Bruce Berkowitz's Strategic Moves in Q1 2024: A Closer Look at Berkshire Hathaway's Impact

Insights into the Investment Shifts of a Value Investing Stalwart

Bruce Berkowitz (Trades, Portfolio), the founder and Managing Member of the Fairholme Fund (Trades, Portfolio), is renowned for his focused investment approach, inspired by Benjamin Graham's "The Intelligent Investor". With a philosophy centered on investing in companies with exceptional management and undervalued stocks, Berkowitz's latest N-PORT filing for the first quarter of 2024 reveals significant moves that reflect his strategic thinking. His investment decisions this quarter highlight a preference for quality management and substantial value, even in less performing companies, provided they offer a significant discount to intrinsic value.

Key Position Increases

Bruce Berkowitz (Trades, Portfolio) has notably increased his stakes in two stocks during the first quarter of 2024:

Bank OZK (NASDAQ:OZK) saw an addition of 273,300 shares, bringing the total to 324,500 shares. This adjustment represents a significant 533.79% increase in share count, impacting the current portfolio by 0.83%, with a total value of $14,751,770.

Enterprise Products Partners LP (NYSE:EPD) was augmented by 228,200 shares, resulting in a total of 5,436,600 shares. This adjustment represents a 4.38% increase in share count, with a total value of $158,639,990.

Key Position Reduces

Conversely, Berkowitz has reduced his positions in two key stocks:

Berkshire Hathaway Inc (NYSE:BRK.B) was reduced by 74,000 shares, marking a -60.18% decrease in shares and a -1.69% impact on the portfolio. The stock traded at an average price of $393.34 during the quarter and has returned 2.43% over the past three months and 15.87% year-to-date.

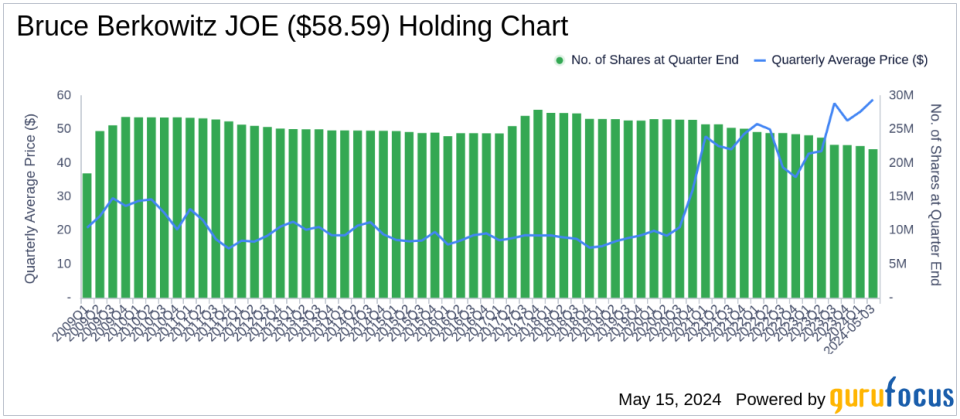

The St. Joe Co (NYSE:JOE) saw a reduction of 166,000 shares, resulting in a -0.73% reduction in shares and a -0.64% impact on the portfolio. The stock traded at an average price of $55.21 during the quarter and has returned 7.19% over the past three months and -2.12% year-to-date.

