Do Datadog's (DDOG) Solid Portfolio & Partner Base Make It a Buy?

Datadog DDOG continues to benefit from strength in customer demand for modern observability, cloud security, software delivery and cloud service management offerings. The solid adoption of its cloud-based monitoring and analytics platform, owing to accelerated digital transformation and cloud migration across organizations, remains a positive.

The company has consistently expanded its portfolio with new features and capabilities, such as serverless monitoring, real user monitoring and security monitoring. This commitment to innovation helps Datadog stay relevant and address evolving customer needs.

Datadog has a rapidly growing customer base, including many large enterprises and high-growth companies. Its customer-centric approach and focus on providing value have contributed to its success and market recognition.

In the first quarter, Datadog had 3,340 customers with an annual run rate (ARR) of $100,000 or more, which increased 14.8% year over year. These customers generated about 87% of the total ARR. As of Mar 31, 2024, 82% of customers used two or more products, up from 81% in the year-ago quarter. Additionally, 47% of customers utilized four or more products, up from 43% in the year-ago quarter.

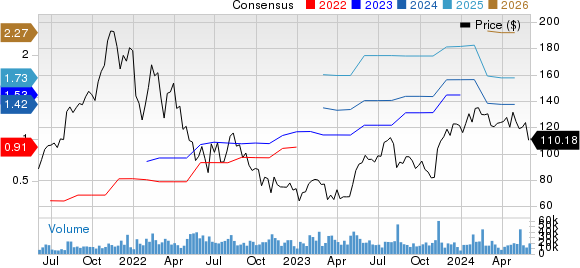

Datadog, Inc. Price and Consensus

Datadog, Inc. price-consensus-chart | Datadog, Inc. Quote

Datadog’s Prospects Ride on Strong Partner Base

Although shares of Datadog have declined 9.2% year to date against the Zacks Computer & Technology sector's rise of 15.2%, we believe its strong portfolio and an expanding partner base will help it to outperform the industry in the long haul.

As businesses increasingly embrace multi-cloud and hybrid cloud strategies, the need for a unified monitoring and observability platform has become paramount. This bodes well for Datadog.

The company has been steadily expanding its integrations and support for major cloud platforms, including Amazon AMZN, Alphabet GOOGL and Microsoft MSFT. This positions Datadog as a powerful ally for organizations navigating complex cloud environments.

At the forefront of Datadog's multi-cloud strategy is its deep integration with Amazon Web Services (AWS). As an AWS Partner Network (APN) Advanced Technology Partner and holder of the AWS Cloud Monitoring Competency certification, Datadog collaborates closely with AWS to ensure seamless monitoring and analysis capabilities for AWS infrastructure, applications, and services. Datadog’s availability on the AWS Marketplace further streamlines the procurement and deployment process for AWS customers.

Similarly, Datadog has cultivated a strong partnership with Alphabet’s Google Cloud, deeply integrating its platform with a wide range of Google Cloud services, including Google Compute Engine, Google Kubernetes Engine and Google Cloud SQL.

Datadog has formed a strategic partnership with Microsoft, aimed at enhancing observability and security capabilities for customers running applications on Microsoft Azure cloud services. This collaboration allows Datadog's monitoring and analytics platform to deeply integrate with Azure services, enabling customers to gain comprehensive visibility across their hybrid and multi-cloud environments.

Additionally, Datadog’s security capabilities are extended to Azure, providing customers with a unified view of their cloud infrastructure's security posture. This partnership streamlines the management and optimization of cloud-native applications on Azure, ultimately improving operational efficiency and delivering better digital experiences for Microsoft's cloud customers.

Datadog's multi-cloud and multi-vendor approach allows customers to monitor their entire cloud infrastructure from a single platform, regardless of the cloud providers they use. This unified view empowers organizations to optimize performance, troubleshoot issues, and maintain a robust security posture across their diverse cloud environments.

As organizations continue to adopt multi-cloud and hybrid cloud strategies, Datadog's ability to provide comprehensive observability across different cloud environments could become increasingly valuable. By partnering with industry giants like Amazon, Google, and Microsoft, Datadog positions itself as a trusted ally for businesses seeking to navigate the complexities of modern cloud architectures.

Conclusion

We believe Datadog’s strong portfolio of offerings in modern observability, cloud security, software delivery and cloud service management and an expanding partner base make it an attractive stock for investors at the current level.

For 2024, DDOG expects revenues between $2.59 billion and $2.61 billion. Non-GAAP earnings are projected between $1.51 and $1.57 per share. Non-GAAP operating income is expected in the range of $585-$605 million.

The Zacks Consensus Estimate for 2024 revenues and earnings is pegged at $2.6 billion and $1.54 per share, respectively. This indicates year-over-year an improvement of 22.1% in the top line and 16.7% in the bottom line. The earnings estimate has also moved 8.5% north over the past 30 days.

The stock sports a Zacks Rank #1 (Strong Buy) and has a Growth Score of A, a combination that indicates a good investment opportunity. A Momentum Score of A makes DDOG an attractive pick for investors.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Datadog, Inc. (DDOG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance