Boiron And Two More High-Yielding Dividend Stocks From Euronext Paris

Amid a backdrop of heightened political uncertainty and rising bond yields in France, investors are closely monitoring market dynamics as the country approaches a significant election. In such an environment, dividend stocks like Boiron can offer potential stability and regular income streams, making them particularly appealing for those seeking to navigate through turbulent market conditions.

Top 10 Dividend Stocks In France

Name | Dividend Yield | Dividend Rating |

Samse (ENXTPA:SAMS) | 9.47% | ★★★★★★ |

Rubis (ENXTPA:RUI) | 7.31% | ★★★★★★ |

CBo Territoria (ENXTPA:CBOT) | 6.82% | ★★★★★★ |

SCOR (ENXTPA:SCR) | 7.61% | ★★★★★☆ |

VIEL & Cie société anonyme (ENXTPA:VIL) | 4.04% | ★★★★★☆ |

Arkema (ENXTPA:AKE) | 4.23% | ★★★★★☆ |

Teleperformance (ENXTPA:TEP) | 3.60% | ★★★★★☆ |

Sanofi (ENXTPA:SAN) | 4.16% | ★★★★★☆ |

Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.38% | ★★★★★☆ |

Piscines Desjoyaux (ENXTPA:ALPDX) | 7.84% | ★★★★★☆ |

Click here to see the full list of 35 stocks from our Top Euronext Paris Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Boiron

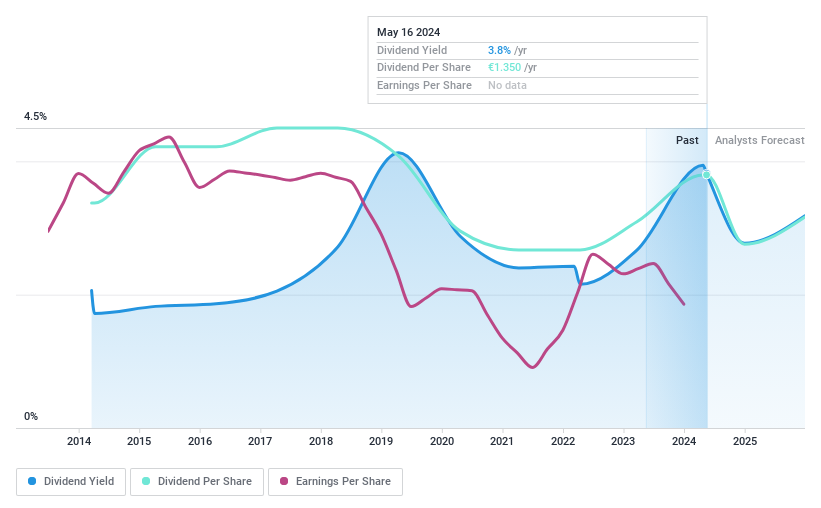

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Boiron SA is a company that specializes in the production and distribution of homeopathic medicines across France, other parts of Europe, North America, and internationally, with a market capitalization of approximately €520.87 million.

Operations: Boiron SA generates €493.25 million from the manufacture and marketing of homeopathic medicines and other healthcare solutions.

Dividend Yield: 4.5%

Boiron reported a decline in both sales and net income for the year ending December 31, 2023, with sales dropping to €493.25 million and net income to €35.83 million. Despite this downturn, the company maintains a dividend payout ratio of 65.4%, supported by earnings, and a cash payout ratio of 85.3%. However, Boiron's dividend history over the past decade has been volatile, undermining its reliability as a consistent dividend payer. The recent cash dividend was set at €1.35 on April 15, 2024.

Click here and access our complete dividend analysis report to understand the dynamics of Boiron.

The valuation report we've compiled suggests that Boiron's current price could be quite moderate.

Infotel

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Infotel SA is a global company that specializes in designing, developing, marketing, and maintaining software solutions in security, performance, and management sectors with a market capitalization of approximately €297.40 million.

Operations: Infotel SA generates revenue primarily through its Services segment, which brought in €296.02 million, and its Software segment, which contributed €11.53 million.

Dividend Yield: 4.7%

Infotel's dividends are supported by earnings with a payout ratio of 76.2% and cash flows with a cash payout ratio of 63.7%. However, the company has experienced volatility in dividend payments over the past decade, reflecting instability in its dividend track record. Currently, Infotel's dividend yield stands at 4.71%, which is below the top quartile of French dividend stocks at 5.48%. Despite this, analysts predict a potential price increase of 26%, suggesting some optimism about its valuation.

Samse

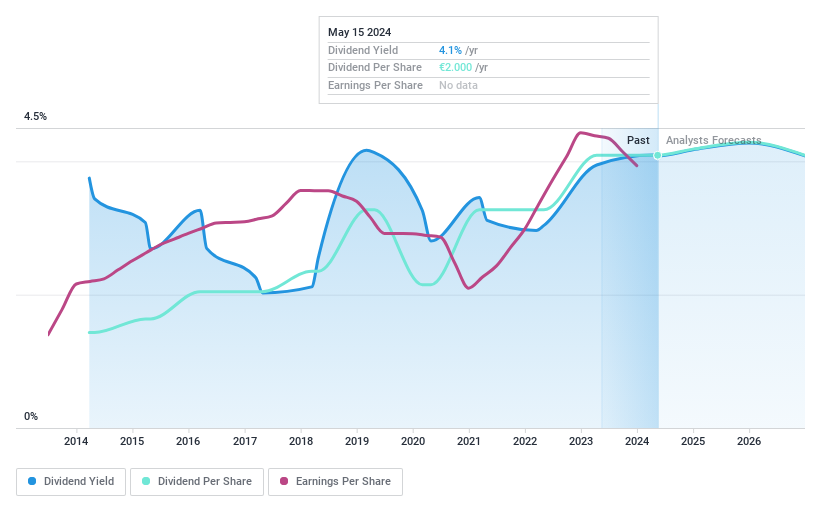

Simply Wall St Dividend Rating: ★★★★★★

Overview: Samse SA, operating in France, specializes in the distribution of building materials and tools with a market capitalization of €0.58 billion.

Operations: Samse SA generates €1.48 billion from its Trading segment and €0.41 billion from its Do-It-Yourself segment in revenue.

Dividend Yield: 9.5%

Samse offers a compelling 9.47% dividend yield, ranking in the top 25% of French dividend stocks. Its dividends are well-supported by both earnings and cash flows with a payout ratio of 66.5% and a cash payout ratio of 58.9%, respectively. The company has maintained stable dividend payments over the past decade, indicating reliability. Additionally, Samse trades at an attractive price-to-earnings ratio of 7.6x, below the French market average, suggesting good relative value amidst its peers.

Click to explore a detailed breakdown of our findings in Samse's dividend report.

Our expertly prepared valuation report Samse implies its share price may be lower than expected.

Where To Now?

Access the full spectrum of 35 Top Euronext Paris Dividend Stocks by clicking on this link.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:BOI ENXTPA:SAMS and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance