Copart (CPRT) to Report Q3 Earnings: Here's What to Expect

Copart, Inc. CPRT is set to release third-quarter fiscal 2024 results on May 16, after the closing bell. The Zacks Consensus Estimate for the to-be-reported quarter’s earnings per share and revenues is pegged at 38 cents and $1.11 billion, respectively.

The Zacks Consensus Estimate for quarterly revenues indicates an 8.38% rise year over year. The Zacks Consensus Estimate for earnings has remained stable over the past 90 days. The bottom-line forecast implies an increase of 5.56% year over year.

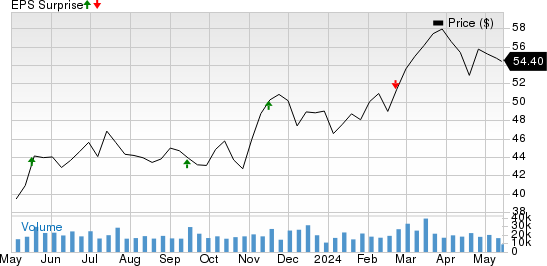

In the last reported quarter, this Texas-based online vehicle auctioning company missed earnings estimates on lower-than-expected service revenues and vehicle sales. The bottom line, however, increased 6.4% year over year. Copart surpassed the Zacks Consensus Estimate in three of the trailing four quarters and missed once, the average surprise being 6.59%.

Copart, Inc. Price and EPS Surprise

Copart, Inc. price-eps-surprise | Copart, Inc. Quote

Factors at Play

Copart holds a leadership position in the automotive auction market, commanding roughly 40% of the market share. In the second quarter of fiscal 2024, its non-insurance Blue Car business, catering to bank, finance fleet and rental partners, has shown robust growth, with the company witnessing more than 30% year-over-year expansion in this segment. Similarly, its dealer sales volume, comprising its Copart Dealer Service business unit and MPA, jumped 21% year over year. The strength of the Blue Car business and growth in dealer sales volume are likely to have continued in the fiscal third quarter, boosting the company’s performance.

Elevated investments to support growth initiatives, including expansion of the business in international markets and the United States, require high capex. Also, operating costs have been on the rise for several quarters amid increasing G&A expenditure and the trend is likely to have persisted in the to-be-reported quarter. High capex requirement and rising operating expenses are likely to have dented Copart’s margins and cash flows.

What the Zacks Model Says

Our proven model does not conclusively predict an earnings beat for Copart this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That is not the case here.

Earnings ESP: The company has an Earnings ESP of 0.00%. This is because the Most Accurate Estimate is in line with the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Copart currently carries a Zacks Rank of 2.

Key Predictions for Other Players

AutoZone, Inc. AZO has an Earnings ESP of +0.81% and a Zacks Rank #2 at present. The company is scheduled to post third-quarter fiscal 2024 earnings on May 21. The Zacks Consensus Estimate for earnings is pegged at $35.75 per share. You can see the complete list of today’s Zacks #1 Rank stocks here.

AZO surpassed earnings estimates in each of the trailing four quarters, the average surprise being 7.69%.

Advance Auto Parts, Inc. AAP has an Earnings ESP of 0.00% and a Zacks Rank #3 at present. The company is slated to post first-quarter 2024 earnings on May 29. The Zacks Consensus Estimate for earnings is pegged at 69 cents per share.

AAP missed earnings estimates in each of the trailing four quarters, the average negative surprise being 148.19%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Advance Auto Parts, Inc. (AAP) : Free Stock Analysis Report

AutoZone, Inc. (AZO) : Free Stock Analysis Report

Copart, Inc. (CPRT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance