Avnet Inc (AVT) Q3 Earnings: Aligns with EPS Projections Amidst Market Challenges

Revenue: Reported at $5.7 billion, down 13.2% year-over-year, falling short of estimates of $5706.64 million.

Net Income: Achieved $88.83 million, significantly below the estimated $100.95 million.

Diluted EPS: Recorded at $0.97, below the estimated $1.11.

Operating Income: $190.2 million, representing a 39.4% decrease from the previous year.

Adjusted Diluted EPS: $1.10, nearly meeting the estimated $1.11.

Electronic Components Sales: Totaled $5.25 billion, marking a 13.4% decrease year-over-year.

Guidance for Next Quarter: Expects sales between $5.20 billion and $5.50 billion, and diluted EPS between $0.90 and $1.00.

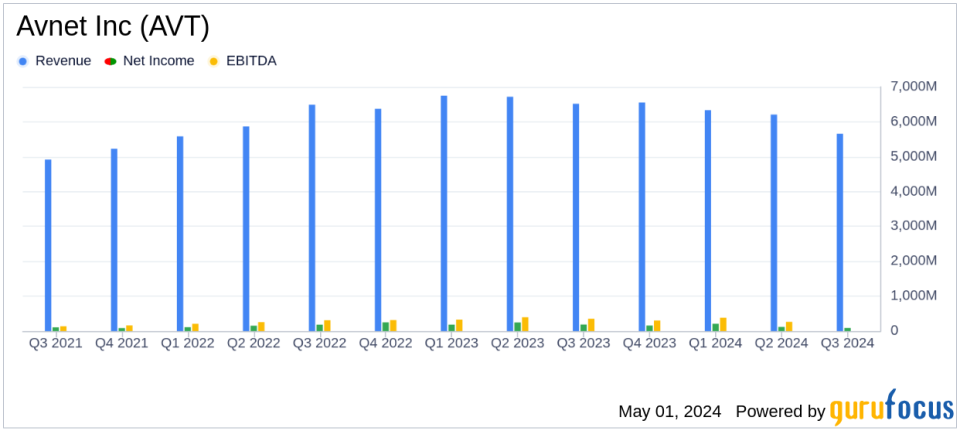

On May 1, 2024, Avnet Inc (NASDAQ:AVT), a leading global distributor of electronic components, announced its financial results for the third quarter ended March 30, 2024. The company reported a third-quarter revenue of $5.7 billion and an adjusted diluted EPS of $1.10, aligning closely with analyst projections which estimated earnings per share at $1.11 and revenue at $5706.64 million. The full details of the earnings can be accessed through Avnets 8-K filing.

Avnet, recognized as the third largest semiconductor distributor globally, operates across 140 countries, serving a vast customer base with a range of electronic components and design tools. This quarters performance reflects a strategic navigation through economic softness and reduced market demand, as highlighted by CEO Phil Gallagher.

Financial Highlights and Market Challenges

The reported revenue of $5.653 billion represents a 13.2% decrease year-over-year and an 8.9% decrease from the previous quarter. Operating income also saw a significant reduction, coming in at $190.2 million, down 39.4% from the same quarter last year. This decline in revenue and operating income underscores the challenges posed by current market conditions, including lower demand in the semiconductor market and broader economic uncertainties.

Despite these challenges, Avnet achieved a robust cash flow from operations, benefiting from a countercyclical balance sheet strategy. The companys focus on reducing operating costs and improving working capital efficiency has been pivotal in navigating the adverse market conditions.

Segment Performance and Future Outlook

Electronic Components (EC) sales were $5.245 billion, down 13.4% year-over-year, with an operating margin of 4.1%. The Farnell segment, which focuses on high-service distribution, reported sales of $407.8 million, a decrease of 10.4% from the previous year. Geographically, all regions experienced a downturn, with the Americas and EMEA facing the steepest declines in sales.

Looking ahead to the fourth quarter of fiscal 2024, Avnet expects sales to range between $5.20 billion and $5.50 billion, with an adjusted EPS forecast of $0.90 to $1.00. This guidance anticipates a continuation of the challenging market conditions, with a sequential sales decline of 3% to 8%.

Detailed Financial Review

The balance sheet remains solid with total assets of $12.325 billion. Current assets stood at $10.486 billion, supported by strong inventory and receivable positions. The company's approach to maintaining a robust balance sheet is evident in its management of liabilities and shareholder equity, which total $7.336 billion and $4.989 billion, respectively.

Operational efficiency is reflected in the cash flow statements, with net cash provided by operating activities at $415.73 million for the nine months ended March 30, 2024. This performance demonstrates Avnet's ability to generate liquidity and manage cash flows effectively amidst a challenging economic landscape.

Investor and Analyst Perspectives

Avnets alignment with analyst expectations on EPS, amidst revenue and income declines, suggests a resilient operational strategy but also highlights the need for cautious optimism among investors. The companys strategic adjustments and focus on cash flow management are critical as it prepares for continued economic volatility.

For detailed insights and further information, investors and stakeholders are encouraged to review the complete financial statements and managements discussion in the 8-K filing.

Explore the complete 8-K earnings release (here) from Avnet Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance