Camping World (NYSE:CWH) Misses Q1 Sales Targets

Recreational vehicle (RV) and boat retailer Camping World (NYSE:CWH) missed analysts' expectations in Q1 CY2024, with revenue down 8.3% year on year to $1.36 billion. It made a GAAP loss of $0.51 per share, down from its profit of $0.05 per share in the same quarter last year.

Is now the time to buy Camping World? Find out in our full research report.

Camping World (CWH) Q1 CY2024 Highlights:

Revenue: $1.36 billion vs analyst estimates of $1.43 billion (4.4% miss)

Adjusted EBITDA: $8.2 million vs analyst estimates of $7.4 million (beat)

EPS: -$0.51 vs analyst expectations of -$0.36 (43% miss)

Gross Margin (GAAP): 29.5%, in line with the same quarter last year

Free Cash Flow was -$93.91 million, down from $173.9 million in the same quarter last year

Same-Store Sales were down 11.8% year on year (beat vs. expectations of down 14.3% year on year)

Store Locations: 215 at quarter end, increasing by 19.3 over the last 12 months

Market Capitalization: $913.6 million

Marcus Lemonis, Chairman and Chief Executive Officer of Camping World Holdings, Inc. stated, “Our intentional efforts to drive down invoice pricing and widen the consumer affordability funnel resulted in our new unit sales meaningfully outpacing broader RV industry trends. We drove record new unit market share for January and February. Our same store new vehicle unit volume increased double-digits in the quarter, with momentum continuing through April.”

Founded in 1966 as a single recreational vehicle (RV) dealership, Camping World (NYSE:CWH) still sells RVs along with boats and general merchandise for outdoor activities.

Vehicle Retailer

Buying a vehicle is a big decision and usually the second-largest purchase behind a home for many people, so retailers that sell new and used cars try to offer selection, convenience, and customer service to shoppers. While there is online competition, especially for research and discovery, the vehicle sales market is still very fragmented and localized given the magnitude of the purchase and the logistical costs associated with moving cars over long distances. At the end of the day, a large swath of the population relies on cars to get from point A to point B, and vehicle sellers are acutely aware of this need.

Sales Growth

Camping World is larger than most consumer retail companies and benefits from economies of scale, giving it an edge over its competitors.

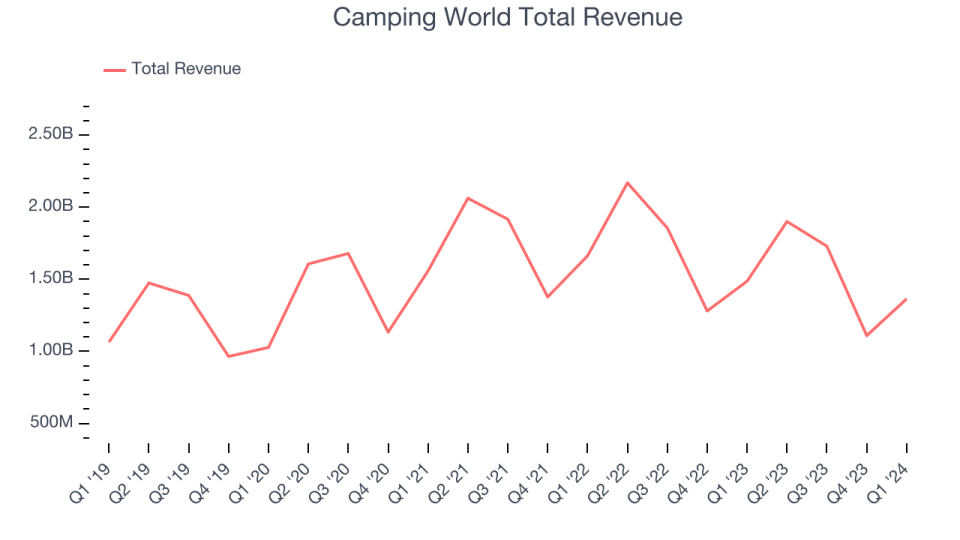

As you can see below, the company's annualized revenue growth rate of 4.9% over the last five years was weak , but to its credit, it opened new stores and expanded its reach.

This quarter, Camping World missed Wall Street's estimates and reported a rather uninspiring 8.3% year-on-year revenue decline, generating $1.36 billion in revenue. Looking ahead, Wall Street expects sales to grow 9.9% over the next 12 months, an acceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Same-Store Sales

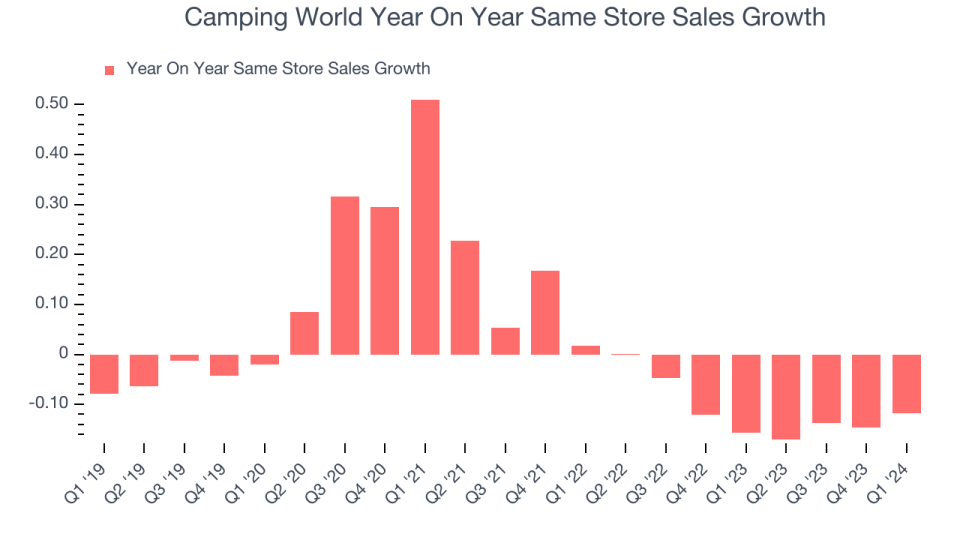

A company's same-store sales growth shows the year-on-year change in sales for its brick-and-mortar stores that have been open for at least a year, give or take, and e-commerce platform. This is a key performance indicator for retailers because it measures organic growth and demand.

Camping World's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 11.2% year on year. This performance is quite concerning and the company should reconsider its strategy before investing its precious capital into new store buildouts.

In the latest quarter, Camping World's same-store sales fell 11.8% year on year. This decrease was a further deceleration from the 15.7% year-on-year decline it posted 12 months ago. We hope the business can get back on track.

Key Takeaways from Camping World's Q1 Results

The results were mixed as the environment in which the company operates remains in flux. While same store sales were down meaningfully and have been down for multiple quarters, this quarter's figure beat expectations. Adjusted EBITDA also exceeded expectations. Management stated that the company has been “...successful in rebalancing our used inventory position and now that market pricing has stabilized, we intend to reinvest in building our stocking levels in a disciplined manner over the coming months. We continue to expect our used business to improve as we move through the balance of the year.” The stock is up 1.2% after reporting and currently trades at $20.29 per share.

So should you invest in Camping World right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance