ChromaDex Corp (CDXC) Q1 2024 Earnings: Aligns with EPS Projections, Misses Revenue Estimates

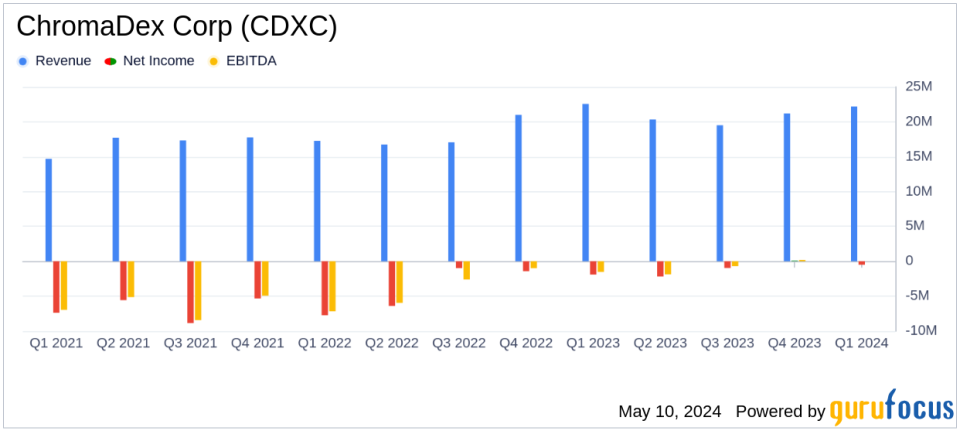

Revenue: Reported $22.2 million, a decrease of 7% year-over-year, falling short of the estimated $23.97 million.

Net Loss: Improved to $0.5 million from a net loss of $1.9 million in the previous year, not surpassing the estimated net loss of $1.33 million.

Earnings Per Share (EPS): Reported a loss of $0.01 per share, better than the estimated loss of $0.02 per share.

Gross Margin: Increased to 60.7%, up from 59.9% in the prior year quarter, indicating improved operational efficiency.

Operating Expenses: Decreased by $1.3 million, reflecting cost control and efficiency improvements despite increased R&D investments.

Adjusted EBITDA: Shifted to a positive $0.7 million from a negative $0.1 million in the prior year quarter, highlighting better operational performance.

Cash Position: Ended the quarter with $27.6 million in cash and no debt, maintaining a strong liquidity position.

On May 8, 2024, ChromaDex Corp (NASDAQ:CDXC) disclosed its financial outcomes for the first quarter of 2024 through an 8-K filing. The company, a pioneer in bioscience dedicated to healthy aging, reported a net loss of $0.5 million, or $(0.01) per share, aligning with analyst estimates for earnings per share but falling short of revenue expectations with total net sales of $22.2 million against the projected $23.97 million.

ChromaDex operates primarily through its Consumer Products segment, with its flagship ingredient Niagen, a NAD+ precursor aimed at combating the effects of aging at a cellular level. The company also operates in the Ingredients segment and Analytical Reference Standards and Services, contributing to its comprehensive approach in the bioscience industry.

Financial Highlights and Operational Achievements

The first quarter saw ChromaDex achieving a gross margin of 60.7%, an improvement from the previous year, driven by a favorable business mix. Despite a slight decline in net sales, primarily due to timing issues with distributor partners, the company managed to reduce total operating expenses by $1.3 million, reflecting disciplined financial management and strategic prioritization of investments in research and development.

The company's Adjusted EBITDA turned positive at $0.7 million, a significant improvement from a negative $0.1 million in the prior year quarter. This metric is crucial as it provides a clearer picture of the company's operational efficiency by excluding non-cash expenses and certain variable items.

Strategic Developments and Market Expansion

ChromaDex continued to expand its market presence with notable partnerships with The Vitamin Shoppe and Sprouts Farmers Market, enhancing the availability of Tru Niagen across a broader consumer base. This expansion is part of the company's strategy to tap into the health-conscious consumer segment and bolster its standing in the competitive wellness industry.

Furthermore, the company's commitment to product quality and transparency was strengthened through the third-party verification of its Tru Niagen product portfolio by Alkemist Labs, ensuring consumers receive products of the highest standard.

Outlook and Forward Strategies

Looking ahead to the remainder of 2024, ChromaDex anticipates continued revenue growth, projecting an increase in gross margin and stable marketing expenses relative to net sales. The company plans to intensify research and development efforts, which are expected to drive future product innovations and support sustained growth.

Rob Fried, CEO of ChromaDex, expressed optimism about the company's trajectory, stating,

We are excited about the opportunities ahead as we intensify our efforts for new launches and continue to drive growth in our Tru Niagen business through strategic partnerships. I am proud of the progress made to date and look forward to another exciting year."

Conclusion

Despite the slight shortfall in revenue expectations, ChromaDex's strategic initiatives and operational adjustments underscore a robust plan aimed at long-term growth and market expansion. The company's focus on innovation and strategic partnerships, coupled with disciplined financial management, positions it well to capitalize on the growing demand for health and wellness products.

Investors and stakeholders can access more detailed financial information and replay the investor conference call via the Investors Relations section of ChromaDexs website.

Explore the complete 8-K earnings release (here) from ChromaDex Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance