Chinese Stocks to Resume Advance for Annual Gains, Survey Says

(Bloomberg) -- A sustainable rebound has repeatedly eluded Chinese equities in recent years, but optimists aren’t ready to throw in the towel yet.

Most Read from Bloomberg

US Allies Allege China Is Developing Attack Drones for Russia

China Can End Russia’s War in Ukraine With One Phone Call, Finland Says

Democrats Weigh Mid-July Vote to Formally Tap Biden as Nominee

Analysts and money managers surveyed by Bloomberg are gearing up for an upbeat second half for the world’s second-biggest stock market as global funds return and corporate earnings improve. They predict that the benchmark CSI 300 Index will record its first annual gain since 2020 while the Hang Seng Index snaps a four-year losing streak.

Calling a bottom in Chinese equities has proven to be an unusually tricky task for market watchers after an uneven economic recovery and geopolitical risks cut short multiple rallies. If yet another rebound fizzles out, this may reinforce doubts about China’s place in global portfolios and call into question the buy recommendations initiated by strategists at UBS Group AG and Societe Generale SA.

The survey’s respondents, most of whom are based on the mainland, are sanguine.

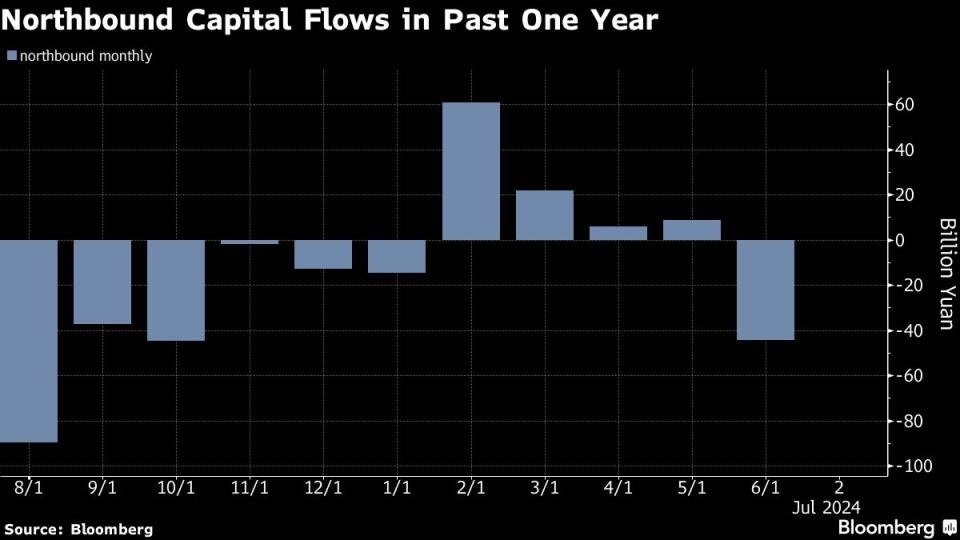

About two-thirds of the 15 respondents said the earnings of companies in the MSCI China Index and CSI 300 Index will bottom out in the coming six months. Over 93% expect the market to attract foreign inflows after global funds sold 44.4 billion yuan ($6.1 billion) of shares in June in the biggest monthly withdrawal since October.

Those surveyed are holding out hope that a recovery will finally take root, citing attractive valuations and potentially stronger growth. The valuation gap between Chinese stocks and the MSCI ACWI Index is near the widest since 2020, according to data compiled by Bloomberg, based on the forward price-to-earnings ratio.

“As investors take profit off expensive tech, Japan and India, they have to rotate somewhere,” said Vey-Sern Ling, managing director at Union Bancaire Privee, who participated in the survey. “China’s economy will gradually recover and investor positioning is light.”

A similar survey at the start of the year had warned that Chinese stocks suffered from a lack of positive drivers, and Beijing’s support efforts would likely continue to fall flat amid persistent risks. But it predicted that the CSI 300 gauge would post a full-year advance of 21%, with some help from bargain hunters.