Portfolio Overview

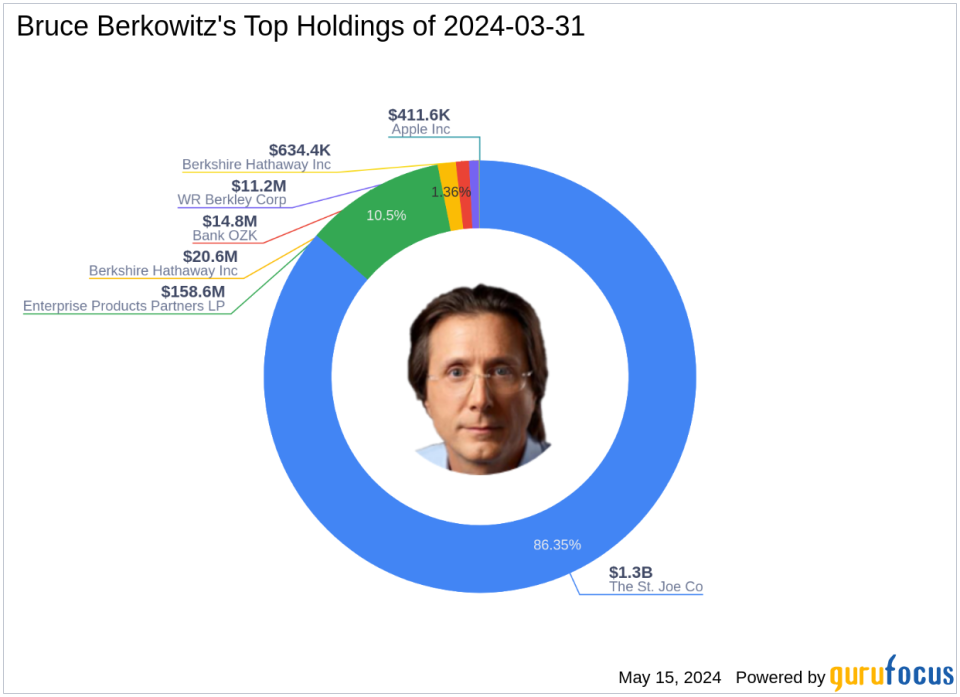

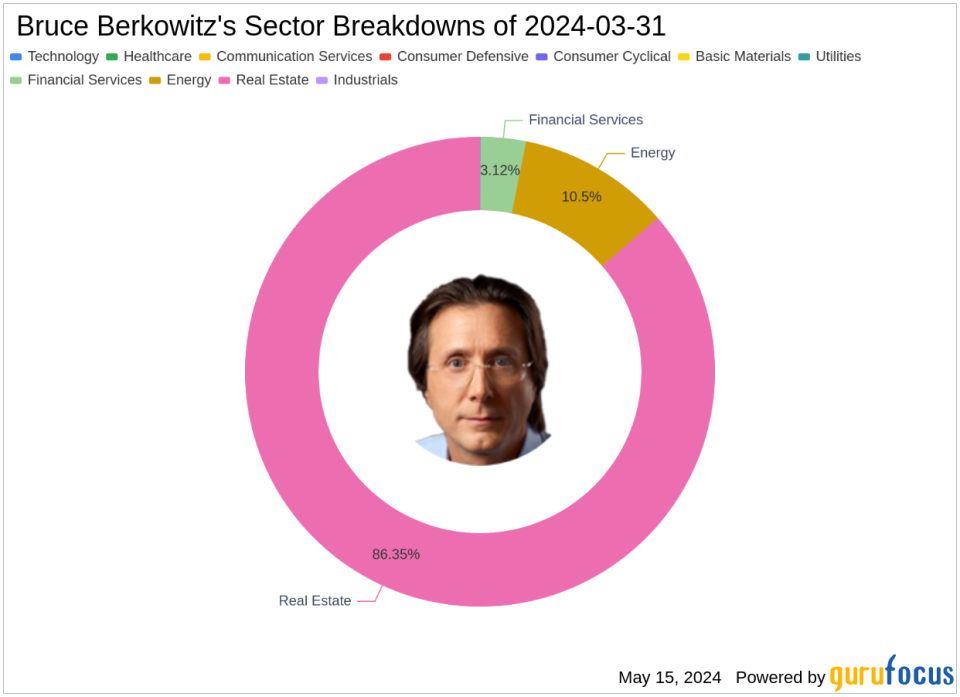

As of the first quarter of 2024, Bruce Berkowitz (Trades, Portfolio)'s portfolio included 7 stocks, with the top holdings comprising 86.35% in The St. Joe Co (NYSE:JOE), 10.5% in Enterprise Products Partners LP (NYSE:EPD), 1.36% in Berkshire Hathaway Inc (NYSE:BRK.B), 0.98% in Bank OZK (NASDAQ:OZK), and 0.74% in WR Berkley Corp (NYSE:WRB). The holdings are primarily concentrated in four industries: Real Estate, Energy, Financial Services, and Technology.

This strategic portfolio adjustment reflects Berkowitz's ongoing commitment to investing in value, guided by a disciplined approach to capital allocation. His moves this quarter, particularly the significant reduction in Berkshire Hathaway Inc, underscore a tactical shift that aligns with his investment philosophy of focusing on intrinsic value and potential catalysts for narrowing the gap between market price and intrinsic value.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance