Automatic Data Processing Inc. (ADP) Surpasses Analyst Revenue and Earnings Estimates in Q3 FY24

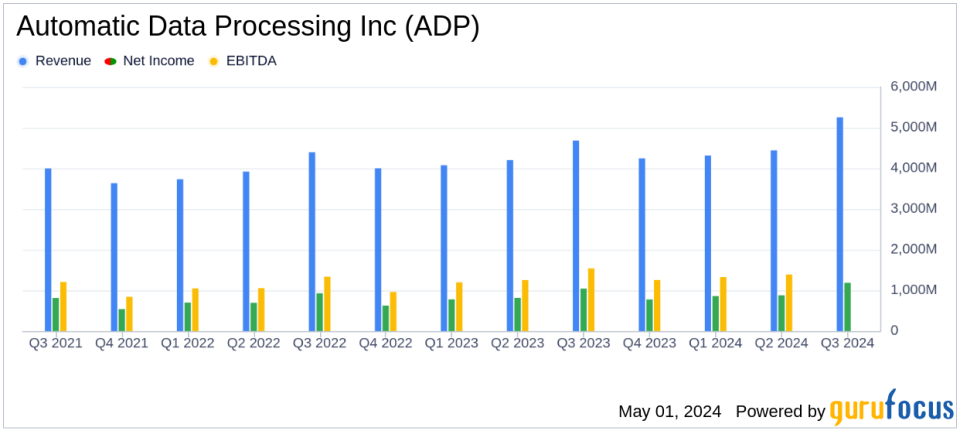

Revenue: Reached $5.3 billion, a 7% increase year-over-year, surpassing estimates of $5224.83 million.

Net Income: Grew 14% to $1.2 billion, exceeding the estimated $1149.31 million.

Earnings Per Share (EPS): Reported at $2.88, up 15% from the previous year, exceeding the estimate of $2.79.

Adjusted EBIT: Rose by 12% to $1.5 billion, with an adjusted EBIT margin increase of 140 basis points to 29.3%.

Interest on Funds Held for Clients: Increased 29% to $321 million, reflecting higher average client funds balances and improved yield.

PEO Services: Segment revenue grew by 5%, with average worksite employees increasing by 3% to approximately 732,000.

Fiscal 2024 Outlook: Expects revenue growth of 6% to 7% and adjusted diluted EPS growth of 10% to 12%.

Automatic Data Processing Inc. (NASDAQ:ADP) released its 8-K filing on May 1, 2024, reporting significant growth in both revenue and earnings for the third quarter of fiscal year 2024. The company announced a 7% increase in revenue to $5.3 billion and a 14% rise in net earnings to $1.2 billion, surpassing the analyst estimates of $5.224 billion in revenue and $1.149 billion in net income. Diluted earnings per share (EPS) also saw a commendable increase, reaching $2.88, which is above the estimated $2.79.

Automatic Data Processing Inc., a global provider of human capital management (HCM) solutions, has been a pivotal player in the industry since its inception in 1949. Serving over 1 million clients, ADP offers a range of services from payroll to human resources outsourcing, and its smaller, rapidly growing professional employer organization (PEO) segment delivers HR outsourcing solutions through a co-employment model.

Financial Performance and Market Position

The company's financial results reflect robust growth and operational efficiency, with a notable increase in adjusted EBIT to $1.5 billion and an expansion of 140 basis points in adjusted EBIT margin to 29.3%. This performance is underpinned by healthy new business bookings and high client retention rates, as highlighted by Maria Black, President and CEO of ADP. She remarked,

Healthy new business bookings and client retention contributed to our strong third quarter results. We strive to deliver innovative products, differentiated service, and exceptional experiences every day, and we are proud these efforts helped to drive new record highs in client satisfaction this fiscal year."

The strategic focus on innovation and customer satisfaction has evidently paid off, positioning ADP well for sustained growth. Furthermore, the company's effective tax rate remained stable at 23.4%, aligning with fiscal projections.

Segment Performance and Future Outlook

ADP's Employer Services segment reported an 8% increase in revenue on a reported basis, driven by a 2% rise in U.S. pays per control. The segment's margin also improved significantly by 230 basis points. Conversely, the PEO Services segment grew by 5% in revenue, although its margin declined by 220 basis points, reflecting some challenges in scaling the business efficiently against higher operational costs.

Looking ahead, ADP remains optimistic about fiscal 2024, forecasting a revenue growth of 6% to 7%, with adjusted EBIT margin expansion of 60 to 70 basis points and diluted EPS growth of 10% to 12%. These projections underscore ADP's confidence in its business model and market strategy, despite ongoing investments in transformation initiatives.

Investment and Operational Insights

The company continues to prioritize high-grade investment strategies for client funds, achieving a 29% increase in interest on funds held for clients to $321 million. This financial prudence ensures safety, liquidity, and diversification of client assets, aligning with ADP's conservative investment guidelines.

In conclusion, ADP's Q3 FY24 results not only demonstrate strong financial health but also reinforce the companys strategic direction focused on innovation, client satisfaction, and market expansion. With solid growth in key financial metrics and a positive outlook for the fiscal year, ADP remains well-positioned to maintain its leadership in the human capital management sector.

Explore the complete 8-K earnings release (here) from Automatic Data Processing Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance