Brandes Investment Partners, LP Increases Stake in Dril-Quip Inc

On May 31, 2024, Brandes Investment Partners, LP (Trades, Portfolio) made a significant addition to its investment portfolio by acquiring 572,314 shares of Dril-Quip Inc (NYSE:DRQ), a key player in the oil and gas industry. This transaction increased the firm's total holdings in Dril-Quip to 3,452,995 shares, marking a notable expansion of its stake. The shares were purchased at a price of $19.34 each, reflecting a strategic move by the firm to capitalize on the current market valuation of Dril-Quip.

Brandes Investment Partners, LP (Trades, Portfolio): A Legacy of Value Investing

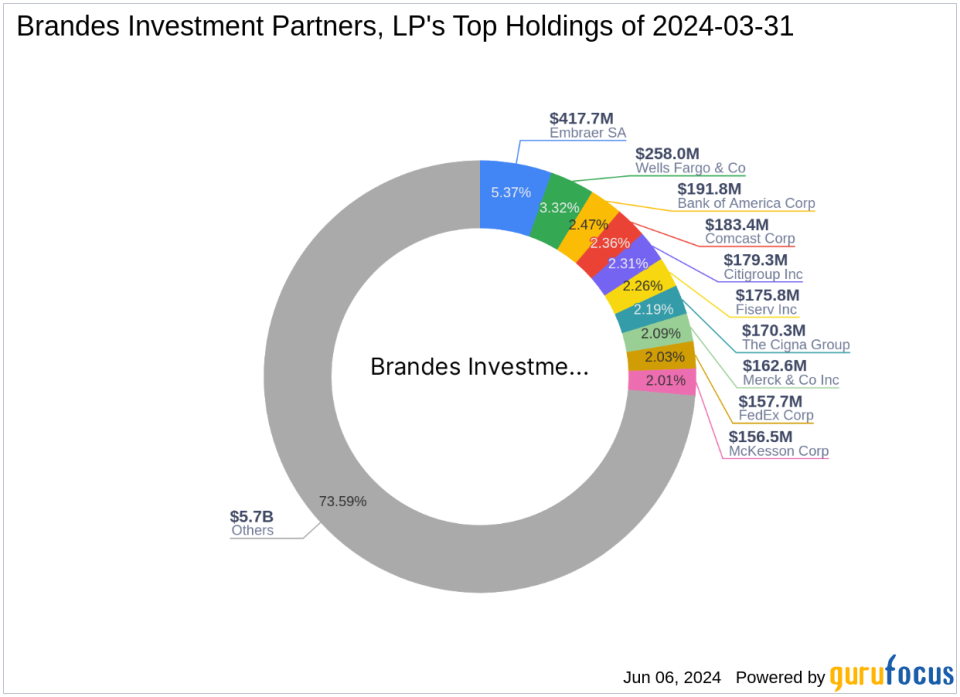

Founded in 1974 by Charles Brandes, Brandes Investment Partners, LP (Trades, Portfolio) has established itself as a formidable entity in the investment world, managing a diverse array of global equity and fixed-income assets. The firm is renowned for its commitment to the value investing principles pioneered by Benjamin Graham. It focuses on acquiring undervalued securities and holds them until their market value aligns with their intrinsic value. Brandes Investment Partners, LP (Trades, Portfolio) manages several funds, including the U.S. Equity and Global Equity Funds, and has a total equity management portfolio worth approximately $7.77 billion. The firm's top sectors include Healthcare and Financial Services, with major holdings in companies like Comcast Corp (NASDAQ:CMCSA), Bank of America Corp (NYSE:BAC), and Citigroup Inc (NYSE:C).

Dril-Quip Inc: Innovating in the Energy Sector

Dril-Quip Inc specializes in developing advanced technologies for the energy sector, focusing on the design and manufacture of drilling and production equipment. With operations spread across the Western Hemisphere, Eastern Hemisphere, and Asia-Pacific, the company caters to a global market. Dril-Quip's diversified revenue streams include product sales, technical advisory services, and equipment rentals. Despite a challenging market environment, Dril-Quip maintains a market capitalization of approximately $602 million. The company is currently deemed "Significantly Undervalued" with a GF Value of $33.70, presenting a potential opportunity for investors.

Impact of the Recent Trade by Brandes Investment Partners

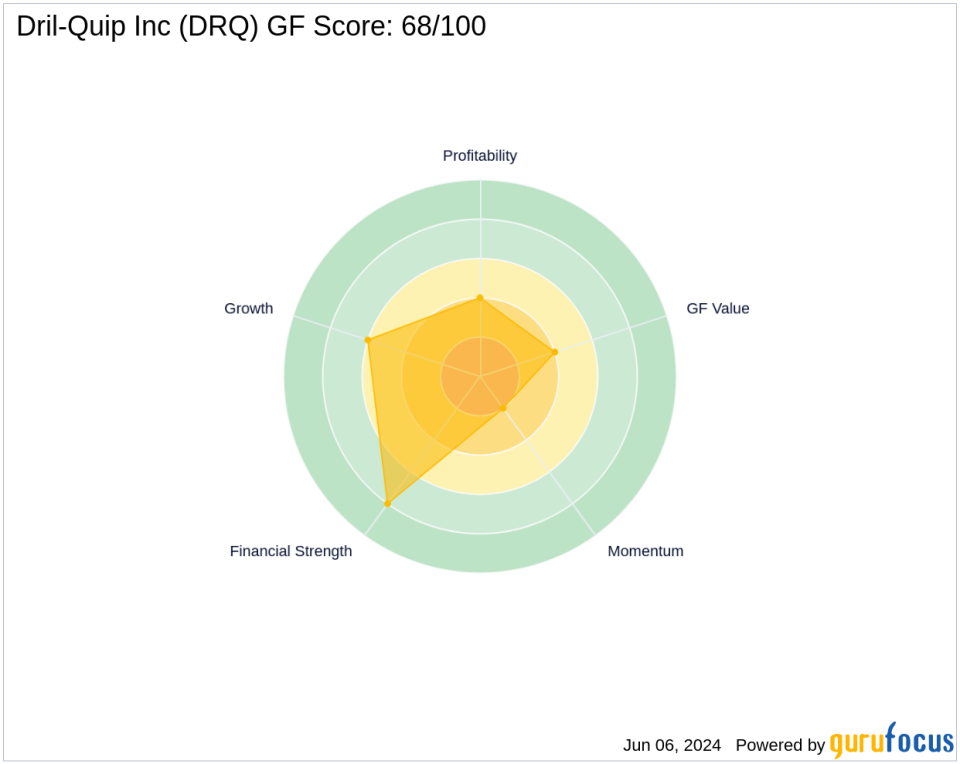

The recent acquisition by Brandes Investment Partners, LP (Trades, Portfolio) has increased its stake in Dril-Quip to 10.03% of its portfolio, reflecting a trade impact of 0.14%. This strategic move aligns with the firm's investment philosophy of capitalizing on undervalued assets. The timing of the purchase at $19.34 per share, compared to the current stock price of $17.49, indicates a proactive approach to investing in a stock that is currently trading below its intrinsic value according to the GF Score of 68/100, suggesting a moderate future performance potential.

Market and Sector Analysis

Dril-Quip operates within the volatile oil and gas industry, which has been facing significant challenges due to fluctuating oil prices and regulatory changes. However, the company's innovative product offerings and global footprint position it well to capitalize on industry recovery. The sector's performance and Dril-Quip's strategic initiatives are likely to influence the firm's investment returns significantly.

Looking Ahead: Strategic Implications for Brandes Investment Partners

The increased investment in Dril-Quip by Brandes Investment Partners, LP (Trades, Portfolio) is a testament to the firm's confidence in the stock's future performance. This move is strategically significant, potentially positioning Brandes to benefit from industry recovery and growth in the energy sector. As market conditions evolve, the firm's stake in Dril-Quip could play a crucial role in its portfolio performance, underscoring the importance of strategic asset allocation and value investing principles in achieving long-term investment success.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance