Brandes Investment Partners, LP Expands Stake in Park Aerospace Corp

Overview of the Recent Transaction

On May 31, 2024, Brandes Investment Partners, LP (Trades, Portfolio) made a significant addition to its investment portfolio by acquiring 190,861 shares of Park Aerospace Corp (NYSE:PKE). This transaction increased the firm's total holdings in the company to 2,111,714 shares, marking a notable expansion of its stake by 9.94%. The shares were purchased at a price of $13.94 each, reflecting a strategic move by the firm to bolster its position in the aerospace sector.

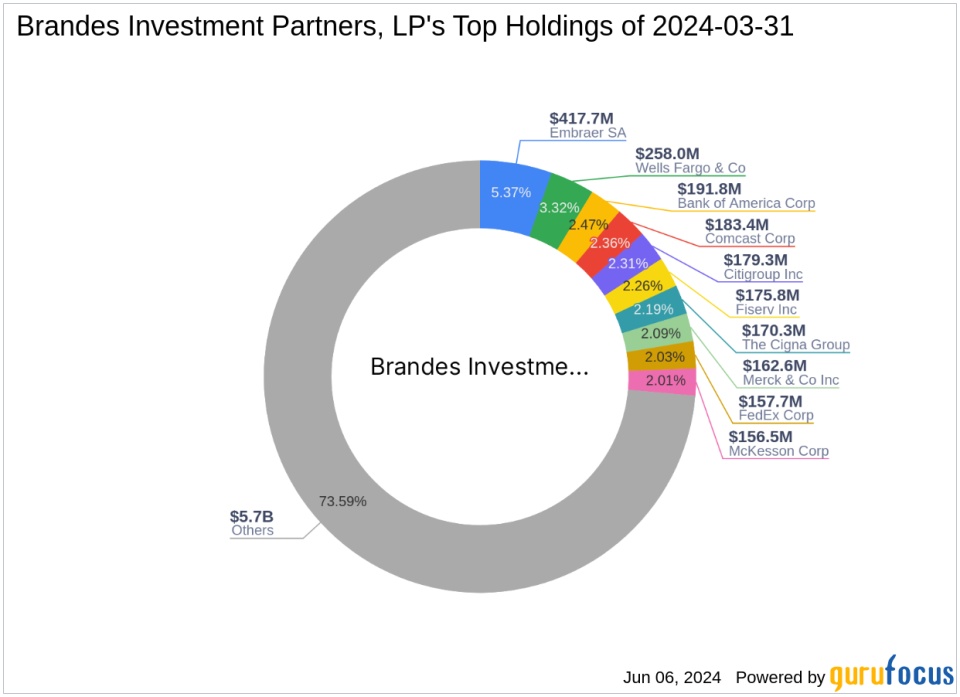

Profile of Brandes Investment Partners, LP (Trades, Portfolio)

Founded in 1974 by Charles Brandes, Brandes Investment Partners, LP (Trades, Portfolio) is a prominent investment advisory firm known for its commitment to value investing principles. The firm manages a diverse array of global equity and fixed-income assets, with a focus on purchasing securities that are undervalued relative to their intrinsic worth. Brandes Investment Partners, LP (Trades, Portfolio) is a disciple of Benjamin Graham and applies these time-tested investment principles across its portfolio, aiming to realize long-term value for its clients. The firm's top holdings include significant positions in companies like Comcast Corp (NASDAQ:CMCSA), Bank of America Corp (NYSE:BAC), and Citigroup Inc (NYSE:C).

Insight into Park Aerospace Corp

Park Aerospace Corp, listed under the ticker PKE, operates within the aerospace industry, specializing in the development and manufacture of advanced composite materials for aerospace markets. With a market capitalization of approximately $269.17 million and a current stock price of $13.29, Park Aerospace Corp is recognized for its contributions to aerospace structures and assemblies. The company's financial health is deemed 'Fairly Valued' with a GF Value of $13.35, closely aligning with its current market price.

Analysis of the Trade's Impact

The recent acquisition by Brandes Investment Partners, LP (Trades, Portfolio) has increased its ownership in Park Aerospace Corp to 10.43% of its portfolio, reflecting a strategic emphasis on this holding. The transaction had a modest impact of 0.03% on the firm's portfolio, indicating a targeted rather than broad-scale adjustment. This move aligns with the firm's investment philosophy of capitalizing on undervalued assets to build wealth over time.

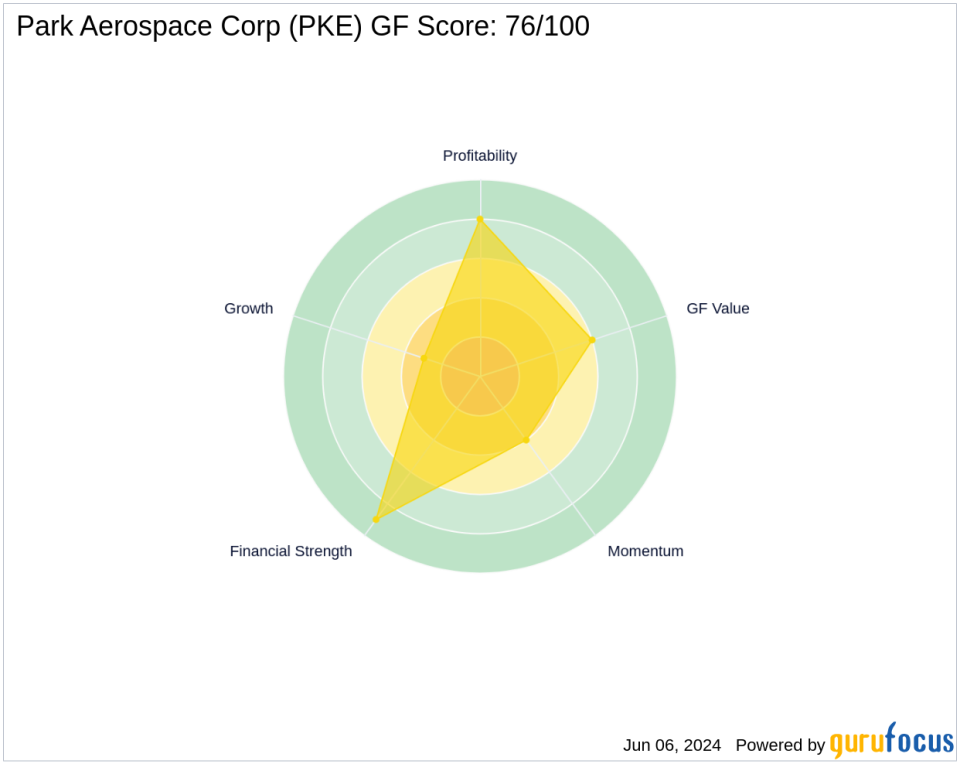

Current Market Performance of Park Aerospace Corp

Despite a year-to-date decline of 9.35% in its stock price, Park Aerospace Corp has shown a robust long-term growth, with its price appreciating by 1625.97% since its IPO in 1984. The stock currently holds a GF Score of 76, suggesting a likely average performance in the future. This score is supported by strong financial and profitability ranks, although its growth rank remains low at 3/10.

Sector and Market Context

The aerospace and defense industry continues to face dynamic market conditions. Park Aerospace Corp, with its specialized focus on aerospace materials, plays a critical role within this sector. The firm's strategic positioning and innovative product offerings allow it to maintain a competitive edge, despite the industry's challenges and the current economic climate.

Other Significant Investors and Market Influence

Brandes Investment Partners, LP (Trades, Portfolio) is not the only notable investor in Park Aerospace Corp. Renowned investor Mario Gabelli (Trades, Portfolio) also holds a stake in the company, contributing to the diverse range of strategic interests and investment approaches within Park Aerospace's shareholder base. This collective investment by prominent financial entities underscores the company's market significance and potential for future growth.

Conclusion

The recent acquisition by Brandes Investment Partners, LP (Trades, Portfolio) of additional shares in Park Aerospace Corp signifies a reaffirmation of the firm's commitment to value investing and its confidence in the aerospace sector's growth potential. This strategic investment move not only enhances the firm's portfolio but also positions it to potentially capitalize on the future appreciations in Park Aerospace's market value.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance