Buy These 5 Financial Transaction Stocks to Tap Market Rally

The financial transaction services industry is expected to benefit from expanding transaction volumes resulting from the widespread adoption of digital means. The ongoing digitization movement, triggered by the pandemic, is a major catalyst for this industry.

The industry is part of the Financial Technology or the FinTech space. The industry players comprise card and payment processing and other solution providers, ATM services and money remittance service providers, and providers of investment solutions to financial advisors. The players in this segment operate their unique and proprietary global payments network that links issuers and acquirers around the globe.

A higher Internet penetration rate and increased usage of smartphones contribute to the increased uptake of digital payments. In light of the prevailing scenario, it has become inevitable to build an enhanced contactless payments suite or upgrade the existing ones.

Owing to the long-term benefits that such investments provide, the industry players have come up with diversified contactless payment options such as mobile wallets, biometrics and QR codes. Such initiatives will enable the players to solidify their presence in the global digital payments market, boost their customer base and diversify income streams.

Improved consumer spending implies greater utilization of product and service offerings of financial transaction services players. This, in turn, offers an opportunity for industry players to process higher transaction volumes. Also, the ease with which e-commerce shopping can be done within the comfort of one’s home is likely to provide an impetus to growth in consumer spending.

Strong wage gains resulting from a tight labor market add to the purchasing power of consumers and subsiding inflationary headwinds boost hopes of continually rising consumer spending in the days ahead.

The Zacks-defined Financial – Financial Transaction Services Industry is currently in the top 18% of the Zacks Industry Rank. In the past year, the industry has provided 15.5% returns, while its year-to-date return is 2.5%. Since it is ranked in the top half of Zacks Ranked Industries, we expect the consulting services industry to outperform the market over the next three to six months.

Our Top Picks

We have narrowed our search to five financial transaction stocks that have strong growth potential for 2024. These stocks have seen positive earnings estimate revisions in the last 60 days. Each of our picks carries either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

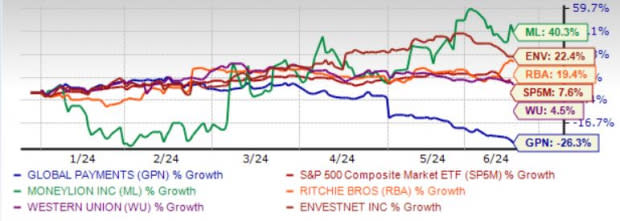

The chart below shows the price performance of our five picks year to date.

Image Source: Zacks Investment Research

MoneyLion Inc. ML is a data-driven, digital financial platform. ML offers mobile banking and financial membership to take control of their finances. ML operates principally in Sioux Falls and Kuala Lumpur, Malaysia.

ML’s principal products include RoarMoney, an insured digital demand deposit account, Instacash, a cash advance product that gives customers early access to their recurring income deposits, Credit Builder Plus membership program, MoneyLion Investing, an online investment account that offers access to separately managed accounts invested based on model exchange-traded fund portfolios, Roundups, which provides features designed to encourage customers to establish good saving and investing habits, and MoneyLion Crypto, an online cryptocurrency account.

Zacks Rank #1 MoneyLion has an expected revenue and earnings growth rate of 23.9% and more than 100%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved more than 100% over the last 60 days.

RB Global Inc. RBA is an omnichannel marketplace that provides value-added insights, services and transaction solutions for buyers and sellers of commercial assets and vehicles. RBA’s marketplace brands include Ritchie Bros., IAA, Rouse Services, SmartEquip, Xcira and Veritread.

In addition, RBA offers title, data, transportation and logistics, refurbishing, inspection, and financial services. RBA serves customers across various asset classes, including automotive, commercial transportation, construction, government surplus, lifting and material handling, energy, mining, and agriculture.

Zacks Rank #1 RB Global has an expected revenue and earnings growth rate of 16.8% and 10%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 3.1% over the last 30 days.

The Western Union Co. WU operations benefit from a solid digital arm, which has been built through multiple partnerships and significant investments. Tactical cost-management efforts are likely to provide an impetus to WU’s margins. It aims to save around $35 million in 2024. We expect total operating costs to decline by nearly 5% year over year, this year.

WU’s prudent capital management strategy through share buybacks and dividend payments bodes well. Innovative products, such as Send Now, Pay Later services that integrate lending and remittance, position WU for enhanced market penetration. Strong branded digital business and growth in transactions are the major tailwinds.

Zacks Rank #1 The Western Union has an expected revenue and earnings growth rate of 1.2% and 1.2%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 4.8% over the last 60 days.

Global Payments Inc. GPN has benefited from the solid contributions of its merchant business. The growing demand for digital payment methods is expected to support GPN’s transaction volume growth.

The EVO Payments buyout is enhancing GPN’s capabilities, as evidenced by the results of recent quarters. GPN’s favorable 2024 outlook further buoys investors’ confidence. We expect revenues to increase 5.5% year over year in 2024.

Zacks Rank #2 Global Payments has an expected revenue and earnings growth rate of 6.4% and 11.6%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.1% over the last 60 days.

Envestnet Inc. ENV provides wealth management software and services in the United States and internationally. ENV operates through two segments: Envestnet Wealth Solutions and Envestnet Data & Analytics. ENV has strong asset-based and subscription-based, recurring revenue-generation capacity.

Envestnet continues to focus on technology development to improve operational efficiency and increase market competitiveness. The demand for personalized wealth management services is creating solid market opportunities for ENV’s technology-enabled solutions and services. An increasing current ratio also bodes well.

Zacks Rank #2 Envestnet has an expected revenue and earnings growth rate of 9.6% and 10.6%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 1.2% over the last 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Western Union Company (WU) : Free Stock Analysis Report

Global Payments Inc. (GPN) : Free Stock Analysis Report

Envestnet, Inc (ENV) : Free Stock Analysis Report

RB Global, Inc. (RBA) : Free Stock Analysis Report

MoneyLion Inc. (ML) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance