Cross Country Healthcare Inc. (CCRN) Faces Earnings Decline in Q1 2024 Despite Meeting Adjusted ...

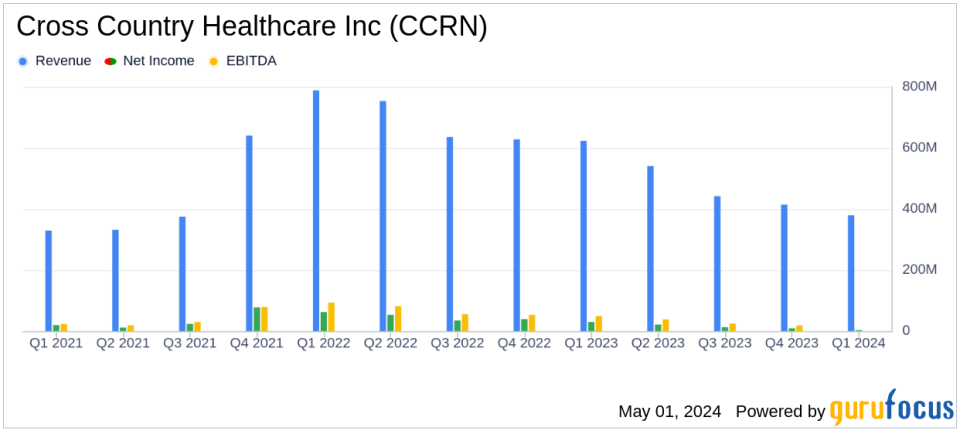

Revenue: Reported at $379.2 million, down 39% year-over-year and 8% sequentially, exceeding the estimate of $374.09 million.

Net Income: Totaled $2.7 million, a significant decrease of 91% from the previous year and 70% from the last quarter, falling short of the estimated $5.92 million.

Earnings Per Share (EPS): Recorded at $0.08, substantially below the prior year's $0.81 and last quarter's $0.26, falling short of the estimated $0.17.

Adjusted EPS: Came in at $0.19, compared to $0.84 year-over-year and $0.29 sequentially, surpassing the estimate of $0.17.

Gross Profit Margin: Declined to 20.4%, a decrease of 200 basis points year-over-year and 150 basis points from the previous quarter.

Cash Flow from Operations: Amounted to $6.0 million, down 87% from the same period last year and 50% from the previous quarter.

Share Repurchase: Repurchased approximately 300,000 shares of common stock for $6.4 million during the quarter.

Cross Country Healthcare Inc. (NASDAQ:CCRN), a prominent provider of total talent management services in the healthcare sector, released its 8-K filing on May 1, 2024, detailing its financial results for the first quarter ended March 31, 2024. The company reported a significant year-over-year decline in net income and revenue, although it managed to align with analyst expectations for adjusted earnings per share (EPS).

About Cross Country Healthcare Inc.

With 38 years of industry experience, Cross Country Healthcare Inc. stands as a market-leading, tech-enabled workforce solutions and advisory firm. The company operates primarily through two segments: Nurse and Allied Staffing, and Physician Staffing, providing a range of services from temporary and permanent staffing to strategic workforce solutions. The majority of its revenue is generated within the United States.

First Quarter Financial Performance

For Q1 2024, Cross Country reported revenues of $379.2 million, a sharp decline of 39% from the previous year and 8% from the prior quarter. This performance was significantly lower than the estimated revenue of $374.09 million. The net income for the quarter stood at $2.7 million, plummeting by 91% year-over-year and 70% sequentially, starkly underperforming against the estimated net income of $5.92 million. The diluted EPS was reported at $0.08, compared to $0.81 in the previous year and $0.26 in the prior quarter. However, adjusted EPS met expectations at $0.19.

Operational Highlights and Challenges

The Nurse and Allied Staffing segment saw a revenue decrease of 43% year-over-year and 10% sequentially, with significant drops in contribution income and average field contract personnel. Conversely, the Physician Staffing segment displayed resilience with a 16% increase in revenue year-over-year. The company highlighted growth in physician staffing, homecare, and education sectors as positive developments amidst challenging market conditions.

Strategic Initiatives and Market Adaptation

John A. Martins, President and CEO of Cross Country, expressed satisfaction with the company's strategic execution during challenging times, particularly noting the growth in key staffing areas. The company continues to adjust its infrastructure to align with market demands and is optimistic about future growth and profitability improvements.

Financial Health and Future Projections

Cross Country ended the quarter with a strong balance sheet, having $5.2 million in cash and cash equivalents and no outstanding debt. Looking ahead to Q2 2024, the company expects revenue between $330 million and $340 million and adjusted EBITDA between $10.0 million and $15.0 million, indicating potential continued challenges in performance.

Conclusion

Despite the downturn in Q1 2024, Cross Country Healthcare Inc. is taking strategic steps to navigate through the volatile healthcare staffing market. The company's ability to meet adjusted EPS estimates amidst significant revenue and net income declines demonstrates a resilient operational focus. Investors and stakeholders will be watching closely to see how the company's strategies unfold in the coming quarters.

For detailed insights and further information, you can access the full earnings report and join the upcoming conference call scheduled for May 1, 2024, details of which are available on the companys investor relations website.

Explore the complete 8-K earnings release (here) from Cross Country Healthcare Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance