Ceylon Beverage Holdings And Two Other Promising Dividend Stocks

Amidst a backdrop of fluctuating global markets, with rising inflation in Europe and mixed signals from the U.S. economy, investors continue to navigate through a complex financial landscape. In such times, dividend stocks like Ceylon Beverage Holdings often attract attention for their potential to offer steady returns and stability.

Top 10 Dividend Stocks

Name | Dividend Yield | Dividend Rating |

Guaranty Trust Holding (NGSE:GTCO) | 8.00% | ★★★★★★ |

Ping An Bank (SZSE:000001) | 6.60% | ★★★★★★ |

Mitsubishi Shokuhin (TSE:7451) | 3.63% | ★★★★★★ |

Sonae SGPS (ENXTLS:SON) | 6.06% | ★★★★★★ |

Globeride (TSE:7990) | 3.74% | ★★★★★★ |

Ryoyu Systems (TSE:4685) | 3.49% | ★★★★★★ |

Banque Cantonale Vaudoise (SWX:BCVN) | 4.51% | ★★★★★★ |

Mitsubishi Research Institute (TSE:3636) | 3.44% | ★★★★★★ |

KurimotoLtd (TSE:5602) | 4.91% | ★★★★★★ |

GakkyushaLtd (TSE:9769) | 4.19% | ★★★★★★ |

Click here to see the full list of 1975 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

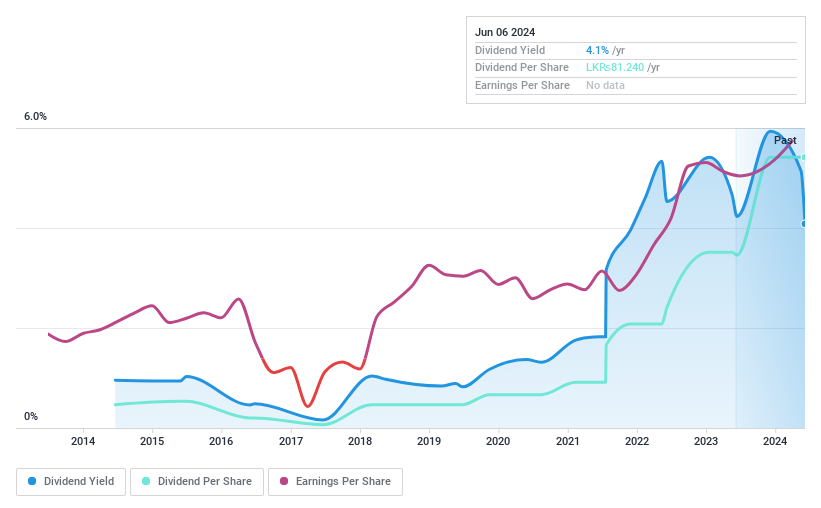

Ceylon Beverage Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ceylon Beverage Holdings PLC, primarily engaged in brewing and marketing beers in Sri Lanka, has a market capitalization of LKR 41.76 billion.

Operations: Ceylon Beverage Holdings PLC generates its revenue primarily from the alcoholic beverages segment, totaling LKR 111.93 billion.

Dividend Yield: 4.1%

Ceylon Beverage Holdings has demonstrated solid financial performance with a notable increase in annual sales to LKR 111.93 billion and net income to LKR 3.96 billion. Despite its low dividend yield of 4.08%, which stands below the market's top quartile, both earnings and cash flows robustly cover dividend payments, with payout ratios of 43% and 29.6% respectively. However, investors should note the company's history of volatile dividends over the past decade, alongside a highly volatile share price recently.

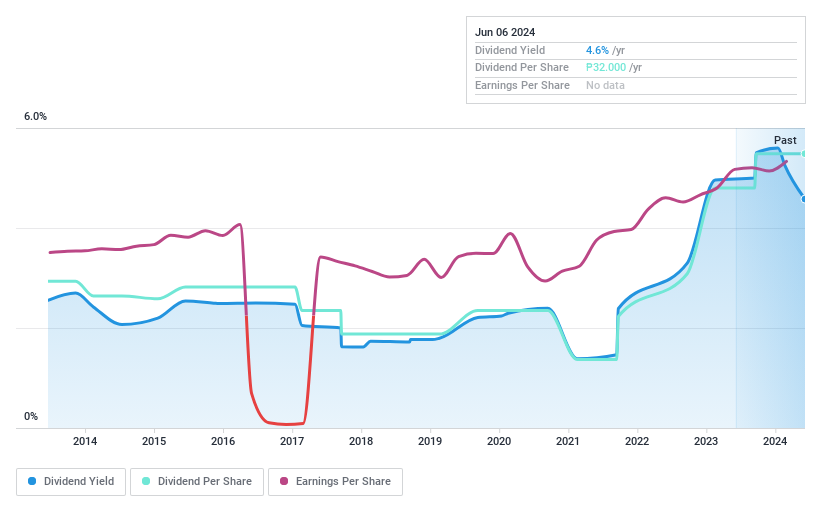

Far Eastern University

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Far Eastern University, Incorporated operates the Far Eastern University in Manila, Philippines, with a market capitalization of approximately ₱16.50 billion.

Operations: Far Eastern University, Incorporated generates revenue primarily through its FEU Main campus at ₱2.94 billion, supplemented by other schools contributing ₱0.85 billion and trimestral schools at ₱1.54 billion.

Dividend Yield: 4.6%

Far Eastern University has shown a mixed performance in its dividend reliability, with a history of volatile dividends over the past decade. Despite this, recent financials indicate robust earnings growth of 20.5% year-over-year, with net income rising to PHP 1.31 billion from PHP 1.21 billion. Dividends are well-supported by both earnings and cash flows, with payout ratios of 38.9% and 50.1%, respectively. However, its dividend yield at 4.58% remains below the top quartile of Philippine market payers at 5.85%.

Swancor Holding

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Swancor Holding Co., LTD. is a company based in Taiwan that manufactures and sells chemical products globally, with a market capitalization of approximately NT$15.17 billion.

Operations: Swancor Holding Co., LTD. generates revenue primarily through its Composite Material Department, which brought in NT$7.33 billion.

Dividend Yield: 3.4%

Swancor Holding's dividend yield of 3.4% trails the top quartile in Taiwan, yet its dividends are sustainable with a modest payout ratio of 35.4% and cash payout ratio of 31.3%. Dividend payments have shown growth over the past decade but lack consistency. Despite robust recent earnings growth and a forecasted annual revenue increase of 21.44%, earnings are expected to decline sharply by an average of 65.9% annually over the next three years, adding uncertainty to future dividend reliability amidst a volatile share price.

Delve into the full analysis dividend report here for a deeper understanding of Swancor Holding.

Our expertly prepared valuation report Swancor Holding implies its share price may be too high.

Key Takeaways

Unlock our comprehensive list of 1975 Top Dividend Stocks by clicking here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include COSE:BREW.N0000PSE:FEUTWSE:3708

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance