Cognex Corporation's (NASDAQ:CGNX) Financials Are Too Obscure To Link With Current Share Price Momentum: What's In Store For the Stock?

Most readers would already know that Cognex's (NASDAQ:CGNX) stock increased by 8.8% over the past three months. However, we decided to study the company's mixed-bag of fundamentals to assess what this could mean for future share prices, as stock prices tend to be aligned with a company's long-term financial performance. In this article, we decided to focus on Cognex's ROE.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Put another way, it reveals the company's success at turning shareholder investments into profits.

See our latest analysis for Cognex

How To Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Cognex is:

7.5% = US$113m ÷ US$1.5b (Based on the trailing twelve months to December 2023).

The 'return' is the profit over the last twelve months. Another way to think of that is that for every $1 worth of equity, the company was able to earn $0.08 in profit.

Why Is ROE Important For Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Cognex's Earnings Growth And 7.5% ROE

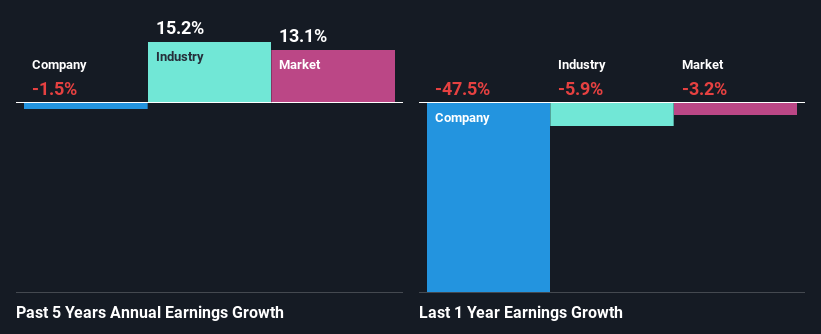

At first glance, Cognex's ROE doesn't look very promising. A quick further study shows that the company's ROE doesn't compare favorably to the industry average of 11% either. As a result, Cognex's flat net income growth over the past five years doesn't come as a surprise given its lower ROE.

Next, on comparing with the industry net income growth, we found that the industry grew its earnings by 15% over the last few years.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. Doing so will help them establish if the stock's future looks promising or ominous. If you're wondering about Cognex's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Cognex Making Efficient Use Of Its Profits?

Cognex has a low three-year median payout ratio of 21% (or a retention ratio of 79%) but the negligible earnings growth number doesn't reflect this as high growth usually follows high profit retention.

Additionally, Cognex has paid dividends over a period of nine years, which means that the company's management is determined to pay dividends even if it means little to no earnings growth. Based on the latest analysts' estimates, we found that the company's future payout ratio over the next three years is expected to hold steady at 22%. Regardless, the future ROE for Cognex is predicted to rise to 15% despite there being not much change expected in its payout ratio.

Summary

On the whole, we feel that the performance shown by Cognex can be open to many interpretations. While the company does have a high rate of profit retention, its low rate of return is probably hampering its earnings growth. With that said, we studied the latest analyst forecasts and found that while the company has shrunk its earnings in the past, analysts expect its earnings to grow in the future. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance