Beacon's (BECN) Texas & Washington Openings Expand Business

In a bid to continue providing services to residential and commercial roofers, Beacon Roofing Supply, Inc. BECN opened a new location in Terrell, TX. Also, it has opened new locations in Everett and Spokane, WA, to support specialty waterproofing contractors.

The Terrell branch serves the Eastern Dallas-Fort Worth market. On the other hand, the Everett and Spokane branches offer a complete catalog of waterproofing, glass and glazing products in demand by specialty contractors.

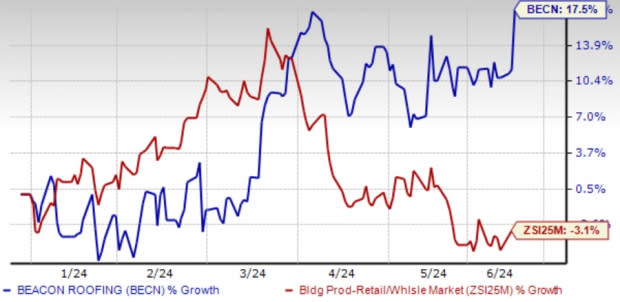

Shares of Beacon — the largest distributor of residential and non-residential roofing materials in the United States and Canada — rallied 17.5% against the Building Products - Retail industry’s 3.1% decline so far this year.

Image Source: Zacks Investment Research

Ambition 2025 Initiative: A Boon for BECN

Beacon has undertaken several strategic initiatives to drive its long-term ambition of growing and enhancing customer experience. One of the primary initiatives includes footprint expansion and increasing its market reach. Beacon is targeting business expansion through bolt-on acquisitions, divestitures and new branch openings.

The company has been focusing on its Ambition 2025 targets (announced on Feb 24, 2022), which emphasize operational excellence, an above-market growth trajectory and accelerated stockholder value creation. The financial targets of Ambition 2025 assume that sales will reach $9 billion (8% CAGR) and $1 billion of EBITDA (10% CAGR), which would translate into an 11% EBITDA margin (up 100 basis points from 2021).

Impressively, the company exceeded its Ambition 2025 revenue and shareholder return targets for 2023. BECN continues to achieve its further Ambition 2025 growth targets and plans to open 25 branches in 2024.

Since the announcement of the Ambition 2025 strategic plan, Beacon acquired 16 companies, which added 50 branches to its portfolio until 2023. The company expanded its footprint by completing four acquisitions, adding 23 branches and opened 10 new locations this year so far.

A solid residential backdrop, exceptional operating cost management and cash flow, a focus on the e-commerce platform, a new On-Time and Complete Delivery Network and a newly designed website are likely to help BECN gain further.

Zacks Rank & Key Picks

Beacon currently carries a Zacks Rank #3 (Hold).

Here are some better-ranked stocks from the Zacks Retail-Wholesale sector.

Wingstop, Inc. WING currently sports a Zacks Rank of 1 (Strong Buy). WING has a trailing four-quarter earnings surprise of 21.4%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for WING’s 2024 sales and earnings per share (EPS) indicates growth of 27.5% and 36.7%, respectively, from the year-ago period’s levels.

Sprouts Farmers Market, Inc. SFM currently sports a Zacks Rank of 1. SFM has a trailing four-quarter earnings surprise of 9.2%, on average.

The Zacks Consensus Estimate for SFM’s 2024 sales and EPS indicates growth of 8% and 9.9%, respectively, from the year-ago period’s levels.

The Gap, Inc. GPS currently sports a Zacks Rank of 1. GPS has a trailing four-quarter earnings surprise of 202.7%, on average.

The Zacks Consensus Estimate for GPS’ fiscal 2024 sales and EPS indicates a rise of 0.1% and 17.5%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Gap, Inc. (GPS) : Free Stock Analysis Report

Beacon Roofing Supply, Inc. (BECN) : Free Stock Analysis Report

Sprouts Farmers Market, Inc. (SFM) : Free Stock Analysis Report

Wingstop Inc. (WING) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance