'Buying a first home is harder when you're single'

Buying a first home is a major challenge for most people. But when you’re on your own, it is even harder.

A newly-published report by the Building Societies Association (BSA) says two high incomes are increasingly needed to afford mortgage repayments, and first-time buyers are facing the toughest conditions for 70 years.

Jess Waring-Hughes, a 32 year-old business manager, is saving furiously to buy on her own and says there is little support for people in such circumstances.

The answer for her was to move back in with her parents while she puts money aside.

“It is weird going back to the childhood room and home again,” says Jess. “It can make you regress to teenage ways.”

Boomerang generation

She is not the exception; she is the norm.

In 1997, the most common living arrangement for an adult aged between 18 and 34 was being in a couple with children, according to the Resolution Foundation think tank. Now, it is living with your parents.

Lisa Griggs is one of them. Like Jess, she is 32, working full-time and frustrated.

“I still feel like a child,” she says, albeit one who pays rent to her parents.

“I do not have any debts, I live within my means, yet I am still unable to purchase anything close to my family and close to my work."

Both say they are extremely fortunate to have the support of their families.

But the BSA says, as home ownership among the young continues to shrink, dependency on parents does not stop there. The Bank of Mum and Dad is commonly helping to pay their grown-up children's deposits.

Half of first-time buyers in their 20s are getting help of an average of £25,000 from their parents, according to the Resolution Foundation.

The BSA says that is often money which had put aside by the older generation for their own security during retirement.

Jess says she sat down with her parents to draw up a savings plan the moment she moved in. Lisa, who has been saving for eight years, says she is “surrounded by spreadsheets”.

The data those spreadsheets show include some grim realities.

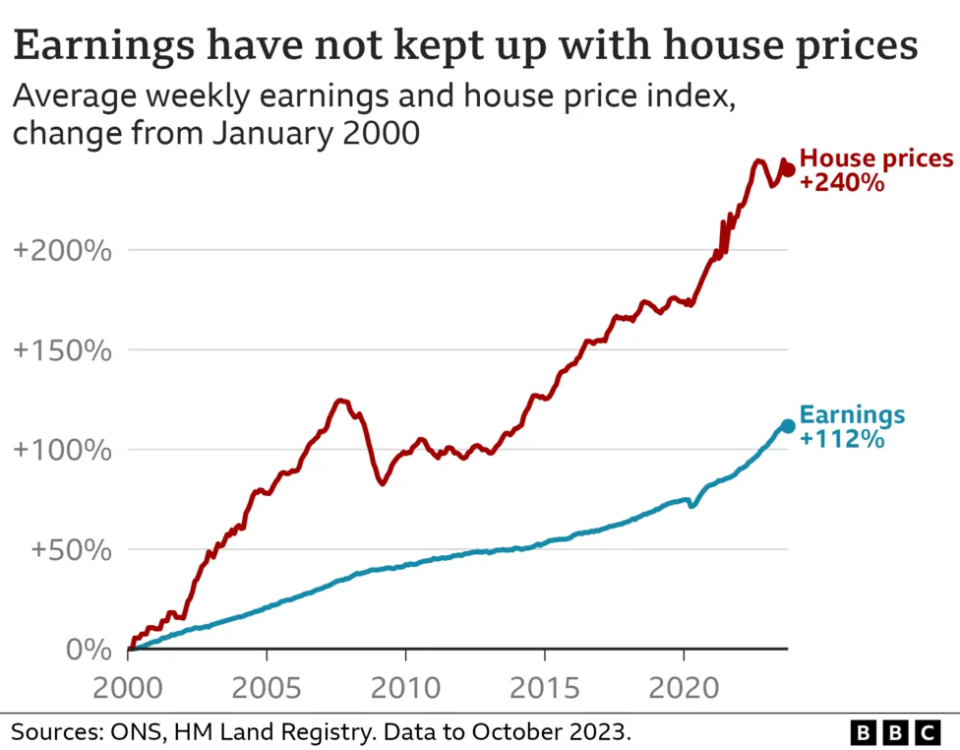

Being in a good job is no guarantee of progress, because growth in wages has failed to keep up with soaring house prices for more than 20 years.

Add to that the sharp rises in the cost of renting, and limits set on how much people can borrow.

The BBC spoke to one 49-year-old musician, who asked to remain anonymous, also wanting to buy alone.

“You should be able to buy somewhere on your own without being a millionaire,” she says.

“The whole market assumes you’re in a couple, preferably a high-earning couple, which forces people into getting stuck in relationships that might not be great for their mental health.”

Lots of people in her situation are worried about the wider health implications.

Although saving for a deposit has been a financial and mental burden for years, the severe ups - and occasional downs - of mortgage rates over the last 20 months is unlike anything seen for two decades.

Two-year fixed deals which once had interest rates of below 2% reached as high as an average of 6.86% last year, according to the financial information service Moneyfacts.

Despite falls since then, lenders have been increasing rates in recent days. Moneyfacts says the typical rate is now 5.87%.

It is now even possible to search the Office for National Statistics to see which regions of England and Wales are the hardest hit by rising mortgage rates and rent.

Heart of the economy

Whether a renter, a mortgage-holder, or someone who has paid off their home loan, few win when potential first-time buyers are locked out of home ownership.

Housing is a key element of the UK economy as a whole. In the last few days, the impact of a stagnant property sector on the wider performance of businesses from banks to retailers has been laid bare.

Many may see banks as part of the problem, but their profits affect their ability to lend, or - depending on investments - may be reflected in the value of savers' pension pots.

In the homeware retail sector, Dunelm recently said furniture sales continued to be "challenging". When people do not move home, they buy fewer tables and chairs.

So, how can the property market get going again for first-time buyers?

Jess argues that someone’s performance as a renter should be taken into account when applying for a mortgage. Lisa says flexibility is required.

The BSA says “new thinking and radical changes are needed”.

Potential solutions

It suggests lender regulations are eased to allow them to lend more to people who cannot afford to pay a big deposit.

But that would be controversial. Those rules were tightened up after the financial crisis of 2007-08 when many argue mortgage lending by banks was out of control.

Realistically, there are few easy options.

In January, Sir Howard Davies, who chairs NatWest, suggested it was not "that difficult" to get on the housing ladder. He later rowed back on his comments, saying he meant access to mortgages was easier.

Either way, it is tough to find anyone searching for a first home who would agree with him.

Ways to make your mortgage more affordable

Make overpayments. If you still have some time on a low fixed-rate deal, you might be able to pay more now to save later.

Move to an interest-only mortgage. It can keep your monthly payments affordable although you won't be paying off the debt accrued when purchasing your house.

Extend the life of your mortgage. The typical mortgage term is 25 years, but 30 and even 40-year terms are now available.

Yahoo Finance

Yahoo Finance