The CSI 300 gauge may end the third quarter at 3,680 points, according to the median of nine estimates in the latest poll, implying a gain of 6% from Tuesday’s close. The survey predicts that the index will end the year at 3,850 points, while the Hang Seng Index will rise almost 10% to 19,500 as of end-September before climbing to 20,950 by year-end.

Most of those surveyed expect fresh capital to flow into the stock market from overseas investors, insurance companies and mutual funds including exchange-traded funds.

But, there are plenty of reasons to be cautious.

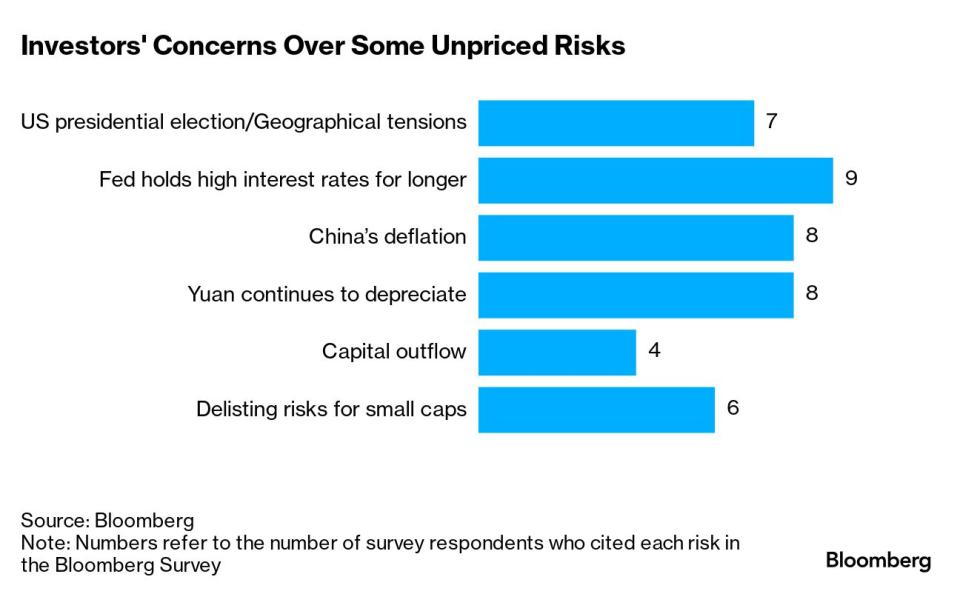

The global environment may not be supportive, as the Federal Reserve signals it’s in no rush to cut interest rates. Uncertainties surrounding the US presidential election, geopolitical tensions and a weaker yuan are likely to compound the risks.

The Hang Seng China Enterprises Index has fallen more than 8% from a peak reached in May, putting it on course to enter a technical correction. This comes after MSCI Inc.’s key Chinese stocks gauge slipped into a correction last month.

Most survey respondents expect the government to unveil more mortgage rate cuts and relax other property restrictions to aid the nation’s embattled real-estate sector.

What to Expect From the Third Plenum, China’s Big Policy Meeting

Market watchers are also looking for authorities to unveil further measures at the Third Plenum, the July meeting that has historically been a venue where the Communist Party announces big shifts in economic policy. The gathering will take place on July 15 to 18.

“The Chinese top leadership is likely to emphasize new quality productive forces that can boost innovation and productivity at the Third Plenum,” said Redmond Wong, market strategist at Saxo Capital Markets, a participant in the survey.

--With assistance from Jeanny Yu, Charlotte Yang, April Ma, Helen Yuan, Cynthia Li, Abhishek Vishnoi, Zhu Lin, Kelly Li and Mengchen Lu.

Most Read from Bloomberg Businessweek

China’s Investment Bankers Join the Communist Party as Morale (and Paychecks) Shrink

The Fried Chicken Sandwich Wars Are More Cutthroat Than Ever Before

For Tesla, a Smaller Drop in Sales Is Something to Celebrate

Dragons and Sex Are Now a $610 Million Business Sweeping Publishing

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance