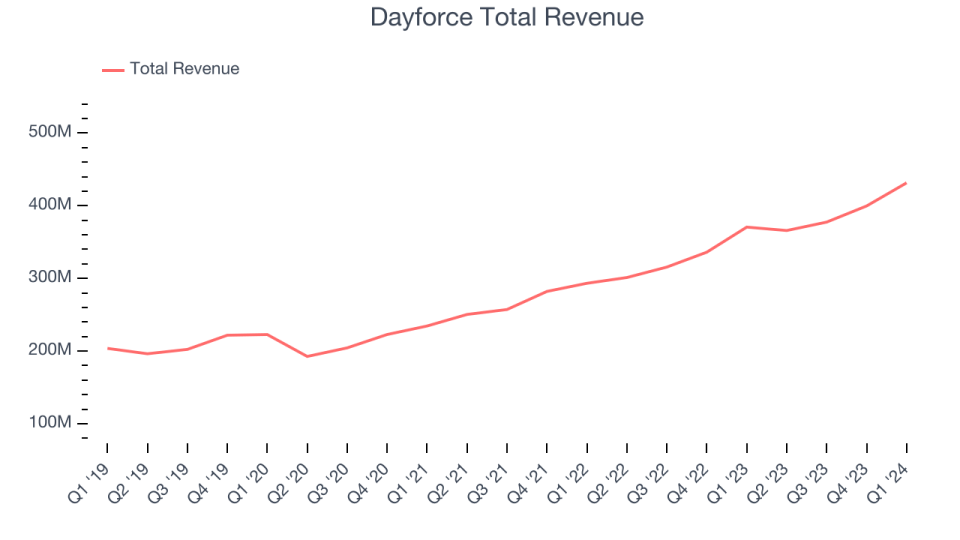

Founded in 1992 as Ceridian, an outsourced payroll processor and transformed after the 2012 acquisition of Dayforce, Dayforce (NYSE:DAY) is a provider of cloud based payroll and HR software targeted at mid-sized businesses.

Dayforce reported revenues of $431.5 million, up 16.4% year on year, topping analysts' expectations by 1.3%. It was a solid quarter for the company, with accelerating customer growth.

“I am pleased to report another strong quarter for Dayforce. We grew both revenue and operating profit, and we exceeded guidance across all key revenue and profitability metrics,” said David Ossip, Chair and CEO of Dayforce.

The stock is up 2.7% since the results and currently trades at $63.04.

Is now the time to buy Dayforce? Access our full analysis of the earnings results here, it's free.

Paylocity (NASDAQ:PCTY)

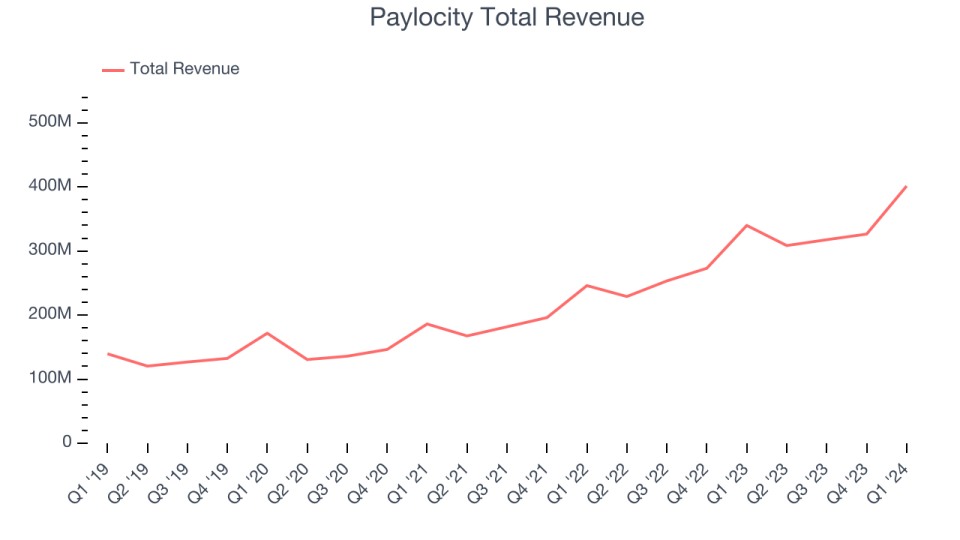

Founded by payroll software veteran Steve Sarowitz in 1997, Paylocity (NASDAQ:PCTY) is a provider of payroll and HR software for small and medium-sized enterprises.

Paylocity reported revenues of $401.3 million, up 18.1% year on year, outperforming analysts' expectations by 1%. It was a solid quarter for the company, with strong sales guidance for the next quarter.

Paylocity achieved the fastest revenue growth among its peers. The stock is up 10.4% since the results and currently trades at $165.

Is now the time to buy Paylocity? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Paychex (NASDAQ:PAYX)

One of the oldest service providers in the industry, Paychex (NASDAQ:PAYX) offers its customers payroll and HR software solutions.

Paychex reported revenues of $1.44 billion, up 4.2% year on year, falling short of analysts' expectations by 1.2%. It was a weak quarter for the company, with a miss of analysts' revenue estimates.

Paychex had the weakest performance against analyst estimates in the group. The stock is up 4.8% since the results and currently trades at $127.48.

Read our full analysis of Paychex's results here.

Asure (NASDAQ:ASUR)

Created from the merger of two small workforce management companies in 2007, Asure (NASDAQ:ASUR) provides cloud based payroll and HR software for small and medium-sized businesses (SMBs).

Asure reported revenues of $31.65 million, down 4.3% year on year, surpassing analysts' expectations by 2%. It was a slower quarter for the company, with a miss of analysts' billings estimates and underwhelming revenue guidance for the next quarter.

Asure achieved the biggest analyst estimates beat and highest full-year guidance raise, but had the slowest revenue growth among its peers. The stock is down 3.7% since the results and currently trades at $7.65.

Read our full, actionable report on Asure here, it's free.

Paycom (NYSE:PAYC)

Founded in 1998 as one of the first online payroll companies, Paycom (NYSE:PAYC) provides software for small and medium-sized businesses (SMBs) to manage their payroll and HR needs in one place.

Paycom reported revenues of $499.9 million, up 10.7% year on year, in line with analysts' expectations. It was a slower quarter for the company, with underwhelming revenue guidance for the next quarter and a decline in its gross margin.

The stock is down 2.7% since the results and currently trades at $181.26.

Read our full, actionable report on Paycom here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance