Avoid Hyundai Elevator On The KRX In Favor Of One Better Dividend Stock Option

In the realm of South Korea's dividend stocks, where average yields hover around 2.2%, investors are often drawn to those offering the highest returns. However, it is crucial to scrutinize the stability and consistency of these dividends. Companies like Hyundai Elevator, which have experienced significant dividend cuts in the past, highlight the risks associated with chasing high yields without considering long-term sustainability.

Top 10 Dividend Stocks In South Korea

Name | Dividend Yield | Dividend Rating |

Kia (KOSE:A000270) | 4.53% | ★★★★★★ |

LOTTE Fine Chemical (KOSE:A004000) | 4.40% | ★★★★★☆ |

NH Investment & Securities (KOSE:A005940) | 6.38% | ★★★★★☆ |

Industrial Bank of Korea (KOSE:A024110) | 7.03% | ★★★★★☆ |

KT (KOSE:A030200) | 5.52% | ★★★★★☆ |

Shinhan Financial Group (KOSE:A055550) | 4.24% | ★★★★★☆ |

KB Financial Group (KOSE:A105560) | 3.68% | ★★★★★☆ |

HANYANG ENGLtd (KOSDAQ:A045100) | 3.09% | ★★★★★☆ |

Kyung Nong (KOSE:A002100) | 4.85% | ★★★★★☆ |

Cheil Worldwide (KOSE:A030000) | 6.01% | ★★★★☆☆ |

Click here to see the full list of 71 stocks from our Top KRX Dividend Stocks screener.

Let's uncover one of the gems from our specialized screener and one you can probably ignore.

Top Pick

Hyosung ITX

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hyosung ITX Co. Ltd, based in South Korea, specializes in providing business solutions and has a market capitalization of approximately ₩167.31 billion.

Operations: The firm operates primarily in the business solutions sector within South Korea.

Dividend Yield: 5.3%

Hyosung ITX has shown a promising approach to dividend sustainability, with recent increases in its dividend payments and a payout ratio of 63.3%, ensuring dividends are well-covered by earnings. Additionally, its cash payout ratio at 21.8% highlights strong coverage by cash flows, contrasting positively against firms with unstable dividend histories. Recent actions include extending their buyback plan, reinforcing their commitment to shareholder returns despite a shorter history of dividend payments since only the past five years.

Take a closer look at Hyosung ITX's credentials here in our dividend report.

Our valuation report unveils the possibility Hyosung ITX's shares may be trading at a premium.

One To Reconsider

Hyundai Elevator

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: Hyundai Elevator Co., Ltd. is a South Korean company that specializes in the design, manufacture, installation, maintenance, and modernization of elevators globally, with a market capitalization of approximately ₩1.51 billion.

Operations: Hyundai Elevator's revenue is primarily generated from its goods handling equipment manufacturing business, which contributes ₩1.66 billion, followed by installation and maintenance services at ₩0.56 billion, and travel and construction activities accounting for ₩0.23 billion.

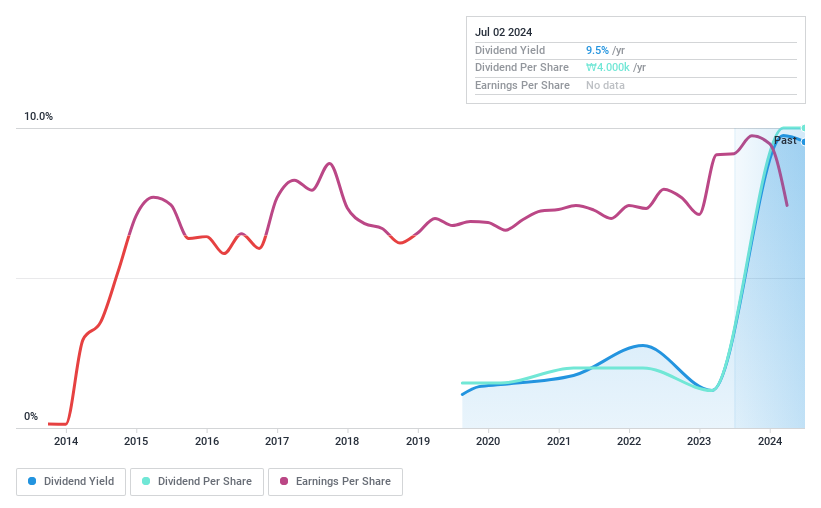

Dividend Yield: 9.5%

Hyundai Elevator's dividend allure is marred by its instability and poor coverage; its dividend yield of 9.54% might seem attractive but is undermined by a payout ratio of 144% and a cash payout ratio exceeding 100%, indicating dividends are not well-supported by earnings or cash flow. Additionally, despite a high yield within the top quartile for South Korea, the company's track record shows volatility in dividend payments with significant reductions, questioning the reliability of future dividends.

Summing It All Up

Click here to access our complete index of 71 Top KRX Dividend Stocks.

Have a stake in one of these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include KOSE:A094280 and KOSE:A017800.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance