Baidu Revenue Slows After China’s Downturn Mars AI Push

(Bloomberg) -- Baidu Inc.’s revenue grew at its slowest pace in more than a year, reflecting the challenges of monetizing its lead in AI during a Chinese economic downturn.

Most Read from Bloomberg

One Dead After Singapore Air Flight Hit By Severe Turbulence

ASML, TSMC Can Disable Chip Machines If China Invades Taiwan

Hims Debuts $199 Weight-Loss Shots at 85% Discount to Wegovy

Tesla Shareholder Group Slams Elon Musk’s $56 Billion Pay Package

Jamie Dimon Says Succession at JPMorgan Is ‘Well on the Way’

Revenue for the three months ended March edged up just 1% to 31.5 billion yuan ($4.4 billion), about in line with estimates. Net income came to a stronger-than-projected 5.4 billion yuan, helped by cost-cutting. Its shares slid more than 1% in pre-market trading in New York.

The results underscore how China’s internet search leader is struggling to translate its first-mover advantage in generative AI into real revenue. Baidu is counting on AI to seed future growth that could bring it to the top tier of global technology conglomerates. Its Ernie model has generated subscription fees as well as ad dollars, giving it a headstart against peers like Tencent Holdings Ltd. and ByteDance Ltd.

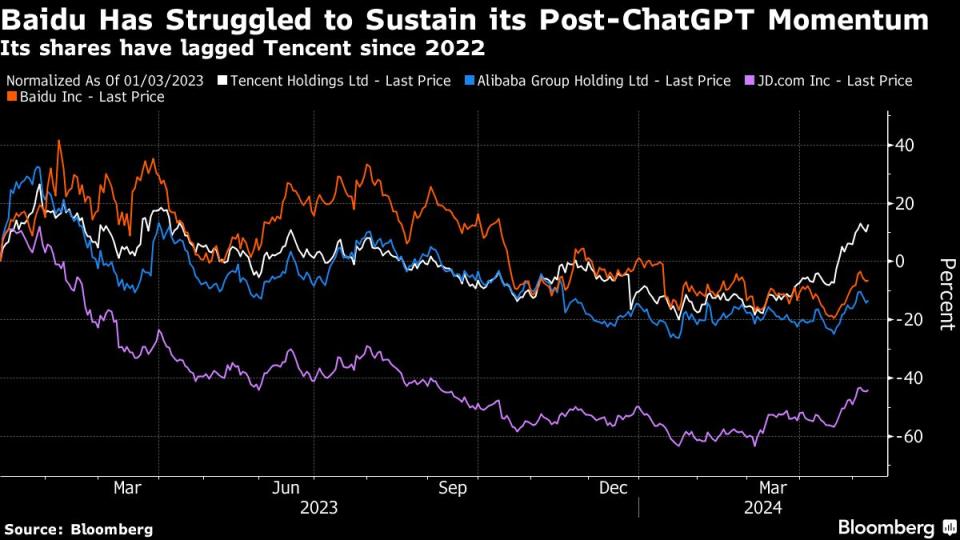

But it could take years before Baidu can comfortably reduce its reliance on search ads, one of the biggest casualties of China’s economic downturn. After an initial rally around the time Ernie emerged, Baidu’s shares have struggled to sustain their momentum.

The world’s second-largest economy also hasn’t fared well post-pandemic. A property meltdown and youth unemployment is sapping consumer sentiment, which is in turn fueling deflation.

What Bloomberg Intelligence Says

Baidu’s headline 1Q beat doesn’t reflect a fundamental turnaround in its prospects, which we think remain difficult. Cost cutting drove adjusted operating core profit 8.6% ahead of consensus, but that had been downgraded 13.6% over the last six months. Group revenue rose just 1.2%, with Baidu Core sales up 3.5%. Baidu Core’s adjusted operating margin was flat at 23%, reflecting continued lack of traction from its AI ventures, including Ernie Bot.

- Robert Lea, analyst

Click here for the research.

Still, Baidu expects Ernie to contribute several billion yuan of additional sales through advertising and cloud services this year. AI is already helping the company generate several hundred million yuan of ad revenue every quarter, executives told analysts on a conference call. With 200 million registered users, its offering is one of China’s most popular and advanced AI models among some 100 domestic competitors, founder Robin Li said at a Shenzhen event last month. That’s thanks to “countless trials and errors” over the past year, he said.

Baidu has made it clear it wants developers to build apps for Ernie, which it likens to a new computer operating system. But it’s contending with well-funded AI startups and open-sourced models like Alibaba Group Holding Ltd.’s Qwen, which is free and popular among Chinese developers.

Baidu’s AI push in autonomous driving could see a quicker payoff. Its robotaxi service — with a fleet of hundreds of fully self-driving cars in big cities like Shenzhen and Wuhan — is on the cusp of reaching break-even on a per-vehicle basis. Baidu will also provide navigation and mapping tools to Tesla Inc.’s assisted-driving system in China.

“China faces a long road to AI profitability,” Bloomberg Intelligence analysts Robert Lea and Jasmine Lyu wrote in a note before the results. “An industry shake-out could drive the sector into profit, though this looks unlikely to happen any time soon in a sector awash with excess capital.”

(Updates with analyst comment and shares from the second paragraph)

Most Read from Bloomberg Businessweek

A Hidden Variable in the Presidential Race: Fears of ‘Trump Forever’

Millennium Covets Citadel-Size Commodities Gains, Just Not the Risk

Netflix Had a Password-Sharing Problem. Greg Peters Fixed It

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance